I am sure, these Budget 2023 -Top 12 key highlights will affect our personal life financial decisions. In this post we will discuss top budget 2023 highlights which can impact our lives and saving habits.

Table of Contents

Budget 2023- Top 12 Highlights

Here few new things, norms added, new tax introduced, older abolished and so on. Let’s have a closer look and begin with the new introductions.

1.Introduction of Mahila Samaan Saving certificate ( MSSC)

The Govt. has introduced Mahila Samaan Saving certificate in an effort to empower women. MSSC will be Available for two years only, ending on March 31, 2025.

Any Indian woman can invest up to Rs. 2,00,000 for a 2 year term at a fixed interest rate of 7.55% under Mahila Samaan Saving Scheme(MSSC).

One can also make partial withdrawals in between.

2. Increase in Senior Citizen Savings Scheme (SCSS) Investment Limit

Lately the elderly people could invest up to Rs. 15 lakh only.

But Now as per the 2023 budget, This SCSS investment limit has increased to Rs. 30 lakh.

This great change in SCSS limit offer huge benefits for senior citizens in India.

Read more about Senior Citizen Savings Scheme

3.Increase in Post Office Monthly Income Scheme (POMIS) scheme Investment Limit

Earlier the Post Office MIS scheme had an investment ceiling of 4.5 lakh for single accounts and Rs. 9 lakh for combined accounts.

But now as per Budget 2023 the POMIS investment limit has been increased to 9 lakh ( single holder)and 15 lakh ( joint holding)respectively.

Read more about Post Office Monthly Income Scheme (POMIS)

4.Leave Encashment limit increased to 25 Lakh

Previously Leave encashment was exempt upto ( Lowest of below)*

- Rs. 3 lakh

- Actual leave encashment amount

- Average salary (basic salary + dearness allowance) of the last 10 months before the employee’s retirement or resignation

- Cash equivalent of pending leave days. The leave basis is a maximum of 30 days leave for every year of service.

* Not applicable for Central Government or State Government employees

Now, Leave encashment limit of Rs.3 lakh is increased to Rs.25 lakh.

5.Surcharge for those whose income is above Rs.5 Cr is reduced

Previously, there was a surcharge of 37% for individual income more than Rs. 5 Cr but now this surcharge is reduced to 25% only.

6.TDS on EPF withdrawal is reduced

As per Budget 2023, TDS on EPF withdrawal ( within 5 years) is reduced to 20% from a limit of 30%.

This means if you do not provide a PAN number than you will have to pay TDS of 20% on EPF Withdrawal ( within 5 years)

7.No Tax on up to an income of Rs.7 Lakh of income under the new tax regime

There was a rebate of 5 lakh under Sec.87A. Now this limit is increased to Rs 7 lakh.

Thus if your income, 7 lakh or below , then no income tax will be applicable under the new tax regime.

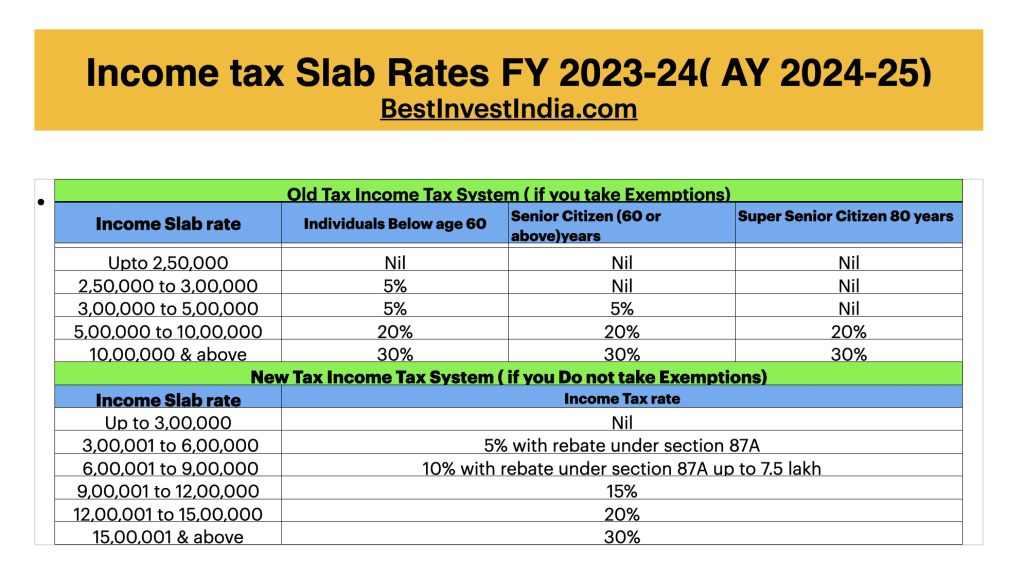

8.Tax rates changed under the new tax regime (no change in the old tax regime)

Till last financial year there were 6 tax slab rates starting from 2.5 lakh. But now these slab rates have reduced to 5 only.

But unfortunately no new changes has been made in the old tax system.

The new Tax Slab Rate for FY 2023-24 / AY 2024-25 are as below.

9.Sec.54 and Sec.54F exemption limit is capped

Earlier, there was no such amount-based limitation under Sections 54 and 54F.

But presently Sections 54 and 54F exemption limit is set to Rs. 10 crore.

10.Introduction of standard deduction under the new tax regime

Earlier standard deduction was allowed in old tax system only.

But now Standard deduction under the new tax regime is introduced.

This means the person with income of 15.5 lakh or more will get the benefit of 52,500.

11.TDS on interest income of NCDs

Earlier interest received from listed NCD was exempt from TDS but now onwards TDS will be deducted on listed debentures interest.

As per the current budget 2023, the Listed NCD holder will get interest after deduction of TDS.

12.Taxable Maturity Proceeds for Life Insurance policies with premium more than 5 lakh

The maturity proceeds from life insurance policies issued on or after 1st April 2023 where aggregate premium is above 5 lakh will be taxable in nature.

However,the death claim arising out of these policies will be tax free in nature.