Mutual Fund SIP is a recurring investment( usually monthly) in mutual funds. Just like you invest your money in a Recurring deposit, similarly, you can invest in mutual fund SIP also.

Last updated on 11 Feb 2024

Table of Contents

What are Mutual Funds?

A Mutual Fund is an investment scheme where people pool in money (just like other investments) and your money is invested (on your behalf) in stocks, bonds, or other securities.

It is one of the best investment avenues which can create huge wealth for its users (investors).

These investments can be used for various investment requirements such as financial goals ( retirement, child education, purchase of an asset, home, etc.), short term money parking, fixed maturity plans, regular income, tax saving, and wealth creation.

Also Read: How To Set Financial Goals SMARTLY

But it is very important to understand mutual funds completely before going further. Here is a complete mutual fund guide.

How to invest in Mutual Fund

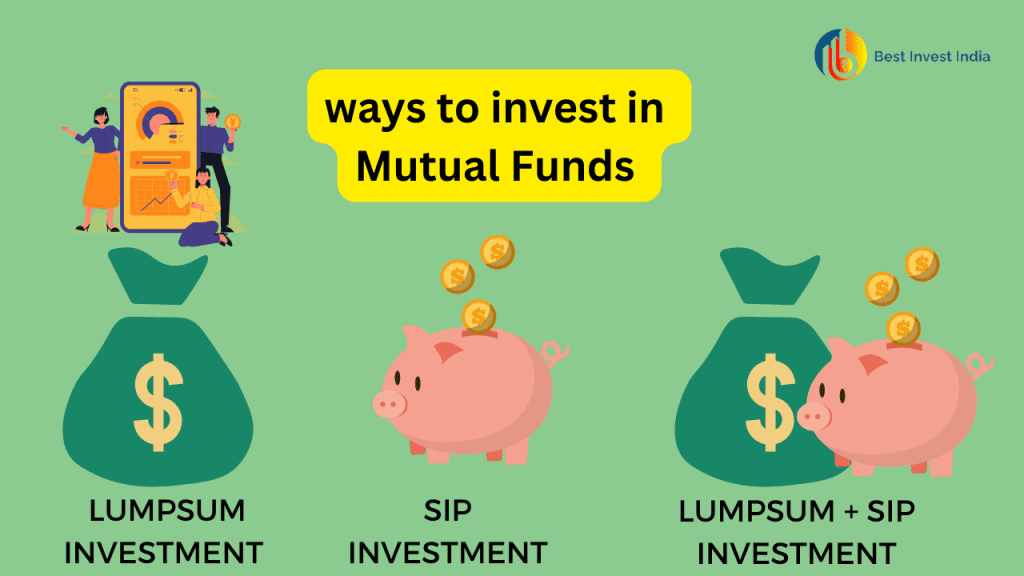

There are two ways through which you can invest in a mutual fund.

- One Time/ Lumpsum Investment

- SIP ( Systematic Investment Plan)

You can choose lump sum investment or SIP investment as per your cash flow.

Mutual Fund SIP Full Form

Mutual Fund SIP Full Form is a Systematic Investment Plan. SIP is a way to invest in a mutual fund scheme.

Here you pay after a FIXED TIME duration and a FIXED AMOUNT. You commit to investing a fixed amount after a definite interval ( say monthly).

You can choose to pay daily, weekly monthly, quarterly, half-yearly, or yearly, however, the monthly mode is famous for its convenience.

If you are salaried or get a regular payout from your business or profession then you can opt in to invest in mutual funds via SIP.

What is the difference between a Mutual Fund and SIP?

Mutual fund is a fund or scheme which pools in money from people while SIP is a method to invest in mutual fund.

You can invest in this mutual fund scheme via two ways either lumpsum or via SIP ( systematic investment plan).

How Mutual fund SIP works- with Example

Say, Mr. Bestii Singh started a monthly SIP of Rs 10000 in January. He paid in January, February and March only. Let’s assume that he foreclosed his SIP before time.

After some time say in December next year, he withdrew his entire amount.

Here He purchased units in January @ Rs 10 ( NAV/Purchase price), in February @ Rs 11, and in March @Rs 9.5. So he could purchase a different number of units each month with the same amount of money. This is because of the reason of price change in mutual fund unit rate.

Now, say at the time of sale ( redemption) the unit price increased to Rs 13. So he will get Rs.38502.38.

a The mutual fund works on unit basis. The money you invest is divided by the NAV ( just like you go to the market and purchase one piece of soap or a toothpaste similarly you purchase here a unit of mutual fund).

As the price (NAV – Net Asset Value) of mutual fund keep on changing, you are allotted different number of units.

Let’s understand with an example of How SIP works:

| Month | Amount | NAV/ Purchase price | Units | No of units |

| January | 10000 | 10 | 10000/10 | 1000 |

| February | 10000 | 11 | 10000/11 | 909.09 |

| March | 10000 | 9.5 | 10000/9.5 | 1052.63 |

| Total No of units | 2961.721 | |||

| Suppose now you want to sell | 13 | Money value 2961.721*13 =38502.38 | ||

How to invest in SIP

To invest in a MUTUAL FUND Scheme, the investor should be KYC compliant. The investor can complete CKYC either through physical form or online mode.

Post KYC, one can invest easily in mutual funds.

For New Investors- KYC process Through Form (Offline)

You require following documents:

- passport size photo

- address proof ( can be Aadhar card, Voter ID , Passport, Ration card, driving license, flat maintenance bill, insurance copy, utility bills( telephone, gas, electricity etc.),bank account statement, passbook ( last entry –not more than 3 month old), ID cards issued by Govt. etc.

- PAN Card (if investment is less than 50000 then PAN card copy is not mandatory, but it is advisable to mention PAN card number.

CKYC Process

- Fill CKYC Form – Basic details such as name, date of birth, address, parents name,PAN number, Aadhar number, phone number and email address etc.

- paste passport size photo signed across

- Attach self attested documents – PAN Card & Address Proof

- all the documents must be attested by an ARN holder or Gazetted Officer, bank manager or by AMC authorized staff.

- Sign form

You also need to submit investment forms ( common application form) also with KYC form. For SIP registration attach SIP form and Auto debit form ( NACH) also.

Don’t forget to add a cheque favoring fund name:

For instance you can write down fund name such as Aditya Birla Sun Life Frontline Equity Fund.

Sample MUTUAL FUND SIP form filling, you can check it from link given below

Filling of CKYC form: Kindly refer to below images

How to invest in SIP in India – Online

- Keep all documents Ready ( scanned copies in jpeg, jpg format)

- Complete KYC ( For first time investors)

- Choose the right plan

- Register for SIP

- Select investment amount

- Choose investment date

- Choose investment duration

- submit

- Make payment

Step1: Complete your KYC

To complete your KYC you should be ready with soft scanned copies of your above said documents i.e pan card, Aadhar card, cheque copy and your photo, signature ( all documents should be saved in jpeg format.Visit AMC website/ Cams/ Karvy.

Go to new investor or first time investment or new investor tab. Fill in your personal information like your name, date of birth, address, nominee, phone number etc. and upload your documents as it asks for.

Alternative easier method using your Aadhar Card

You can easily be KYC compliant just entering your Aadhar card number also. But you can invest only upto Rs 50 K through this method.

- Enter your Aadhar number

- Submit OTP sent to your registered mobile number

- Your basic details will be automatically be filled in

- There is no need of video call

- Make investment either lumpsum or start an mutual fund SIP

STEP 2 : Register for an SIP

- Go to the AMC website/ Cams/Karvy

- Register a new account ( to do this look for a button like ‘new investment’ , ‘intiate investment’ , ‘ new investor’.

- Once you click this button, this will take you to a form. You need to fill your basic information like your name,address,phone number , date of birth etc.

- At this time you also have to choose your email id and password for carrying out transaction online.

- Fill in your bank account details from which you wish to start your SIP.

- Once you fill in information and AMC portal has sent confirmation, you can start your SIP.

STEP 3 Select the Right SIP

- Choose the amount and frequency as per your need and your payment capacity.

- Choose a SIP date carefully. Ideally, it can be at the start of the month when you get your salary in your account.

- Choose a growth option for money appreciation.

- If you wish to increase the SIP amount periodically say each year then you can opt for the SIP TOP Up option also.

Conclusion

A systematic investment Plan is an easy to start and maintain investment plan. In other words, mutual fund SIP is an easy to create wealth plan for investors, which is pocket friendly too. It allows investors to start with as small as Rs 500 per month. Even few AMCs allow to start with Rs 100 a month as well.

Above all the future SIP amount deduction is automatic. To start a SIP, is a one time process. later the amount gets deducted automatically ( through NACH).

How to Plan Your Investment?

You can always work with a Certified Financial planner and plan your finances, including Emergency funding, building a corpus for house purchase, and taking care of your health needs so that you can plan a better retirement income in your second inning, leading to a more secure and financially stable retirement.

If you have learned something new and found the article informative, Then please share & Comment. This will help me reach more readers and spread financial awareness.