ICICI Pru GIFT Pro, a protection and savings-oriented life insurance plan which helps you build a safety net to provide financial protection to your family along with guaranteed benefits.

Table of Contents

ICICI Pru Guaranteed Income For Tomorrow Pro – Salient Features

- Tradition Life insurance Plan

- Non-market linked, non-participating plan (maturity value is given in beginning itself)

- 5 variants (we will discuss later)

- Minimum premium: Varies depending on the variant

- Maximum premium: No cap

ICICI Prudential Guaranteed Income for Tomorrow (Gift)Pro plan comes in 5 variants

- Guaranteed Income ( Level or increasing ),

- Money back benefit

- Save the date

- Lump sum payout instead of Income

- Lower Cover Income Booster

# Guaranteed Income

Here, you make a premium payment for a set number of years. You will begin receiving money when the policy payment term is over (one year after the end of the premium term).

You can also choose increasing income option also. The income will increase at a simple interest of 5% on an annual basis.

Suppose you are getting yearly income Rs 100, next year you will get Rs 105 and Rs 110 next to next year.

How guaranteed Income works?

- Pay for a predefined time

- You get steady or increasing( simple interest 5%) income

# MoneyBack benefit

In addition to guaranteed income, the policyholder can also choose to take a moneyback ( 0-100% of paid premium).

If you choose the money-back option, your take-home pay will be lower, and vice versa. ( example given below)

# Choose when you want Money back

You can take money back any year, on or after the maturity date of the policy. The MoneyBack Benefit will be payable at the end of the year, as chosen by you.

# Save the Date

One can choose to receive income on any date of your choice like your spouse’s birthdate, your anniversary date, date of maturity of your policy or any special date of your choice to receive the Guaranteed Income

# Flexibility to receive all future benefits as a lump sum benefit at a discounted value

You have the choice to convert future benefits into a lump payment at policy maturity (or at any time throughout the income term, at a discounted rate) in place of accepting yearly income.

All guaranteed future earnings as well as the MoneyBack Benefit (if applicable and not already paid) can be converted into a lump payment at your discretion. In the terrible event that the Life Assured passes away during the Income Period, the Claimant is still afforded this flexibility.

# Low Cover Income Booster

You can opt for taking lower life cover ( sum assured) and increase your take home income level.

Death Claim

In case of unfortunate death of life assured, the nominee will get the highest of the below three mentioned options:

Death Benefit is highest of:

a. Sum Assured on Death (defined as Death Benefit multiple X Annualized Premium)

b. 105% of the Total premiums paid up to the date of death

c. Death Benefit Factor X Maturity Sum Assured X {number of months for which premiums are paid up to dateof death / (12 X Premium Payment Term)}

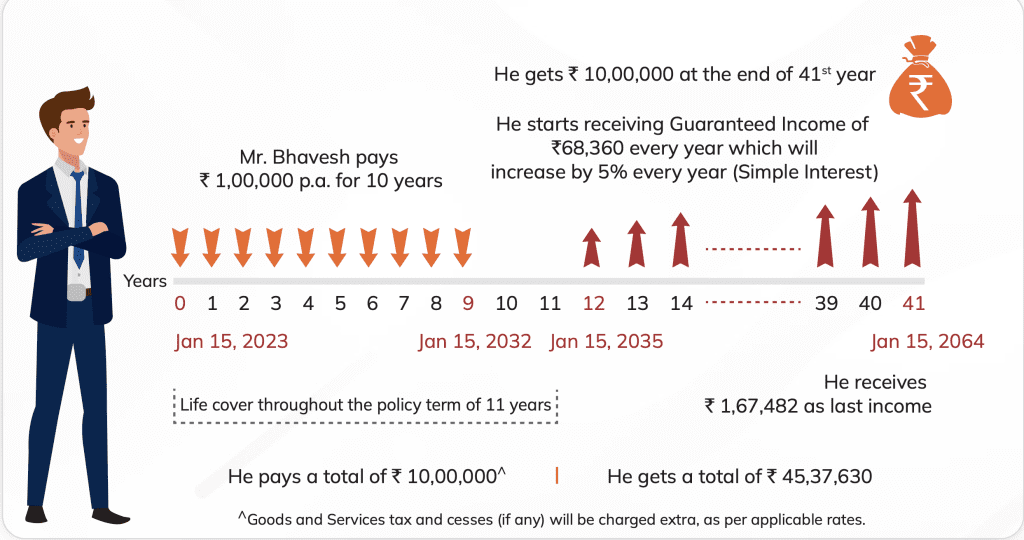

Illustration from brochure

Let’s say Mr. Bhavesh from the earlier example wants to receive income that increases every year to meet his future goals.

He decides to pay an annual premium of Rs. 1 lakh in ICICI Pru GIFT Pro and receive 100% MoneyBack Benefit in the last year of the Income Period and gets a life cover of minimum Rs. 10.70 lakh for 11 years.

He selects Increasing Guaranteed Income option to ensure an increasing Income throughout the income tenure. The Illustration given below shows the increasing guaranteed income that Mr. Bhavesh will receive.

If you wish to judge via the return you will get, it is 6.38% IRR (if you stay invested as per the illustration)

What happens if you stop paying the premium

- If you stop paying premiums in the first two years, no benefits will be payable.

- If you stop paying premiums after you have completed payment of premiums for two years, the policy can continue with reduced benefits.

- In such a case, Paid-up Maturity Benefit or Paid–up Death Benefit will be payable.

Reasons to buy ICICI Pru GIFT Pro

Although the product return is low but it is a good investment option for those who love to make FDs for investing purposes. At least here you are getting tax benefit, guaranteed returns and various options to choose from.

Should you buy ICICI Pru GIFT Pro?

I never have much interest in such things because of the following.

- Low returns

- Limited liquidity

- High exit penalty

You cannot just stop paying the premiums if you discover after the fact that the plan is subpar. You might only receive a little amount of your money returned or nothing at all.