Kotak MF has launched the Kotak Special Opportunities Fund, an open ended equity mutual fund following special situations theme. The fund aims to strike the right opportunity in an uncertain market, thus creating alpha.

Table of Contents

What are these special opportunities/ Situations ?

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in opportunities presented by Special Situations.

- Company Specific Events/Developments,

- Corporate Restructuring,

- Government Policy change and/or Regulatory changes,

- Technology led Disruption/ Innovation

- companies going through temporary but unique challenges and other similar instances.

An economy, industry or company have multiple challenges in their journey. Challenges lead to uncertainties and multiple uncertainties mean multiple opportunities.

Who should buy?

Kotak Special Opportunity Fund is suitable for long-term investors ready to take some risk with their investments.

Kotak Special Opportunities Fund– NFO details

Scheme Benchmark– Nifty 500 TRI

The NIFTY 500 index represents the top 500 companies selected based on full market capitalization from the eligible universe.

The NFO opened on 10th June 2024 & Closes On: 24th June 2024.

Open for repurchase 25 June 2024

Minimum Investment – The minimum subscription amount required is Rs 100 and in multiples of Re 1 thereafter.

Minimum SIP – Rs 100 in multiples of Re 1 thereafter

Investment Objective– Long-term capital appreciation via investing in equity and equity-related instruments.

Category – Equity Fund (Thematic – special situation)

Exit load ( if 10% of the initial investment amount (limit) purchased or switched in within 1 year from the date of)– Nil

Exit load ( if withdrawal/redemption of more than 10% of initial investment amount (limit) purchased or switched in within 1 year from the date of)- 1%

Exit Load ( if sold units after 1 year) – Nil

Benchmark Index– NIFTY 500 TRI

Fund Manager– Mr Devender Singhal (Equity) & Arjun Khanna (For Overseas )will manage the scheme.

Mr. Devender Singhal has 22+ years of experience in the Indian Equity market. Fund management experience with Kotak is about 8 years. He has been successfully managing schemes such as Kotak Multi Asset allocator FOF ( along with Mr Arjun Khanna), Kotak Equity Savings, Kotak Debt hybrid & multicap fund.

Why Invest in Kotak Special Opportunities Fund?

Attempts to Make the Most of Market Changes: The stock market can be full of surprises and shocks. The fund aims to take advantage of these opportunities.

Invest in Unique Events: The fund looks for chances to invest in companies going through material changes like new government policies, management changes, temporary but unique challenges, and more…

Professional Management: Our experienced fund management team uses their expertise to identify and invest in Special Situations amongst ever-changing environment

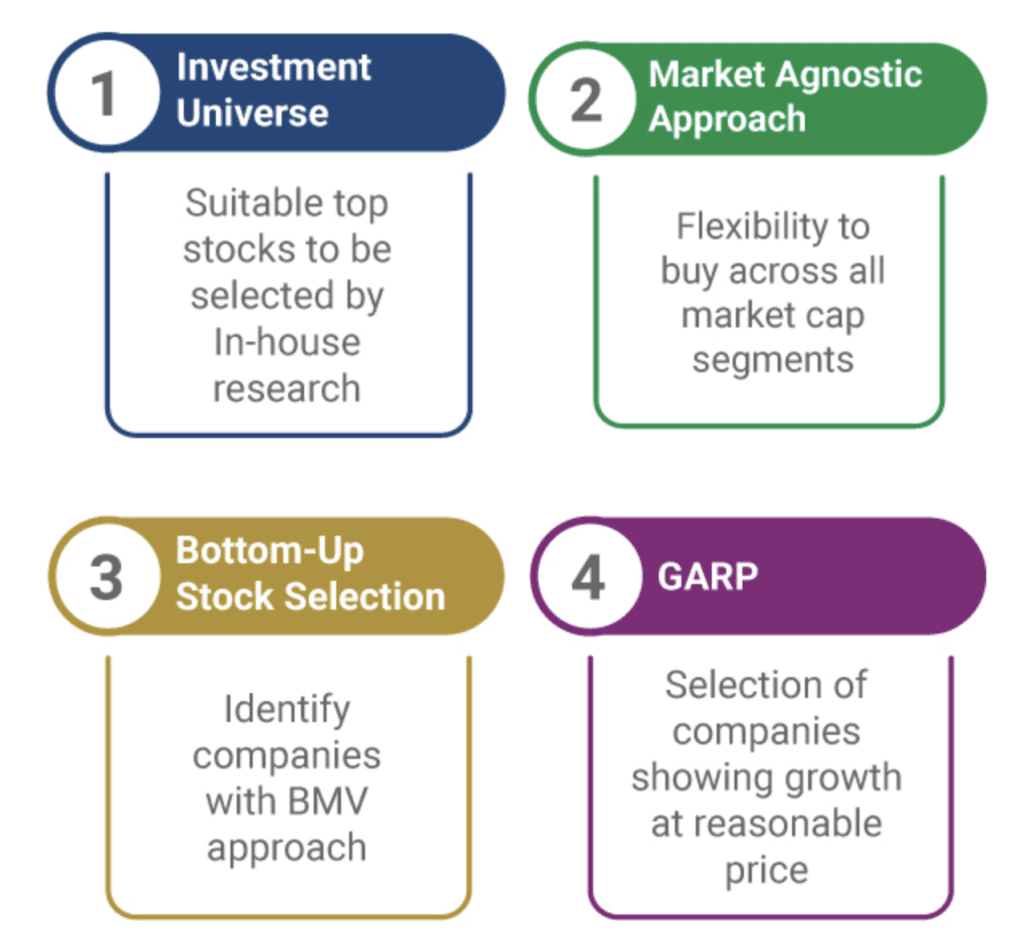

Market Cap Agnostic: Our fund invests across all market capitalizations—large, mid, and small-cap—seeking opportunities regardless of company size.

Bottom-up Stock Selection: The fund identifies companies with a BMV approach

Asset Allocation:

Click here for the detailed NFO presentation.

Kotak Special Opportunities fund -Review

The Special situation or special opportunities funds invest based on triggers such as corporate restructuring, government policies, regulatory changes or technology-led disruptions. The strategy is agnostic of market mood or valuations, that make these kind of funds ideal for current markets.

The special situations strategy identifies and capitalises on unique events or circumstances that can impact the value of a particular investment. Thus investing in this special situation fund can be a contrarian view to normal active funds and therefore may add diversification to the portfolio.

Before investing, bear in mind that the funds are highly risk and suitable for long-term investing only