Kotak Mutual Fund has launched Kotak Nifty 100 Low Volatility 30 Index Fund. It is an open-ended scheme that aims to track the NIFTY 100 Low Volatility 30 Index.

Let’s first try to understand the underlying index.

Table of Contents

What is Nifty 100 Low Volatility 30 Index?

Nifty 100 Low Volatility 30 Index aims to measure the performance of the low volatile securities in the large market capitalisation segment.

The securities are selected from Nifty 100 index that are available for trading in the derivative segment(F&O).

The benchmark composition is such that, it is suited for comparing the scheme performance.

Why Choose Kotak Nifty 100 Low Volatility 30 Index Fund over Nifty 100 or Nifty 50 Index Fund?

One should invest in Nifty 100 Low Volatility 30 Index for below mentioned reasons:

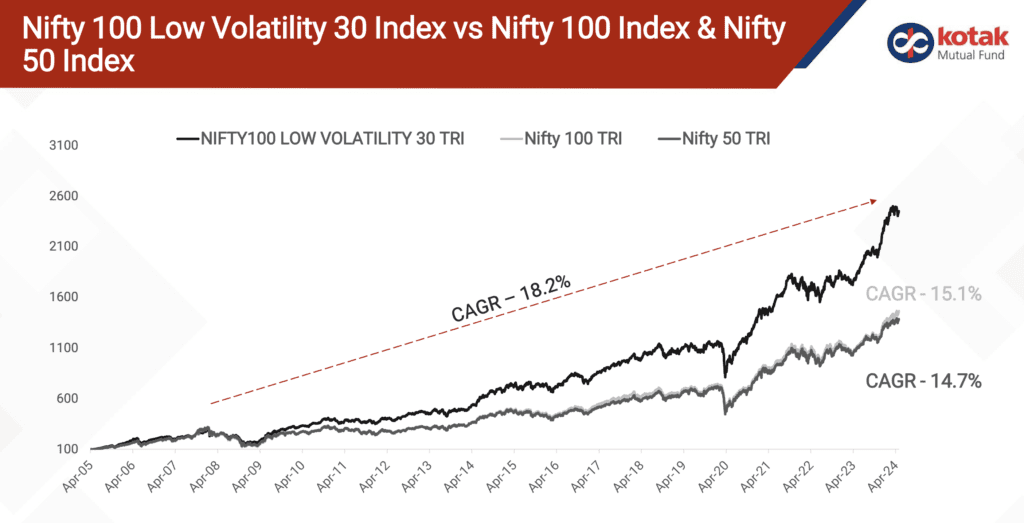

Reason # 1 – it has Outperformed with lower volatility

Source: KMAMC Internal. Data source: Motilal Oswal, Bloomberg and ICRA. Data as of 30th April 2024. Past performance may or may not be sustained in the future. The performance of the index shown does not in any manner indicate the performance of the Scheme.

Reason # 2 -The index has lower volatility as compared to broader indices

| 10 Year Returns | Nifty 100 Low Volatility 30 Index TRI | Nifty 100 TRI | Nifty 50 TRI |

| Annualised return | 16.5% | 14.9% | 14.3% |

| Annualised Volatility (Standard Deviation) | 13.7 | 16.4 | 16.3 |

| Sharp Ratio | 0.7 | 0.5 | 0.5 |

Reason # 3 – The Index has outperformed across time periods

Index Rolling Returns

| Index | 3Yr(%) | 5Yr(%) | 7Yr(%) | Since Inception (1st April 2005) |

| Nifty 100 Low Volatility 30 Index TRI | 17.7 | 13.1 | 14.5 | 15.7 |

| Nifty 100 TRI | 17.5 | 12.2 | 12.7 | 12.4 |

| Nifty 50 TRI | 17.7 | 12.4 | 12.4 | 11.9 |

Reason # 4 – The Index has outperformed as compared Nifty 50 & 100 over a long period.

Reason #5 – Lower Drawdown during market correction

Reason #6 -Better Index Rolling Returns

Returns are as on 30-April-2024.. Source: ICRA. Past performance may or may not be sustained in the future. For Rolling returns, the rolling period is the respective time period and the rolling frequency is one day. The performance of the index shown does not in any manner indicate the performance of the Scheme. Kotak Mahindra Asset Management Company Limited (KMAMC) is not guaranteeing or promising any returns/futuristic returns.

Reason #7 – Better Calender Year performance

In 10 out of 18 calendar years, Nifty100 Low Volatility 30 TRI has performed better than both Nifty 100 TRI and Nifty 50 TRI

Reason #8 –Portfolio Composition & Sector Exposure

Kotak Nifty 100 Low Volatility 30 Index Fund- stock selection criteria

The fund has a unique investment approach since it invests in stock universe Nifty 100 Stocks. The stock selection criteria is based on stock duration on index ( the stock should have a minimum listing history of 1 year.

stocks are selected on basis of below given parameters:

- Stock Universe Nifty 100

- Stocks should have minimum listing history of 1 year

- Stocks are selected based on the volatility Score

- Least volatile stocks receive the highest weight

- Rule based entry & Exit

- Index is Re-balanced on quarterly basis March, June, September and December to determine entry and exit of stocks

Where the fund will invest money?

| Top 10 Securities | Weight (%) |

| ICICI Bank Ltd | 4.45 |

| Hindustan Unilever Ltd | 4.25 |

| Asian Paints Ltd. | 3.98 |

| ITC Ltd. | 3.89 |

| Titan Company Ltd. | 3.84 |

| Britannia Industries Ltd | 3.81 |

| Sun Pharmaceutical Industries Ltd. | 3.70 |

| Nestle India Ltd. | 3.68 |

| UltraTech Cement Ltd. | 3.68 |

| Reliance Industries Ltd. | 3.58 |

KOTAK NIFTY 100 LOW VOLATILITY 30 INDEX FUND -NFO Details

The NFO opened on 22nd May 2024 and it will remain till 31st May 2024.

Minimum Investment – During the NFO period, the minimum subscription amount required is Rs 100 and in multiples of Re 1 thereafter.

Minimum SIP – Rs 100 in multiples of Re 1 thereafter

Investment Objective– Long-term capital appreciation via investing in equity and equity-related instruments.

Category – Index Fund

Exit load – Nil

Benchmark Index- NIFTY 100 Low Volatility 30 Index (Total Return Index)

Fund Manager– Mr. Devender Singhal, Mr. Satish Dondapati and Mr. Abhishek BisenUnderlying Index

Conclusion

This fund suits Equity investors targeting long-term capital appreciation by investing in an Index Fund. We can call it a smartly chosen index fund since money is invested based on various factors.

Suitable for people who want to take higher risks to get some better returns than other funds. People with low/moderate-risk appetite and who are dependent on the maturity of the fund should AVOID investing in the fund.