ICICI prudential has launched ICICI prudential PSU equity fund, an open ended equity fund. The PSU Equity Fund is open for subscription from 23rd August and the NFO will close on 6 September.

ICICI prudential PSU equity fund provides the opportunity to invest in across market capitalisation i.e large cap, mid and small cap. The Fund will predominantly invest in PSU Stocks.

Table of Contents

ICICI Prudential PSU Equity Fund -Features

The fund objective is to provide long term capital appreciation by investing predominantly in equity or equity related instrument of PSU companies.

The ICICI Prudential PSU Equity fund will invest minimum 80% in PSU stocks and scheme may also invest up to 20% in other equity or equity related securities.

Type of the Scheme

An open-ended equity scheme following the PSU theme.

Investment Objective

The scheme objective is to generate long term capital appreciation by investing predominantly in equity and equity related securities of Public Sector Undertakings (PSUs).

However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

Asset Allocation as per SID (in %)

THE ICICI Prudential PSU Equity Fund will invest in below mentioned undertakings:

| Equity & Equity related instruments of Public Sector Undertakings | 80-100 |

| Other Equity & Equity related instruments | 0-20 |

| Debt instruments, Units of Debt Mutual Fund schemes, and Money market instruments @ and Preference shares | 0-20 |

| Units issued by REITs and INVITs | 0-10 |

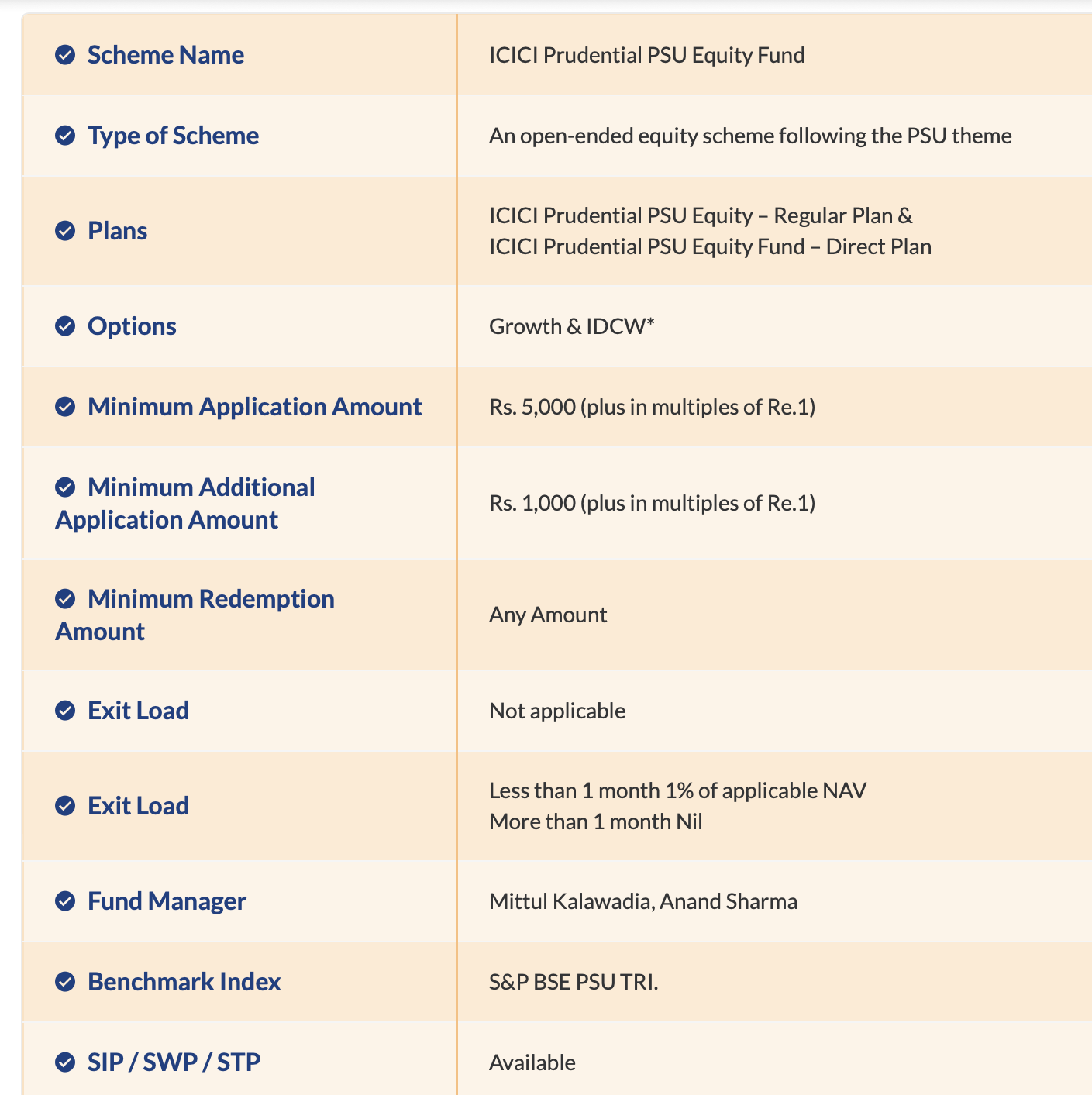

ICICI prudential PSU equity fund -Details

One can invest in PSU Equity Fund as a one time investment of minimum Rs. 5000 or through SIP. There is no Entry load.

However, if you exit the scheme before completion of 1 year 1% exit load will be applicable.

Where the the Scheme will invest?

The scheme predominantly invest in stock that are part of S & P BSE PSU TRI Index. it invest minimum 80% in equity and equity related instruments of public sector undertaking and may invest up to 20% in other equity and equity related security.

The scheme may also diversified the investment across market capitalisation i.e.large, mid and small cap companies depending on the market opportunities.

What is Public Sector Undertakings?

PSU usually have substantial government ownership. Therefore this space seeks to provide better margin of safety.Public sector undertakings are present in various sectors like telecom, IT ,agriculture, energy, defence power and more.

PSU stocks are available in various sectors thereby providing adequate diversification, by investing across the sectors.

Thus ICICI prudential PSU equity fund provide you the opportunity to invest in PSU companies across the sectors.

PSU Stocks usually pay higher dividends. If one invested directly as stocks, the dividends is taxable as per the tax slab rate of an individual. If bought as a mutual fund will be taxed as per mutual fund taxation law.

Who should invest in ICICI prudential PSU equity fund?

ICICI prudential PSU equity fund is suitable for the investor who seek long term capital appreciation and who want to follow the PSU theme.

Since fund is investing in PSU stocks only, thus it belongs to thematic category of mutual funds. As per the riskometer, the fund is in high risk category.

As per the riskometer, the fund is riskier than the large cap and other categories of funds. Therefore investors who can invest for long duration (more than 5-7 years) should only invest in the fund.

Additional Reading

Beginners Guide To Mutual Fund

SIP Or LumpSum – Which Is More Profitable?

Mutual Fund SIP-Systematic Investment Plan II Step By Step Guide On How To Start A Mutual Fund SIP

How To Become A Crorepati With SIP Investment 5000 Per Month