Ruchi had invested her money in mutual funds long back. She wanted to sell/redeem/withdraw her money from Mutual Funds but she was not sure how to redeem/ withdraw Mutual Fund online or offline.

While interacting with the Financial Planner she came to know the ways by which she can redeem her money. how-to-withdraw-redeem-exit-mutual-fund

Let’s explore out the ways:

Table of Contents

Ways to withdraw/Redeem Mutual Funds

- Offline Redemption

2. Online Redemption

Both ways are easy for the investor. You can choose any method at your convenience. One can choose any mode to withdraw money from mutual funds.

There is no difference between both in money terms.

Withdraw Mutual Fund OFFLINE through Physical Forms

STEP #1 Download & Print the Redemption Form/Slip

You can get form through mutual fund office/ CAMS/ KARVY office or might be it is attached along with your account statement also.

Alternatively, click on the below link to download the forms.

Karvy common transaction form link:

CAMS redemption form link:

STEP #2 Fill the Redemption Form

Now fill the redemption slip and deposit it to the AMC ( mutual fund company) Or deposit it with CAMS or KARVY office.

The information which is required to fill the form are:

1. Investors Name – write down investor’s name

2. Folio number – Folio no. is an account number with the respective AMC. Folio number is written in account statement and in all communication with the AMC.

Folio number is written on the top left-hand side of your account statement, where your name and address is mentioned.

In simple language, you can understand it as your account number with the mutual fund company, Just like you have account number with the bank.

If you have invested in many funds of different AMC then you will be having different Folio numbers with each AMC.

To watch Video click on the link :

3. Name of Mutual Fund scheme –

Mention the fund name from which you want to withdraw money.

Options of the scheme:

Write down the option which you had taken initially like dividend option/ dividend reinvestment option or growth option. The option is written along with your fund name in your Account Statement.

5.Regular or Direct:

If you had taken mutual fund from a distributor then you have to write regular and if you have yourself invested without any broker then it is a direct mutual fund.

6. Amount of money/ odd number of units:

You have to mention the amount of money you want to withdraw or the number of units.

If you do not know the amount of money and want to withdraw the entir amount then you can write all the units.

How to withdraw from Mutual Fund ONLINE?

All you need to have is a registered email id and a registered phone number for online registration.

The procedure is the same as you have filled in your information in the offline method.

You can fill in all your details in online mode also and click on redemption

How to Withdraw money from Online

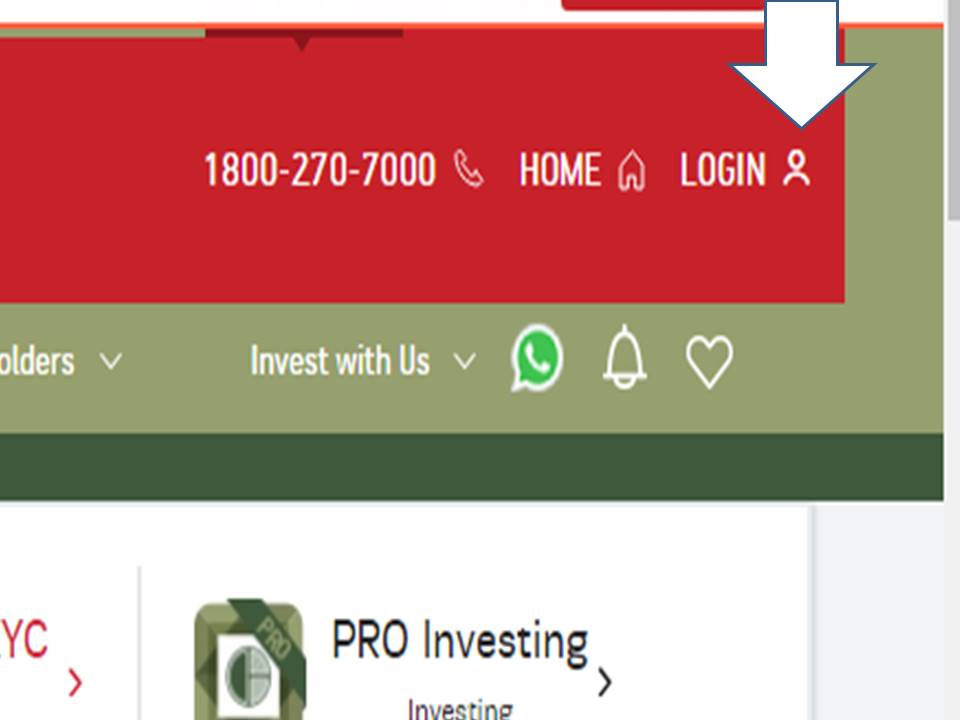

- Go to the respective AMC website. Click on the login tab.

- You will be prompted to register. Click on register tab.

- Submit your PAN card number/ Folio number here.

- Generate a login ID and password.

- Click on Your Mutual Fund Portfolio

- Expand transaction tab

- Click on redeem button

- Choose amount or withdrawal units

- Submit your request

This is how to withdraw money from mutual funds online.

The tabs or preface might be different for each AMC but the procedure is almost similar.

Read more about Mutual Funds

All about Mutual Funds you need to know

FAQ

What is redeem in mutual funds?

The redemption/ redeem in mutual fund meaning is to withdraw money from mutual fund. One can withdraw money from mutual fund in one go or withdraw partially and continue to get returns from the remaining amount.

What if I have many Folios in one AMC?

You have to fill separate forms for each folio number. Alternatively, you can submit merge folio numbers and then you can submit redemption request.

Can I withdraw/sell mutual fund any time?

You can withdraw mutual fund anytime (except ELSS and close ended fund). But it may be subject to exit load and lock-in period if any.

withdrawal from ELSS funds before completion of 3 years and close-ended funds is not possible prior to specified time.

How to withdraw mutual funds before locking period?

If mutual fund have lockin period, then withdrawal from such close ended fund is not possible before specified time.

What is Exit load?

If you wish to withdraw before the specified lock-in time of a mutual fund scheme than a load is levied on the withdrawal amount. This load at the time of exit is called Exit load.

How Exit load is calculated?

The exit load is calculated on the withdrawal amount before completion of the specified time.

For example, if you initially deposited Rs 1 lac in an equity mutual and after 4 months you wish to withdraw Rs 50000 from the fund.

The value of Total money is 1,05,000. Say if the exit load is 1% then you have to pay 1% of Rs 50000 ( withdrawal amount) i.e. Rs 500.

Is Exit load deducted on principal amount also?

Yes, the exit load is deducted on principal and interest also.

If I withdraw the entire amount does my Folio number still remains?

The folio number is unique to an investor.

Even if you close the account, the folio number still remains as zero Folio number.

Can I invest in the same Folio again after some time?

Yes, you can.

The folio number is unique to an investor. Therefore you can invest in same folio.

How much time, money is transferred to my account?

The money is transferred in three working days in your account. The proceeds from the redemption will be credited to the registered bank account of the first-named unit holder.

Is it easy to withdraw from mutual funds?

It is absolutely very easy to withdraw money from mutual funds. You get money in 3-5 working days.

Can you withdraw money from mutual funds without penalty?

Money can be withdrawn without penalty after a specified time. For example it is usually 1 year in case of equity mutual funds, any time in liquid mutual funds, 3 years in debt mutual funds. However the lock in time ( no penalty time) vary from fund to fund.

What happens if I withdraw my mutual funds before 1 year ?

If you withdraw the entire amount than your folio still remains with zero value. But it does not hold any significance for you.

However, the gains from mutual funds become taxable in nature. If you withdrew from equity mutual fund before completion of 1 year than gains are taxable @15% and if withdrawn after 1 year than gain over and above Rs. 1 lac will be taxable @10%.

For instance suppose you had invested 1 lac and decide to withdraw before 1 year.

At this time your gains are say 10000.

Than in case it is a equity fund the gains will be taxed@15%.

So you have to pay 10000*15%=Rs. 1500 as short term capital gain.

if it is debt fund than the gain of Rs 10K will be added to your income and will be taxed as per your income tax slab rate.