LIC’s Dhan Sanchay is a non linked, non participating, Individual Saving Life Insurance Plan. Dhan Sanchay provides guaranteed income during the payout time along with life insurance cover for the entire duration of the plan.

Table of Contents

Premium Payment Options

The policyholder get three premium payment option to choose from. One can choose the payment option as per the choices given below.

- Regular Premium – Premium Payment for entire duration ( in accumulation phase)

- Limited Premium Payment – Premium Payment for a limited time ( in accumulation phase)

- Single Premium – Single Premium payment

How Benefit are paid during Payout Period( Income period)

The income benefits are paid on the basis of premium payment option

For Regular Premium/Limited Premium Payment Option

If policyholder choose regular or limited premium payment option than he/she can choose income from the below options:

Option A -Level income benefit

Income from the policy will remain same with the passage of time. For instance, if the income amount is 50000 annually- policyholder will get same 50000 amount each year for specified duration.

Option B- increasing income benefit

Income will increase every year with simple interest rate@5%

For Single Premium Payment option

If one make single premium payment to buy LIC Dhan Sanchay plan than the below mentioned income benefit will be given

Option C -Single Premium Level income benefit

Same amount of income is paid in this option.

Option D- enhanced cover with level income benefit

The sum assured will be enhanced with level income.

Buying Tip : One needs to choose these options carefully since post buying the policy, the option cannot be altered.

Eligibility to buy LIC Dhan Sanchay Plan

Anyone in the 3 year age to age 65 can buy the plan with few limitations. Please refer to the table below:

| Feature | General | Option A Level Income | Option B Increasing Income | Option C Level Income | Option D Level income enhanced cover |

| Minimum Entry Age | 3 Year | ||||

| Maximum Entry Age | 50 Years | 50 Years | 65 Years | 40 Years | |

| Minimum Maturity Age | 18 Years | ||||

| Maximum Maturity Age | 65 years | 65 Years | 80 years | 55 years | |

| Policy Term | 10 & 15 Years | 10 & 15 Years | 5,10 & 15 Years | 5,10 & 15 Years | |

| Premium paying Term For 10 year policy | For Regular Premium – 10 years | For Limited Premium – 5 Years | |||

| Premium paying Term For 15 year policy | For Regular Premium – 15 years | For Limited Premium – 10 Years | |||

| Payout Period | Equal To Premium paying term | Equal To Premium paying term | Equal to policy term | Equal to policy term | |

| Minimum Annual Single Premium | Rs 30,000 | Rs 30,000 | 2 lac | 2 lac | |

| Minimum Death Sum Assure | 3.3 lac | 3.3 lac | 2.5 lac | 22 lac | |

Date of commencement of Risk

In case of minor name policy the risk coverage will start after 2 years ( from the date of policy issuance) or from the age of 8 years at the policy anniversary.

For the people above age 8, the risk coverage will start immediately.

Maturity Benefit

Maturity Benefit will be payable in the form of Guaranteed Income Benefit and Guaranteed terminal benefit.

Suppose you paid 30000 annual premium in Option A than the payout will be 30000*1.10*1 =33000

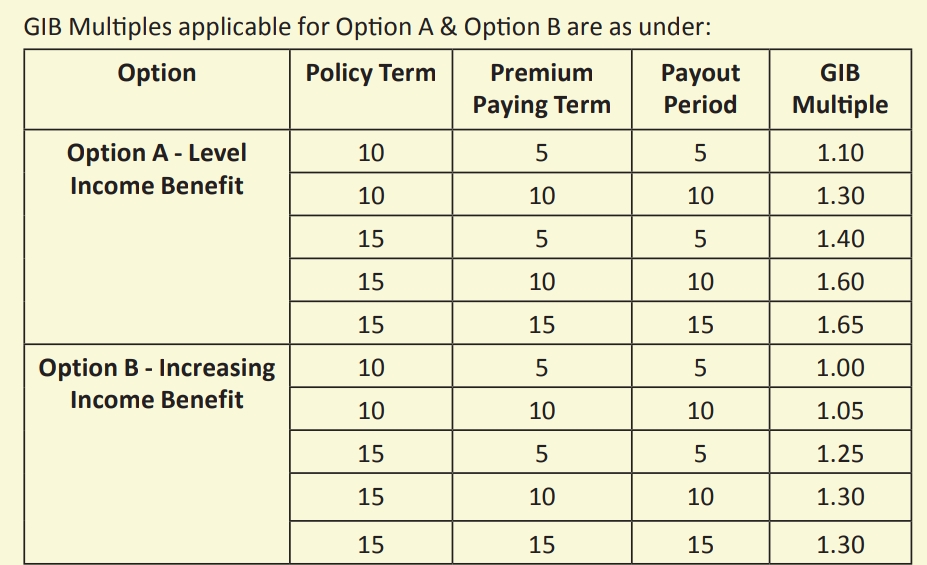

Maturity Benefit Under Option A & B ( Guaranteed Income Benefit )

Under Option A– Guaranteed Income Benefit shall remain constant during the Payout Period.

Under Option-B Guaranteed Income Benefit shall be increased yearly by a simple rate of 5% per annum on completion of each year of Payout Period.

GIB Multiples as mentioned in Option B above are applicable for the First Year of the Payout Period.

Maturity Benefit Under Option C & D (Guaranteed Income Benefit )

b) Under Single Premium payment (Option C & Option D): Guaranteed Income Benefit amount shall be calculated as under: Guaranteed Income Benefit = Single Premium x GIB Multiple x Modal factor for GIB

Under Option-C & Option-D Guaranteed Income Benefit shall remain constant during the Payout Period.

| Policy Term in years | Payout Period | GIB Multiple |

| 5 | 5 | 0.25 |

| 10 | 10 | 0.18 |

| 15 | 15 | 0.16 |

Option D: Single Premium enhanced cover with Level Income Benefit

| Policy Term in years | Payout Period | GIB Multiple |

| 5 | 5 | 0.20 |

| 10 | 10 | 0.15 |

| 15 | 15 | 0.10 |

Guaranteed Terminal Benefit (GTB):

Guaranteed Terminal Benefit (GTB) is paid with the last installment of Guaranteed Income Benefit (GIB) as a lumpsum payment.

Guaranteed Terminal Benefit depends on the Option chosen by the policyholder, Policy Term, Premium Paying Term & Age at Entry of life assured.

Guaranteed Terminal Benefit (GTB) Calculations – Under Regular/Limited Premium payment (Option A & Option B)

Annualized Premium x GTB Multiple x Modal factor for GTB

Guaranteed Terminal Benefit (GTB) Calculations – Under SINGLE Premium payment (Option C & Option D)

Modal Factor

Death Benefit

In the unfortunate event of the death of a policyholder the sum assured on death will be given to the nominee.

| Option | Sum Assured on Death |

| Option A & B | 11* Annual Premium Or Sum Assured on Maturity or105% of premium paid |

| Option C | 1.25 * single Premium Amount orSum Assured on Maturity |

| Option D | 11* single Premium |

Riders

Regular/Limited Premium payment (Option A & Option B):

- LIC’s Accidental Death and Disability Benefit Rider

- LIC’s Accident Benefit Rider

- LIC’s New Term Assurance Rider

- LIC’s New Critical Illness Benefit Rider

- LIC’s Premium Waiver Benefit Rider

Single Premium payment (Option C & Option D):

- LIC’s Accidental Death and Disability Benefit Rider

- LIC’s New Term Assurance Rider

Option to take death payout for nominee

This is an option to receive Death Benefit in installments over a period of 5 years instead of lump sum amount (under an in-force as well as paid-up policy).

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum installment amount for different modes of payments being as under: