While many people are investing their money others are withdrawing. When you are investing through SIP, the common questions arises about SIP taxation or Do I have to pay tax on SIP?

In this blog post we will discuss about SIP taxation and understand how SIPs are taxed.

Table of Contents

SIP taxation depends on three broad factors:

1. your residential status

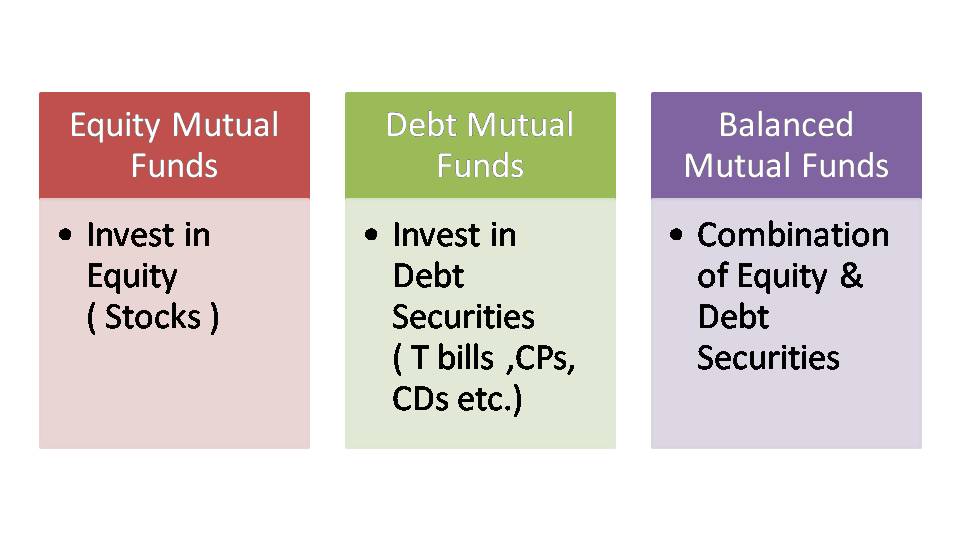

2. type of fund

3. your holding period of that particular fund.

The taxation rules are the same for mutual funds or SIP.

To understand how SIP is taxed – let’s begin with the basics first.

Systematic Investment Plan or Mutual Fund SIP

A systematic Investment Plan( SIP ) is a way to invest in a mutual fund scheme.

Mutual Fund SIP is a recurring investment( usually monthly) and works similar to a Recurring deposits.

You can invest in mutual fund SIP just as you invest in any other monthly investment scheme.

However, returns are not guaranteed in SIPs as guaranteed in RDs.

Here you pay after a FIXED TIME duration and a FIXED AMOUNT. You commit to investing a fixed amount after a definite interval ( say monthly).

You can choose to pay daily, weekly monthly, quarterly, half-yearly, or yearly, however, the monthly mode is most famous for its convenience.

What is SIP in a mutual funds with Example?

Say, Anmol started a monthly SIP of Rs 10000 in January. He paid in January, February, and March only. Let’s assume that he foreclosed his SIP before time.

After some time say in December next year, he withdrew his entire amount.

Here He purchased units in January @ of Rs 10 ( NAV/Purchase price), in February @ Rs 11, and in March @Rs 9.5. So he could purchase a different number of units each month with the same amount of money. This is because of the reason of price change in mutual fund units rate.

Now, say at the time of sale ( redemption) the unit price increased to Rs 13. So he will get Rs.38502.38.

The mutual fund works on a unit basis. The money you invest is divided by the NAV ( just like you go to the market and purchase one piece of soap or a toothpaste similarly you purchase here a unit of mutual fund).

As the price (NAV – Net Asset Value) of a mutual funds keeps on changing, you are allotted different number of units.

Let’s understand with an example-How SIP works:

| Month | Amount | NAV/ Purchase price | Units | No of units |

| January | 10000 | 10 | 10000/10 | 1000 |

| February | 10000 | 11 | 10000/11 | 909.09 |

| March | 10000 | 9.5 | 10000/9.5 | 1052.63 |

| Total No of units | 2961.721 | |||

| Suppose now you want to sell | 13 | Money value 2961.721*13 =38502.38 |

SIP Taxation

There are two types of charges which are applicable when we withdraw from mutual funds.

- Exit load

- Capital gain tax

Exit load -Different mutual funds may have different exit loads. Equity Mutual funds have an usual exit load of 1% if you withdraw before completion of 1 year.

Here, we will discuss the general rule of exit load in equity, debt mutual funds, Equity oriented hybrid funds, and Debt oriented Hybrid funds.

Exit load on the basis of type of Fund & your investing duration

| Type of fund | Before 1 year ( Equity Funds)/ Before 3 year ( Debt funds) | After one year/3 year |

| Equity mutual fund | 1% of the withdrawal amount | No exit load |

| Debt Fund – Liquid | Liquid Fund- No exit load ( some funds might have very low exit load ( please check once before investing) | |

| Other debt funds | exit load vary from scheme to scheme and different funds may have different duration of exit load |

Taxation on the basis of type of fund & Your Investing Duration

Both Equity and Debt mutual funds have different investment duration for taxation. For instance, short-term capital gain in equity mutual funds is considered for investment duration of up to 1 year while this time is 3 years in the case of Debt mutual funds.

Capital gain tax is of two types

- Short term capital gain

- Long term capital gain

Even taxation is also different for equity & debt mutual funds. The below table explains well about taxation rate.

Now let’s understand How SIPs are taxed

In the case of a systematic Investment Plan, each month’s payment is considered a new investment (from a taxation point of view), and each investment is taxed accordingly.

Let’s take the example of Angrez Singh again, Saying he has Started a SIP of Rs. 5000 and paid 12 installments in total.

Let’s first assume he invested in an equity mutual fund, then if he withdraws the entire amount after the completion of 1 year then his first installment will be considered for LTCG while the rest 11-month investment will fall under STCG.

Money invested Rs 60000

Redemption value on Jan 22 = 72000

The exit load on total of 11 installments because these installments have not completed 1 year

exit load will be 6000*11*1%=66000 *1%=Rs 660

Tax first installment will come under LTCG Tax as it has completed 1 year. Here tax value is nil as LTCG is only Rs. 1000 ( 6000-5000). So no tax on first installment. ( please consider capital gain taxation table for tax reference).

STCG will be applicable for rest of 11 installments as all these installments have not completed 1 year duration. So the STCG will be calculated as follows:

Money invested Rs 55000

Redemption value on Jan 22 = 6000*11=66000

STCG = 15% of gain = 15% *(66000-55000)

15% * 11000=1650

If he had invested in a debt mutual fund then this time period will be replaced by 3 years as given above also. ( please correlated with debt mutual fund taxation for this)

- ( Please note that redemption value on Jan 22 is taken constant for understanding purpose. All figures given below are hypothetical for illustration purpose only)

How SIPs are taxed?

To understand it fully- please consider watching

FAQs

Can I withdraw my SIP anytime?

Yes, you can withdraw your SIP amount anytime provided it is not an ELSS mutual fund or any other close-ended fund. You can withdraw the partial or entire amount also.

Are there any charges for SIP?

Yes, withdrawal charges may be applicable depending on type of fund, your residential status, and your holding period. The taxation is explained in the article.

How exit load calculated in SIP?

In case of equity mutual fund, if you withdraw before completion of 1 year then 1% of the withdrawal amount is deducted as exit load ( Most equity funds have 1% exit load for a 1-year duration – this may vary from fund to fund).

In debt funds, this exit load varies from fund to fund.

Is withdrawal of SIP taxable ?

Yes, withdrawal from SIP amount is taxable in nature.