Welcome to the ultimate guide to LIC term insurance plans! I Life Insurance Corporation (LIC) is a renowned insurance company which is safeguarding the financial future of millions of Indians for decades.

This post will cover everything you need to know about LIC term insurance, helping you to make an informed decision.

Whether you’re a first-time buyer or considering switching your existing policy, we will cover all the essential details of the LIC term insurance plan, including its benefits, features, claim process, and policy options. We will also delve into the factors you need to consider before choosing a plan that suits your unique requirements.

Table of Contents

What is term insurance and why is it important?

Term insurance is an insurance plan which is a pure risk cover plan. This also means economical plans with high risk coverage ( Life Cover). There will be no maturity value attached to the plan.

Buying term insurance means you are only buying life coverage / life insurance and nothing is paid on maturity.

Term Insurance Example

Let me explain with an example of Mr. Bestii Singh. Suppose Bestii age 25 and he buys a term plan of Rs 2 Cr and pays an annual premium of 40K ( assumed). The plan coverage is till age 70.

Now if Bestii survives till age 70, he won’t get anything in return ( means money is not refundable). In case Bestii dies before age 70, then Rs 2 Cr will be paid to his nominee.

Term Insurance is important since you can buy a high risk cover ( life insurance) at low cast ( low premium).

Thus, A term plan is a pure risk cover and the most cost-effective form of life insurance. Term insurance is the most affordable plans that provides financial security to your loved ones

Buy Term plan,

Not because, you are going to die

But,

Because your family members are going to live

Mamta Khanna, Certified Financial Planner

LIC Term Insurance plans

currently LIC has three term insurance policies. While the fourth plan is withdrawn.

- LIC New Tech term ( 954)

- LIC Jeevan Kiran ( 870)

- LIC Saral jeevan Bima (859)

- LIC Jeevan Amar ( withdrawn Plan)

Features and benefits of LIC term plan

Please refer the post LIC Term Insurance- Jeevan Kiran Vs New Tech Term Vs Saral Jeevan Bima to understand the complete difference between LIC term plans.

Types of LIC term insurance plans

On the basis of Maturity

There are two types of LIC pure risk cover plans –

- With return of purchase price term plan

- Without Return of purchase price term plan

Difference between LIC and term insurance?

There are multiple kinds of Life insurance plans in LIC such as Money back, term insurance, annuity plans, term insurance plans, ULIPs, and women empowerment.

But, LIC plans can be broadly expanded in 3-4 types of plans

| LIC -Life Insurance plans | Type of Plan | Premium | Life Cover | Expected return |

| Endowment Plan ( people refer it LIC generally) | Endowment Plan – Guaranteed maturity | Medium to high | Low | 5%-6% |

| Money back Endowment Plans | Endowment Plan -Guaranteed maturity | Medium to high | Low | 4%-5.5%-6% |

| Term Insurance Plans( without return of premium) | Term Plan -No maturity | Low | High | 0% |

| Term Insurance Plans( with return of premium) | Term Plan- Guaranteed maturity | Medium | High | Premium is refunded |

| ULIP – Unit Linked Insurance Plan | ULIP – maturity is NOT Guaranteed | Medium | Low | market-linked Returns |

| Annuity/pension Plans | Pension – Deferred/ Immediate Annuity | Medium | Low | 5%-6.5% |

Broadly, LIC Insurance plans are long-term plans ( 10-30 years ) that provide low insurance coverage and have low returns.

On the other hand, term insurance plans provide high-risk coverage at a very low cost comparatively.

Top 7 Reasons Why Should You Buy Term Life Insurance?

What Is Term Insurance-Advantages & Details

Mutual Funds Vs Life Insurance- Which Is Better?

LIC Term Insurance- Jeevan Kiran Vs New Tech Term Vs Saral Jeevan Bima

What is the difference between term insurance and term insurance with return premium?

With regular term insurance plans, the paid premium is NOT returned at maturity whereas, the case of return of purchase price plans, the entire paid premium is returned to the investor at maturity of the policy.

However, the premium rates of With return of purchase price term plans are quite high as compared to basic term plans.

Here, With Return Of Purchase plans itself defeats the purpose of economical life insurance plans.

Read more :

The Difference Between Term Insurance And Life Insurance

What Is Term Insurance-Advantages & Details

Top 7 Reasons Why Should You Buy Term Life Insurance?

LIC Jeevan Kiran ( 870) – New Term Plan

LIC or Term Insurance – which one to buy?

LIC is the company that provides all types of life insurance policies which include term plans too. But Here, LIC means the endowment plan for comparison purposes.

Although there is no similarity between the endowment plan and a term plan except both are insurance policies.

| Feature | Endowment Plans | Term Plan |

| Policy Duration/ Term | Endowment plans typically have very long duration usually 10-30 Years | Term Plan too have to kept for long duration, since the coverage needs to be till you have financial dependents on you |

| Life Insurance Coverage | Since these plans provide a maturity benefit, they provide a low risk coverage. | Term plan life cover is high as compared to premium. That is reason, why they are highly recommended products. |

| Premium | These are costly insurance products, since ROI from the policy is low | Premium is comparatively low. |

How to choose the right LIC term insurance plan for you

It’s always recommended to buy high life insurance cover. Thus a plan which provides high life cover at low cost should be considered.

- Shortlist from with and without return plans.

- Decide your life insurance cover amount & rider amount.

- Choose your coverage duration

- Choose payment frequency

- With return LIC Insurance Plan ( LIC Jeevan Kiran 870) is available both online and offline mode. Buy it as you like.

- There are two -without return plans –LIC New Tech term & LIC saral Jeevan Bima

- New Tech term is an online only plan and the minimum coverage amount is 50 lac and there is no upper side limit. Whereas LIC saral Jeevan Bima is available both online and offline but its maximum coverage is 25 lac only.

Understanding the claim process for LIC term plans

For any claim you need to approach the servicing branch. Address of the servicing branch will be given to you after completion of policy. You will get all required information from the branch for requirement of claim.

On receipt of intimation of death of the Life Assured the Branch Office calls for the following requirements:

a) Claim form A – Claimant’s Statement giving details of the deceased and the claimant.

b) Death certificate of policyholder

c) Documentary proof of age, if age is not admitted

d) Original Policy Document

e) Evidence of title to the deceased’s estate if the policy is not nominated, assigned or

issued under M.W.P. Act.

Factors that affect the premium of LIC term insurance policy

The factors that affect the LIC Term Insurance premium are

- Age

- Policy term

- Life coverage amount

- Current health status

- If you take alcohol . cigarette Premium will be high

- Health conditions

- Lifestyle

- Profession

- Activity you involve in

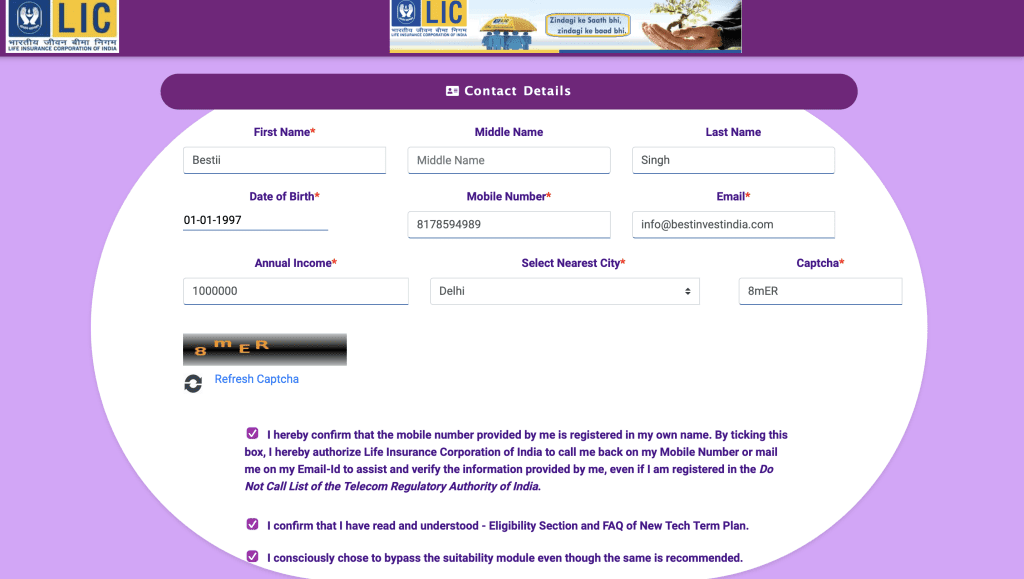

How to purchase LIC term life insurance online buy

- Visit link https://digisales.licindia.in/eSales/liconline

- Choose term assurance

- Click on buy online ( blue button)

- Click to buy online again

- Keep your documents ready – photograph & signature ( JPEG Format),self attested copy of address proof, Income proof, pan card,self canceled cheque

- Fil lin basic details and confirm the details

- Click on the tab calculate premium

- Submit the OTP

- Check and analyze details, add rider such as ADBR etc to enhance the coverage

- Pay the premium ( choose any mode of payment comfortable to you)

- The company will share policy documents over email.

- You are done with buying LIC Plans online.

LIC 1 Crore Term Plan -Premium Calculator

the There are several calculators available online but LIC online platform is the best to calculate premiums. To calculate the premium for the LIC Risk Cover plan- Visit link https://digisales.licindia.in/eSales/liconline and check LIC 1 crore plan or more.

The premium for 1 crore term plan LIC , Bestii Singh 26 years, term 40 years, life cover 1 crore, ADBR 50 lac is Rs 18144 ( level sum assured- the sum assured will remain same throughout policy.).

Conclusion:

Making an informed decision about LIC term insurance plans is necessary. Since it might be a one time decision for you. Thus choosing a plan is crucial.