SBI has introduced SBI multicap fund on 14th Feb 2022 and the NFO will close on 28 February 22. Thereafter, the fund will be available for subscription from 8th march 22.

SBI multicap fund is an open ended multicap scheme i.e. the scheme is investing its money in large cap, midcap and smallcap in the ratio of 25:25:25. The rest 25% will be invested as per the fund manager’s wisdom.

The investment objective of the scheme is to provide investors with opportunities for long term growth in capital from a diversified portfolio of equity and equity related instruments across market capitalization.

The benchmark index is NIFTY 500 Multicap 50:25:25 TRI Index.

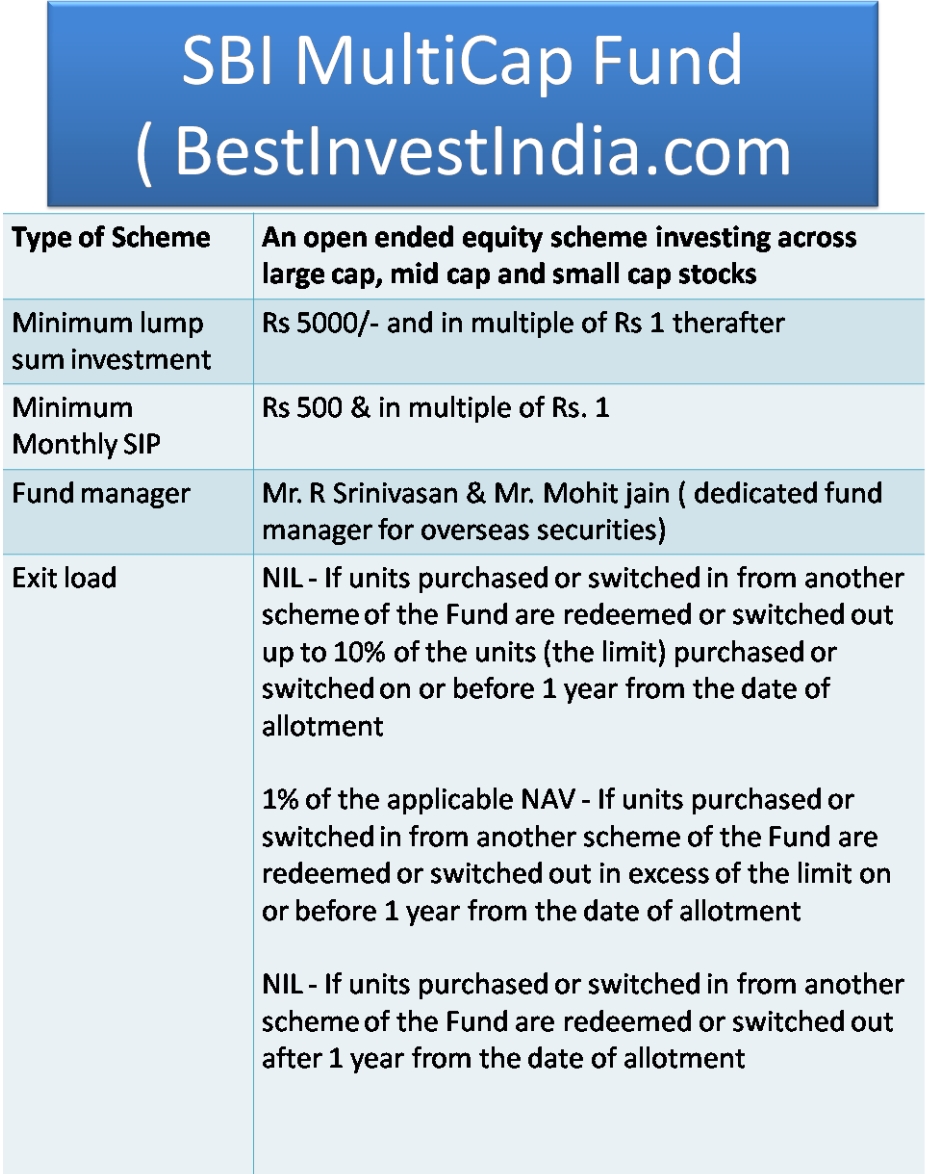

For lumpsum investment the minimum application size is Rs. 5000/- and in multiples of Re. 1 thereafter. If you wish to start a monthly SIP than minimum SIP amount is Rs. 500 & in multiples of Re.1

Who should Invest?

If you are looking for Long term Wealth creation (>5 years) and want to have an unbiased flavor of different market caps in one fund then this is the right fund for you.

Should you invest in SBI Multi Cap Fund?

SBI multicap fund is investing in large, mid and small cap stocks.

As per the SEBI mandate all multicap funds have to invest 25%of the Corpus in each capping i.e.the fund has to invest at least 25% amount in large cap segment, 25% amount in midcap segment and 25% amount in small cap segment.

Looking at the segmentation of investment, SBI multicap fund is suitable for long-term investors who are willing to take some risk.

If you are not much aware of different market caps investment and want a hassle free investment then SBI Multicap Fund is a good option.

Since the mid and small cap category of investments may require higher time to generate good profits therefore you should stay invested for more than 5 years.

Invest only if you can stick to the long-term investment goal and you are willing to take some risk.

If you are not sure about your investment horizon then you may go for the debt funds of shorter durations.

Now looking at the prospective whether you should invest in SBI multicap fund or not. I would like to suggest you to compare the return of the other funds before investing.

Since, a new fund always takes some time to generate returns, it’s better to choose the timetested funds.