Table of Contents

What is the Mutual Fund Taxation Rate for the Financial Year 2019-20?

In this post, we will understand Mutual Funds taxation rules Financial Year 2019-20.

Well, these rules will be applicable ONLY if you redeem or sell your mutual fund units.

If you wish to continue your MF investments than you do not need to pay any tax for your investment.

It is also essential to understand that your entire amount is not taxable.

Rather whatever gains/profit you make from your mutual fund, will be taxable.

This gain is referred to as Capital Gain and this gain is taxable only when you sell or take money out from your mutual funds.

Factors determining the Mutual fund taxation rate

- Type of fund -Equity or Debt Fund

- Holding period

- Your residential status

Type of fund – Equity or Debt fund

Equity mutual fund and debt mutual fund both carry the different tax structures.

Equity Mutual Fund -The funds which invest (more than 65%) primarily in equity/stock-based investments are called Equity Mutual funds.

Debt Mutual Fund -While the funds which invest in non-equity instruments such as Govt. Securities, treasury bills and CPs, bonds debentures are called debt funds.

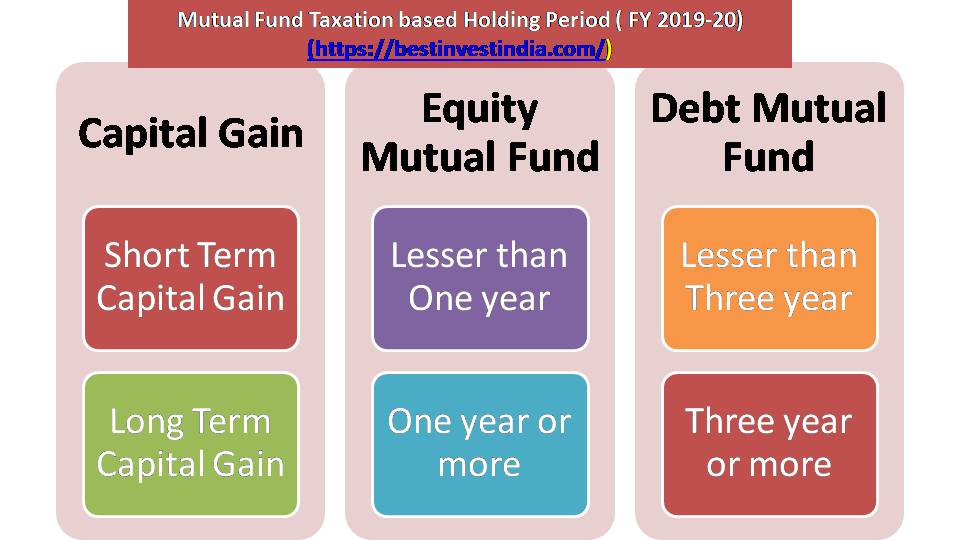

Holding Period

The other factor which determines your mutual fund taxation is your holding period.

This also means that after how much time you redeemed your money from mutual funds.

Even holding period definition is also different for equity and debt funds.

Residential Status

Your tax also depends on your residential status. There are different tax rules for Indian resident and NRI

Please correlate it with the below-given chart

Table

Let’s understand with an example

Mr. Ram invested in Equity Mutual Fund 1 year back and now he want to redeem his money.

Money invested in Equity Mutual Fund (one year back) Rs 10,00,000

Redeemed Entire Money with a profit of Rs 12,00,000

His Long Term Capital Gain Rs 12,00,000- Rs 10,00,000

Taxable @10% exceeding Rs 1lac Rs100000 * 10%

His tax will be Rs 10000

Suppose he redeemed only Rs 5,00,000

Say his profit is Rs 60,000

Then he does not have to pay any tax as this amount is lesser than 1 lac

Securities Transaction Tax (STT):

Whenever you buy or sell a security (other than commodity and currency) through a recognized stock exchange than you have to pay a tax called STT

STT is levied on the value of taxable securities transactions as under:

Taxation of Mutual Fund Dividends

Dividend on Equity Mutual Funds:

The dividend from equity mutual funds is completely tax-free in the investor’s hands. But Mutual fund companies have to pay DDT.

Dividend on Debt Mutual Funds

The dividend from Debt mutual funds is completely tax-free in the investor’s hands. But Mutual fund companies have to pay DDT.

NRI Mutual Fund Investment & TDS Deduction

If you are a NRI than you have to pay TDS on your mutual fund redemptions. The TDS rates are described below.

I hope after reading this post you must have got an understanding of mutual fund taxation. Please reply in the comment section.

Additional Reading https://bestinvestindia.com/why-you-should-not-invest-in-mutual-funds/