SWP stands for systematic withdrawal plan from mutual funds. Under SWP option, either you deposit a lump sum amount in a mutual fund or use your existing mf units, to start monthly withdrawal from your money.

For example

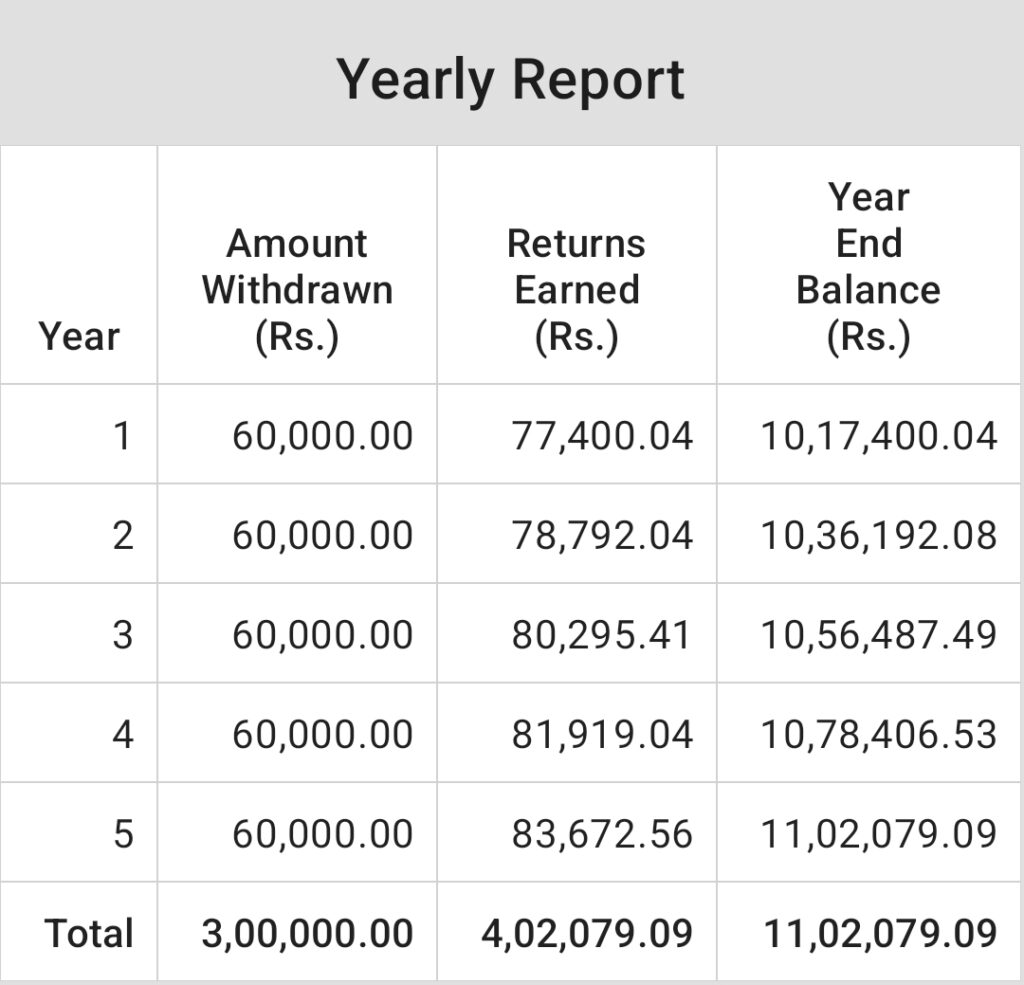

Mr. Ram wants to take income from SWP in mutual funds. To do this, he deposited Rs 10 lac in a mutual fund and started taking a monthly income of 10k from this money. https://youtu.be/ucUATpc5CDk

Once you submit a SWP request, it takes a month’s time to start getting income from your money. However you are free to withdraw any amount before completion of this time.

You can start SWP from any category of fund, be it equity mutual fund, debt mutual fund, balanced mutual fund or liquid fund etc.

Table of Contents

What are the benefits of SWP in Mutual Funds?

Flexibility

You can choose the withdrawal amount, frequency and date as per your own choice and convenience.

You can also stop taking withdrawals anytime ( By cancelling SWP ).

You can increase withdrawal amount anytime by starting a new SWP instructions (two SWP at a time) or by cancelling the previous one and starting a new one.

Monthly Income

SWP from a mutual fund can be the best source to generate monthly income. Since traditional plans have some limits attached to them, I mean you can only deposit a fixed amount in the schemes Such as POMIS, SCSS, PMVVY and other schemes.

While You can take any amount of Monthly income from systematic withdrawal plan.

Capital Appreciation

While you are taking income, your money is earning interest.

No TDS

TDS is not applicable on Mutual fund withdrawal. However, mutual funds withdrawal attracts capital gain Taxation.

How does SWP work differently than other options

In a systematic withdrawal plan you can customize your withdrawal amount, withdrawal date and even frequency too.

For instance as per the above example of Mr. Ram, can take a withdrawal of any amount 5K/10K/20K (or any other amount) from his 10 lac investment.

In Case of a fixed deposit or some other Investments like post office MIS or senior citizen Saving Scheme, you can take interest payment from your investment while in case of SWP this is quite different because here you withdraw principal and interest amount together.

For instance if you deposit 10 lac in Fixed deposit and SWP from a debt fund.

Here first box represent SWP from Mutual Funds and box 2 ( right side) represent Monthly income from Fixed deposit.

In MF SWP plan regular income of 5000 monthly from a balanced fund @8% safe return while in case of Fixed Deposit interest income @ 5.75%.

The final balance in SWP MF is 11lac and in Fixed Deposits 10 lac, the deposit amount itself.

There is a clear difference of approx 3000 monthly income and final amount.

To understand – please read the post How SWP works.

Who Should Opt for a Systematic Withdrawal Plan or SWP in Mutual Fund?

SWP Plan is suitable for who want to take regular income from their money. However, for money appreciation, one should not take systematic withdrawal from mutual fund but instead invest lumpsum amount in mutual funds.

Read more-How to invest lumpsum amount in mutual funds

Tax implications of SWP from mutual fund

The maturity amount from fixed deposit and other investments are taxed as per the one’s income tax slab rate and before maturity TDS is deducted.

However in mutual fund withdrawals, capital gain tax is applicable.

Mutual fund gains (also known as capital gain) are only taxed when you redeem mutual fund units (sell mutual fund units).

Mutual fund tax depends on three factors.

Type of Mutual Fund

Equity mutual fund and debt mutual fund both carry the different tax structures.

Equity Mutual Fund -The funds which invest (more than 65%) primarily in equity/stock-based investments are called Equity Mutual funds.

Debt Mutual Fund -While the funds which invest in non-equity instruments such as Govt. Securities, treasury bills and CPs, bonds debentures are called debt funds.

Holding Period

The other factor which determines your mutual fund taxation is your holding period.

This also means that after how much time you redeem your money from mutual funds.

Even holding period definition is also different for equity and debt funds.

Residential Status

Your tax also depends on your residential status. There are different tax rules for Indian resident and NRI.

Is SWP better than FD?

For generating monthly income SWP is far better than Fixed deposits. Mutual funds provide inflation adjusted returns in the long term.

However, one should start SWP from debt mutual funds ( liquid,ultra short, short term mf ) or from balanced mutual funds only.

Taking income from equity mutual fund can be risky, if you do not know much about mutual funds. Taking income from equity mf can be highly risky, because this way you money value may depreciate faster as compared to debt funds.

Your principal amount can be exhausted before you come to know.

Read more about mutual funds