LIC’s Bima Ratna is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan which offers a combination of protection and savings.

This plan provides financial support for the family in case of unfortunate death of the policyholder during the policy term and also provides for periodical payments on survival of the policyholder at specified durations to meet the various financial needs.

This plan takes care of liquidity needs through loan facility. This product can be currently purchased through Corporate Agents, Insurance Marketing Firms (IMF), Brokers, CPSC-SPV and POSP-LI engaged by these intermediaries viz. Corporate Agents, Insurance Marketing Firms (IMF) and Brokers.

Table of Contents

LIC Bima Ratna Details – (Plan 864) Eligibility, Features & Review

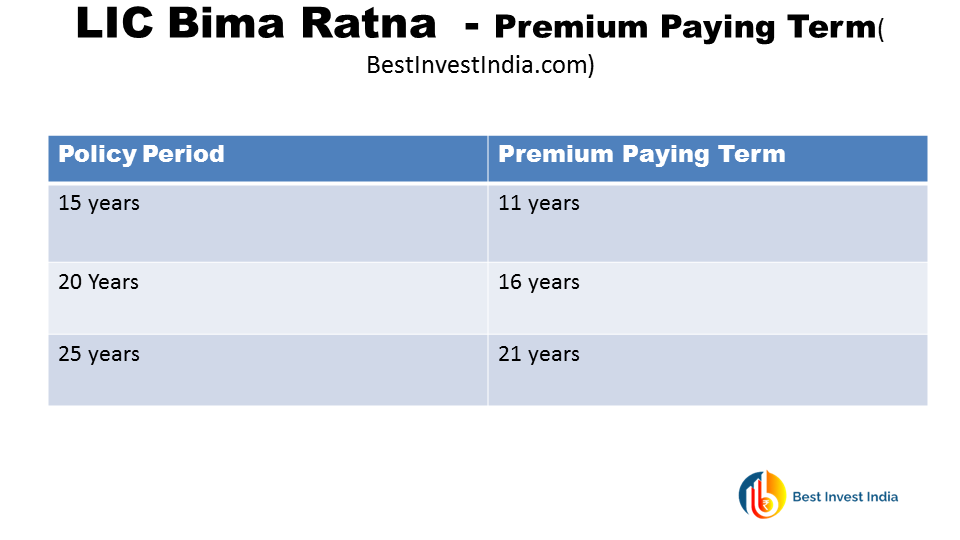

LIC Bima Ratna policy is available for all age group from 90 days to 65 years. But one can avail the 864 LIC Plan for different premium paying terms ( 11/16/21 years) as mentioned in the table.

One can invest for minimum 15 years and maximum 25 years in the policy. Minimum monthly premium amount is 5K whereas minimum sum assured in the policy is 5 lac.

864 LIC Plan -Premium Paying Term

What you will get – Survival benefits

You will get the below mentioned benefits a given in the table and at maturity you will get 50% of sum assured and guaranteed additions.

How to calculate Guaranteed Additions

Suppose MR. A has a sum assured of SA of 5 lac and he takes policy for 15 years than his guaranteed additions will be as follows

for first 5 years – INR 50/1000 of SA

=50*500000/1000

=50*500

=25000*5 years

=125000

Similarly for next 5 years 55*500000/1000*5=137500

For another 5 years 60*500000/1000*5=150000

So in net total Mr. A will get 50% of SA i.e. 2,50.000 +4,12,500 = INR 6,62,500

Death Benefit

In the unfortunate event of death the higher of the following will be paid to the nominee

- higher of 125% of Basic Sum Assured

- or 7 times of annualized premium.

- This Death Benefit payment shall not be less than 105% of total premiums paid

PLUS

Accrued Guaranteed Additions will also be paid along with the above mentioned amount

LIC Bima Ratna policy Maturity Calculator

At maturity 50% of Basic Sum Assured and accrued Guaranteed Additions( explained above), shall be payable.

Date of commencement of risk

In case, the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier.

For Children aged 8 years or more, risk will commence immediately.

Riders

Riders can increase/enhance the benefits under the policy. One can buy riders at a nominal additional cost.

The following riders are available:

LIC’s Accidental Death and Disability Benefit Rider

This rider provides enhanced sum assured in case of accidental death. In case of accidental death -the Accident Benefit Sum Assured will be payable in lump sum along with the death benefit under the base plan.

Suppose Mr. A buys LIC Bima Ratna policy for SA 5 lac and accidental rider 2 lac. In case of accidental death his family will get

From the base plan –

- higher of 125% of Basic Sum Assured

- or 7 times of annualized premium.

From Accidental rider –

Rider sum assured

In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years.

In Addition future premiums for Accident Benefit Sum Assured as well as premiums for the Basic Sum Assured ( Only upto Accident Benefit Sum Assured) under the policy, shall be waived off.

For example if base policy sum assured is 5 lac. Accidental rider is for 2 lac than in case of accidental disability – the premium of base policy for sum assured 2 lac only( same as per the accidental rider sum assured premium) will be paid and accidental rider premium will also be paid.

Under LIC Bima Policy for the life of minors, this rider will be available from the policy anniversary following completion of age 18 years on receipt of request.

LIC’s Accident Benefit Rider

This rider provides enhanced sum assured in case of accidental death. In case of accidental death -the Accident Benefit Sum Assured will be payable in lump sum along with the death benefit under the base plan.

This rider is available at inception of the policy only

LIC’s New Critical Illness Benefit Rider

This rider is available at the inception of the policy only. The cover under this rider shall be available during the policy term. If this rider is opted for, on first diagnosis of any one of the specified 15 Critical Illnesses covered under this rider, the Critical Illness Sum Assured shall be payable.

LIC’s Premium Waiver Benefit Rider

If this rider is opted for, on death of proposer, payment of premiums in respect of base policy falling due on and after the date of death till the expiry of rider term shall be waived.

LIC Bima Ratna Policy – Review

The Bima Ratna Policy is a guaranteed return policy with money back ( almost at the maturity point). This is a kind of saving policy wherein you get around 2% higher return than a saving bank account. The IRR is quite low for a insurance cover.

In my view before purchasing the policy one should also explore other options such as Post Office NSC, PPF etc. which offer better returns.

To meet insurance need one can choose to buy a term plan which offer you better coverage. The best is to consult a Financial Planner rather than wasting your money on such useless saving plans.

‘Also Read LIC Term Plans