I am glad that you are willing to secure your future financially.

Usually people keep on procrastinating it until late 30, 40 or sometimes 50 also. To secure future financially you need to keep some of the factors in mind.

-

Table of Contents

Here are some simple steps you can take to ensure your financial security before turning 50 years old:

Know where are you right now :

Means at least try and put some effort and know where you stand right now. I mean what is your net worth right now.

I know it is not worth knowing as you are confident enough that your future will be bright and secured. I am confident too.

But isn’t it worth considering your life goals, for which you wish to work and save your money.

-

You can reach your destination:

If you know where to reach, how to reach, what mode you can take, how long it will take and what duration of time you have to ensure that your future financial goals are.

So it is absolutely necessary to know the above factors as to ensure to meet the target amount.

It is just like your office work deadline where you have to know where, how, what and duration/time to submit file/work or a project.

-

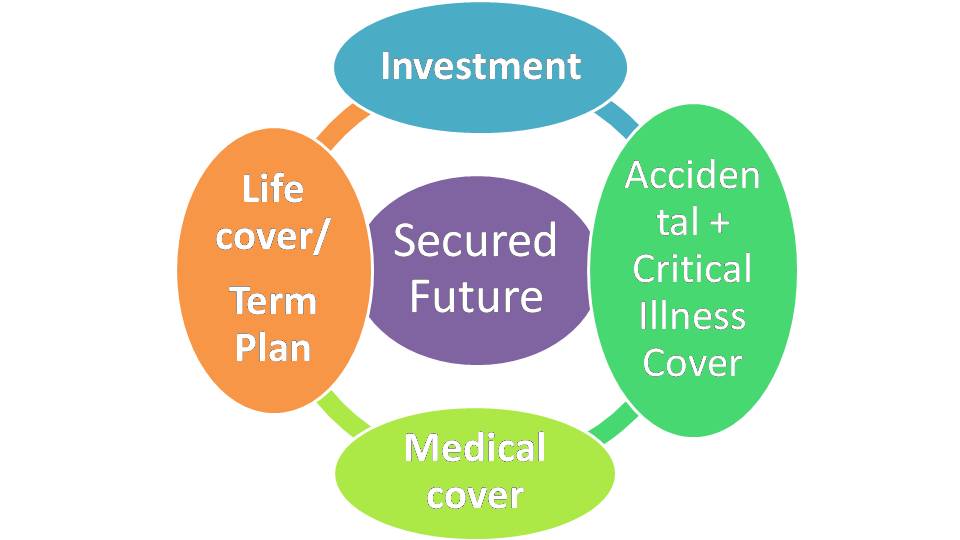

Buy adequate protection cover:

Term Plan, Accidental cover, Critical illness cover and medical cover are the four pillars of personal and financial safety to you and family.

It further strengthens your belief that you are secured against future contingencies, which nobody can predict beforehand.

Along with investments having above mentioned cover is also a very important aspect of securing future.

One contingency may wipe out all your savings and planning. So it is of utmost important to secure fully.

-

Never Buy a Product you do not understand

Understanding of a product you buy is a must. You should never invest in a product which you don’t understand. For instance, people buy insurance policy for the sake of tax saving but forgets to gauge whether it is suitable to their future need of not.

They even tend to ignore the rate of return it will provide. Is it inflation linked or not? Will they be able to get money when their goal will arrive in future?

I have personally seen many cases in which money is required in this year but maturity of the policy is in next year. This is really sad for the person who is there in the situation.

-

Plan your retirement well in advance:

Many people live in the impression that their pension policy or the pension from the employer or rental income will be sufficient to meet their future expenses.

Unfortunately this amount tends to be less when they reach their retirement phase.

This is because they do not take inflation into account, which is the main culprit here, which plays a foul game with your investments.

Try to recollect, what used to be the grocery bill when you were young or what used to be the cost of things you bought in your childhood days and how much does it price now.

-

To counter inflation, Invest in Equity or Equity Mutual Fund too:

Whether you agree or not, but if you wish to have wealthy future ahead, you will have to invest in equity too.

If you are comfortable with debt investments only then increase the amount substantially.

You can take help of online freebie calculators for that matter or consult a Financial Advisor.

-

Be Courageous enough to dump your non performing investments:

To get help on this you can contact a financial advisor and get a Financial Plan prepared from him or her. This will help you to know inappropriate investments in your kitty.

-

Say yes to Portfolio Review:

Once you start the investment you should have a regular Portfolio Review so that you can dump the non performing investment and replace it with better investments to reach to your goal. This also helps you to map your investment with your life goals and lets you know if there is any shortfall for the same.

One can invest as per his/her comfort level i.e. if one is getting regular cash flow, one can start a SIP along with bulk investment or only SIP. If one does not have regular cash flow like in case of professionals and business owners, they can invest whenever they have surplus money.Here the most important aspect is to invest, be it any mode. Mode of investment can be chosen as per your comfort level.

It is always better to know where you have to reach. Once you know, you can take the right measures, right Investments.

-

Reduce your Debt :

You should work on to reduce your debt/loan liabilities as interest eats your hard earned money.

-

Keep a separate Emergency Fund:

I know this must be the first thing to do. I had written it at last so that you ensure that you do it first.

You should at least keep your six months income or 3-5 lac as an emergency fund in FD or Ultra Short mutual fund category.

Unforeseen events can happen with anybody so better be prepared for it.

Conclusion:

To secure your future financially you must plan your finances well in advance just like you plan your holiday.

So have a Financial Plan today and secure your future.

Secure it with a sound bullet proof planning of a Financial Plan.