LIC SIIP plan is a LIC’s Unit linked insurance plan. LIC SIIP 852 is a regular premium payment plan which provides investment and insurance cover in the same plan.

There are multiple benefits attached to the SIIP LIC like guaranteed additions, maturity benefit, life cover and more. We will cover each section one by one.

Let’s begin with

One can buy LIC SIIP 852 plan both ways-online and offline and also choose the premium payment frequency as Yearly, half yearly, quarterly or monthly.

Table of Contents

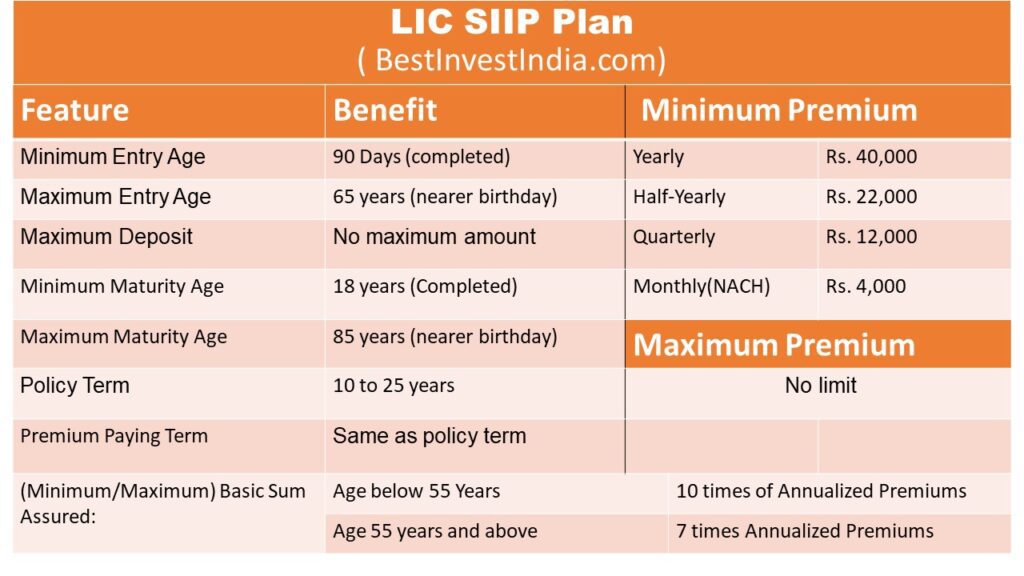

LIC BII Plan 852 – Eligibility & Premium Details

LIC 852 Plan -Maturity Benefit

At maturity an amount equal to Unit Fund Value shall be payable, if all due premiums under the policy have been paid.

The added advantage of LIC SIIP 852

The entire amount paid as mortality charges will be refunded to the policy holder provided If all the due premiums are paid.

Guaranteed Additions

The policyholder will get Guaranteed Additions, if all the premium is paid till maturity.

| End of Policy Year | Guaranteed Additions (as percentage of one Annualized Premium) |

| 6 | 5% |

| 10 | 10% |

| 15 | 15% |

| 20 | 20% |

| 25 | 25% |

Partial Withdrawal

After completion of 5 policy years, one can withdraw money partially

| Policy Year | Percent of Unit Fund |

| 6th to 10th year | 20% |

| 11th to 15th year | 25% |

| 16th to 20th year | 30% |

| 21st to 25th year | 35% |

Effect of partial Withdrawal on Sum Assured

After partial withdrawal, the Basic Sum Assured or Paid-up Sum Assured, whichever is applicable, shall be reduced to the extent of partial Withdrawals for two years.

On completion of two years’ period from the date of withdrawal the original Basic Sum Assured/Paid-up Sum Assured shall be restored.

Fund Choice

The investor gets four fund choices namely growth, balanced, secured and bond. You can choose any one fund from the these options.

Charges under the LIC SIIP Plan

There are four types of charges applicable in SIIP Plan.

1.Premium Allocation Charge:

This is the percentage of the premium charged towards charges from the premium received. The balance amount is utilized to purchase units for the policy.

2.Mortality Charges

Mortality Charge is the cost of life insurance cover, which is age specific.

The Mortality Charges deduction takes place at the beginning of each policy month by canceling the appropriate number of units out of the Unit Fund Value. The monthly charges will be one twelfth of the annual Mortality Charges.

The rate of Mortality Charge per annum per Rs. 1000/- Sum at Risk for some of the ages in respect of a healthy life are as under:

Example: Mr. A, 35 years have sum assured of 10 lakh

The mortality charges for Mr. A will be 10,00,000/1000*1.60 = Rs 1600 each year. So, Rs 1600/12 =133.33 will be deducted at the beginning of every month.

3.Other Charges

Fund Management Charge

This is a charge levied as a percentage of the value of the assets and shall be appropriated by adjusting the Net Asset Value. The Fund management charges of 1.35% p.a. of Unit Fund for all the four fund types

For “Discontinued Policy Fund”, these charges are reduced to 0.50% p.a. of Unit Fund

Switching Charge

This is a charge levied on switching of monies from one segregated fund to another. One can avail 4 switches free of charge in a policy year.

Subsequent switches in that year shall be subject to a Switching Charge of Rs. 100 per switch. This charge will be recovered by canceling appropriate number of units out of the

Partial Withdrawal Charge

This is a charge levied on the Unit Fund at the time of partial withdrawal of the fund during the contract period.

A flat amount of Rs. 100/- shall be deducted by canceling the appropriate number of units out of the Unit Fund Value on the date on which partial withdrawal takes place.

Settlement Option

If you feel that your nominee will not be able to handle the money after you than you can exercise this option any time. Under settlement option you can instruct the company to pay death claim in installments. Here you can choose the frequency of payment for a period of 5 year.

The death claim amount shall then be paid to the nominee as per the option exercised and no alteration

whatsoever shall be allowed to be made by the nominee.

The Unit Fund under such policy will continue to be invested as per the fund type existing as on the date of intimation of death.

What if, you choose to Not pay the Premium

If you opt to not pay a subsequent premium than the policy money is shifted to a discontinued fund. In such a case you have to pay penalty as discontinuance charges

AP is annual Premium amount

FV is – Unit Fund Value on the date of discontinuance of policy

“Date of discontinuance of the policy” shall be the date on which the intimation is received from the Life Assured / Policyholder about the surrender of the policy or on the expiry of the Grace Period (in case of non-payment of contractual premium due during the Grace period), whichever is earlier.

Death Benefit

On death before the Date of Commencement of Risk:

An amount equal to the Unit Fund Value shall be payable.

On death after the Date of Commencement of Risk:

An amount equal to the highest of the following shall be payable

1.Basic Sum Assured reduced by Partial Withdrawals,

2.Unit Fund Value

3.105% of the total premiums

* In case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

What is LIC SIIP Plan?

Finally in a nutshell LIC 852 plan is a market linked insurance plan where you can buy the plan by paying 40k yearly premium and choose the premium paying term and frequency.

You can choose the fund type based on your risk profile and your understanding of market. This plan does not provide choosing the funds in 50:50 proportion. Therefore one have to choose a single asset class to invest in. However mixed investment is given in each fund choice. You can choose as per your requirement.

Here, firstly the charges are deducted from the plan and thereafter the remaining premium is invested.