A lot of people have invested their hard-earned money in equity mutual funds and stocks to earn good money. But, what to do if there is mutual fund loss?

COVID 19 not only impacted our movement, life, economy but mutual fund loss also. No one had expected such a situation to see in their lifetime.

All of a sudden, I mean in no time, everything crashed. Forget about returns, the original principal amount is drastically gone down by 20%-40%.

The situation seems scary. On one hand, there is a complete lockdown, closed business for a few days and the value of your hard-earned money is also depreciating.

Table of Contents

What to do When Mutual Fund’s value goes down in a market crash?

NOTHING!

Yes, you heard it right. Please do not do anything. Just sit and relax.

Offended! I know it is really hard to do that. How can one sit and relax when his money value is going down with each passing day.

Yes, As a Financial Planner, I suggest you calm down and stop worrying about your investment if you have invested your money for a long time i.e. probably for more than five years and followed right asset allocation religiously.

This is market nature to move in, up and down movement.

You very well know that there is the morning after each night, sunrise after sunset. The Similarly market will also go up after a downfall.

This shall too pass

&

we will be able to make it a paradise once again.

What about the Loss

Please note that these are notional losses (that is a loss in papers only) and if you redeem/exit/sell then you will make this loss real.

From the earlier market downfall, we can find out that after each fall market bounces back again.

Do you remember the market fall of 2008?

The market reached a level of 8000 from a level of 20000+ but bounced back in 20 months’ time only.

If we recollect from this data we can find out that on average the recovery period is somewhere between six months to one and a half years only.

You can yourself analyze the market journey from 8000 to 40000 in a span of 12 years.

Ok, let me correct 30000 now.

So, please calm down and do not redeem your investments. Let it bear fruits for you in a later stage.

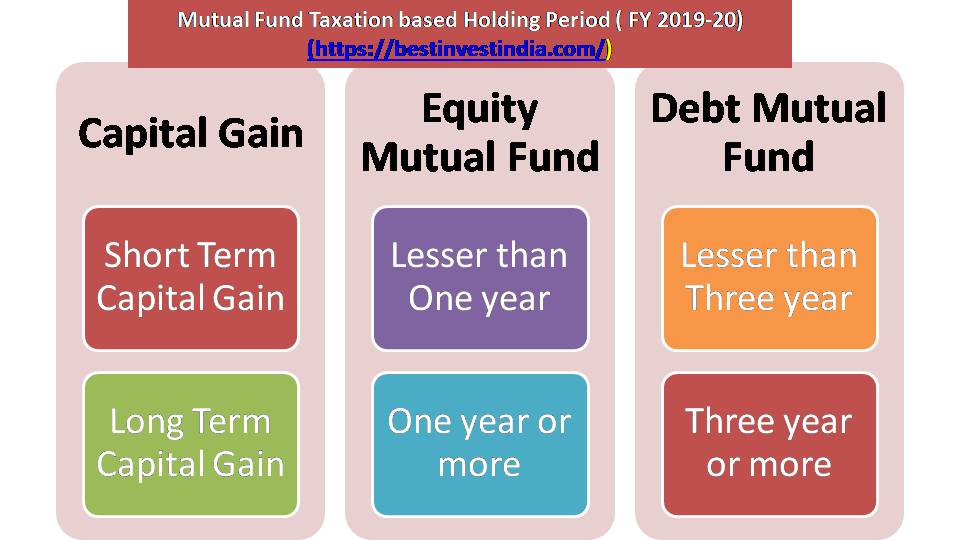

If you redeem than you will also lose on account of exit load and capital gain taxation

Can you lose all your money in Mutual Funds?

To answer this, it is very necessary to understand how does Mutual fund works.

A single Mutual fund scheme invests in more than 40-50 stocks(researched) of different sectors. Thereby reducing the risk of mutual fund schemes.

You know in a market fall all sectors do not depreciate in value in one go and even if it goes down than not in the same proportion.

Thus you never lose all your money in mutual funds. You can see negative returns for some time but it does not wipe out all your money.

Is it good to invest in Mutual Funds when the market is down?

It is quite evident from the past market downfall experiences that if somebody invests in the market downfall for a long time then one can make very good returns over a long time.

But one should follow the right strategies and invest as per the Financial Planning way.

Here one should not put the entire amount in one go but strategize and invest it periodically. This way sudden volatility can be reduced to some extent.

Please remember not to compromise your Emergency/Contingency Fund for investing at such a point.

Also, it is suggested to follow financial planning principles and diversify your Investments and the best is to link your investments with your life goals

What am I supposed to do when my mutual funds are down

It is very necessary to calm down and not to redeem your money from your investments.

Further, it’s time to take a deeper look at your investments and investing patterns. There is a need to follow the financial planning principles such as

- Keeping a separate emergency/ contingency fund (at least 12 to 18 months expenses)

- Linking your investments with your life goals

- Make a suitable asset allocation based on your risk profile, your financial life, and your current financial position and market Outlook.

- Sticking to your original asset allocation.

- Buy adequate insurance cover to safeguard you and family from any unforeseen events

- Diversify your Investments

- Not to run after high returns and follow tactical asset allocation for investment

- Investing in Financial planning way.

- Have a regular portfolio review

Conclusion

You should avoid redeeming your money in mutual fund loss in the market crash and follow investment in financial planning way.