Nippon India Silver ETF FoF is a new fund launched by the AMC. Nippon India Silver ETF FoF will invest money in physical silver and silver-related instruments. The Silver ETF EoF NFO is open from January 13 and closes on 27 Jan 2022.

Minimum Investment for Nippon India Silver ETF FoF

The minimum investment is Rs 1000 for ETF and Rs 100 for FOF and in multiple of Rs 1 thereafter. Here you can start a SIP also in Nippon India Silver FoF.

To invest in Nippon India Silver ETF you require a demat account. If you do not have a demat account – no worries. You can still invest in Nippon India Silver FoF. The Nippon India Silver FoF will invest in the same ETF itself and help investors to invest without a demat account.

Where Nippon India Silver ETF FoF will invest Money?

The Nippon India Silver ETF and FoF will invest the money in physical silver and silver-related instruments.

The silver ETF FOF performance is benchmarked against the domestic price of silver (based on LBMA Silver daily spot-fixing price). Physical silver will be of 99.9 percent purity (999 parts per thousand) conforming to London Bullion Market Association (LBMA) Good Delivery Standards.

Nippon India Silver ETF FOF- Should you invest?

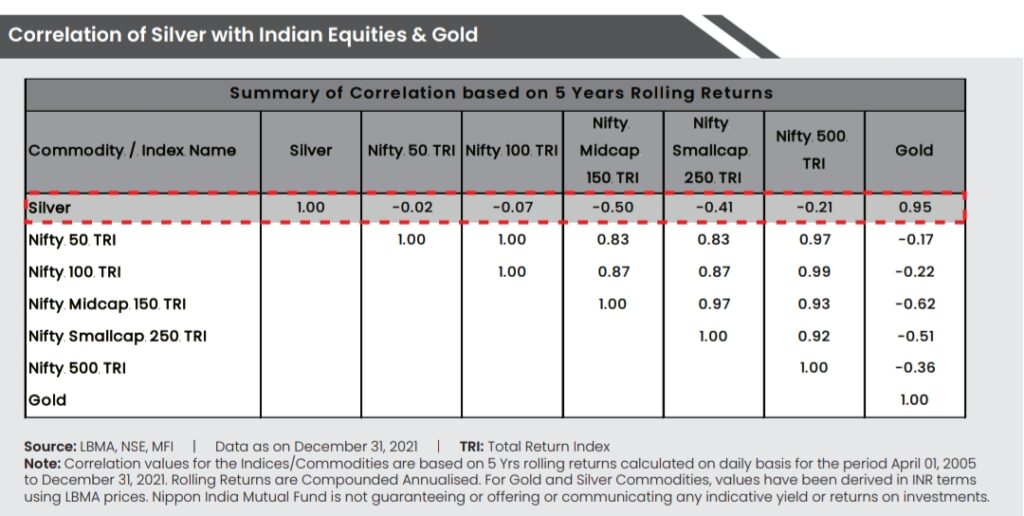

- It is evident from history itself – that equity indices and silver or other commodities have a negative correlation with each other. This also means, in a declining equity market the performance of silver or other commodities is better. Hence investing in silver ETF FoF can provide you with a hedge against volatility.

- Investing in silver ETF or FOF will help you diversify your portfolio as a part of your asset allocation.

- Since it is in paper format, provides you a hassel free storage, easy liquidity, no fear of theft, no additional locker cost and even no worry about the purity of silver.

- Additionally you can invest in very small denominations too.

- There is no lock in time and hence you can withdraw your money anytime.

Drawbacks of Silver ETF FoF

- The Silver ETF FoF will definitely track the silver commodity index but subject to tracking error. This means that here expense ratio matters a lot. Many AMCs like ICICI Prudential ( already launched), DSP Mutual fund ,HDFC Mutual fund, ABSL Mutual fund are also coming with silver ETF.

- Since it is launched very first time, there is no gurantee of scheme objective will be met or not.

In my view since there is no gurantee of the performance in future, the investor should be cautious to invest their hard earned money. One should ONLY invest as per their asset allocation and their base Financial Plan requirements. Still you can invest, if you trust silver to give you good returns in future.