Choosing between SIP or PPF and know which is better, always confuses the investors. PPF is well known for its safe and secure returns while the mutual fund has high returns. A constant battle goes on while choosing between PPF or mutual fund.

This post will make it clear on mutual fund or PPF, which is better.

Post last updated on 16 July 2024

Table of Contents

PPF and Mutual Fund – which is best?

Let’s first understand PPF and mutual funds separately first.

PPF is a 15-year scheme, safe and secure scheme. The Central Government of India backs it.

Since it’s a 15 year scheme, you must deposit money at least once a year for 15 years.

A Mutual Fund is an investment scheme where people pool money (just like other investments). This money is invested (on your behalf) in stocks, bonds or other securities ( depending on the scheme objective).

Learn More about Difference Between SIP And Mutual Fund -Example

Read more PPF : Public Provident Fund -Interest & Maturity Amount

PPF online payment How To Make Online Payment Of PPF/SSA/ Post Office Savings

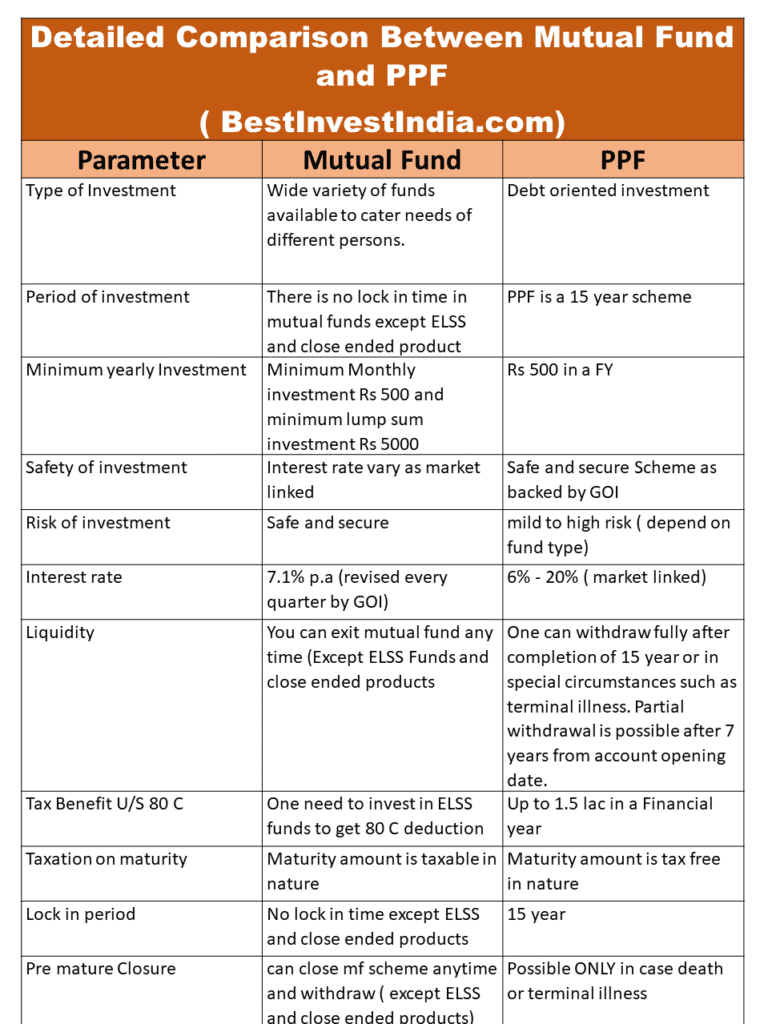

Type of Investment

PPF is a debt scheme( fixed return) whereas mutual funds can be categorised as equity, debt and balanced funds. In mutual funds, returns are not guaranteed. The return depends on factors such as Scheme performance, market conditions and economic parameters.

Period of Investment

PPF is a 15-year compulsory payment scheme whereas in a mutual fund you can pay for any duration. There is no compulsion or mandatory payment. Even if you have started a mutual fund SIP, you can stop paying in between and stop SIP.

Minimum Investment

In PPF, you have to compulsorily pay Rs 500 each financial year, whereas you can start a SIP with as little as Rs 100/500 and Rs 5000 as one-time investment. Few Funds allow Rs 1000 as a time investment.

Safety of Investment

Mutual funds are market-linked products. Thus MF return fluctuate with market movement. While, PPF is a risk free investing option, backed by GoI.

Mutual funds can be categorised into different asset classes. Mutual Fund classification depends on their underlying portfolio.

Interest rate & Liquidity

The current PPF interest rate is 7.1% while in the case of mutual funds, there is no fixed return.

However, you can assume a return of around 7%-15%.

Mutual funds are highly liquid in nature ( you can withdraw anytime subject to condition, if any) while PPF withdrawal is only possible after 15 year. However after 7 years partial withdrawal is possible.

Tax Benefit U/S 80C

PPF is loved for its Exempt – Exempt – Exempt attribute.

- Money Deposit– You get tax deduction up to 1.5 lac in an FY.

- Interest – interest is tax Free.

- Maturity – Maturity is also tax Free.

In Mutual Funds, ELSS Funds (Tax Saving Equity Mutual Funds), gets tax deduction U/S 80C.

ELSS mutual fund schemes are diversified schemes with 3 3-year lock-in period. You can even deposit a higher amount than 1.5 lac but you will get 80 C benefit only for 1.5 lac. ELSS Funds Meaning, Tax Benefit & How To Invest?

https://bestinvestindia.com/best-tax-saver-funds-india-top-10-elss-funds/

Top 7 tax saving investments in India

Taxation on Maturity

PPF maturity is completely tax-free whereas gains on mutual funds are taxed when you exit a scheme. The taxation of mutual funds depends on many factors.

Read More : Mutual Fund Taxation – How Your Gains Are Taxed?

Is it good to invest in PPF or Mutual Fund?

It will be a biased decision to rate one product above the other. Both products are known for their unique benefits. However, as an investor, one can choose both or one depending on their need and requirements.

PPF is best suited for risk-averse investors, whereas if you are willing to take some risk and need better returns, you can move to mutual funds.

In addition, it is best to set your asset allocation and decide your debt-to-equity ratio. If your asset allocation permits, you can accommodate both together.

Let’s calculate it

PPF or Mutual Fund Calculator

Let’s Calcluate for Bestii Singh starts investing in both PPF Vs SIP, monthly and Lump-sum ( for calculation purposes).

| PPF ( Monthly Contribution Rs 12500) – ROI 7.1%, 15Years | SIP ( Monthly Contribution Rs 12500)- ROI 12%, 15Years | PPF ( Yearly Contribution Rs 150000) – ROI 7.1%, 15Years | Mutual Fund ( Yearly Contribution Rs 150000) – ROI 12%, 15Years |

| Maturity – Rs 39,44,600 | Maturity – Rs 59,55,434 | Maturity –Rs.40,68,210 | Maturity – Rs.62,62,990 |

Read More, Earn More

Enjoy our videos on Youtube

https://www.youtube.com/watch?v=-cul-kU8ji0&list=PLBn8Od6PRYmJp_1H-f5YLtSpl5q-Nq2kc

https://www.youtube.com/watch?v=THI4l_ndozQ&list=PLBn8Od6PRYmK0zwTICAEa-tcznFewneRa

Subscribe to our Youtube Channel