Last updated on 11 February 2024. Before this was edited on 1 OCTOBER 2023

PFRDA has updated NPS withdrawal rules recently to make it more attractive for users. Let’s explore NPS Withdrawal rules.

NPS (National Pension Scheme) is a Government of India Retirement Scheme launched in 2009. NPS is a pension scheme managed by PFRDA( Pension Fund Regulatory and development Authority).

NPS is a retirement scheme therefore you have to contribute in NPS till your retirement age i.e. till the age of 60. Thereafter you get pension for all your life.

The amount of pension depends on the amount you utilize for annuity purpose and annuity option you choose while selecting annuity.

watch our video on Annuity options

NPS Annuity Options/Konsa option behtar hai, Kitni pension milegi

Table of Contents

Who Can Invest in NPS

Any Indian resident or NRI/OCI between age 18 years but below 70 (earlier it was 65), can invest in NPS. The account will be closed if citizenship status of NRI changes from NRI to foreigner.

How to invest in NPS

There are two ways by which you can register and invest in NPS

- Physical or Offline mode–

To open NPS account you have to deposit your documents with POP-SP (point of presence service provider).There is whole list of POP- SP which includes Bank, post office and other non financial institution.

To know the details of your nearest POP, please visit the link given below

https://npscra.nsdl.co.in/pop-sp.php

When you go to this link, it will ask you for your country and location and you will get the list of POP-SP.

a You can choose service provider as per your convenience.

- Online or eNPS :

You can join NPS through online mode also.

For opening online account,you can visit the website of eNPS.

Alternatively you can download eNPS mobile app from Google Play Store or apple IOS.

The eNPS website page looks like this when you open the link. https://enps.nsdl.com/eNPS/NationalPensionSystem.html

Latest NPS Withdrawal Rules 2024-25

NPS Withdrawal in 2024 is different for different life stages and also depends on when you want to withdraw the money. Let’s talk about different rules one by one.

- Partial Withdrawal from NPS

- Premature Exit from NPS – If you joined NPS before age 60

- Premature Exit from NPS – If you joined NPS After age 60

- Normal Exit at Superannuation/ Retirement

- Noraml Exit ( if you joined after age 60)

Partial Withdrawal From NPS

Earlier partial withdrawal from NPS was not allowed. But now an NPS subscriber can make partial withdrawals from NPS (up to 3 times in the entire duration of NPS).

The following are the conditions of NPS premature withdrawal

- Subscribers should be in NPS at least for 3 years

- Withdrawal amount will not exceed 25% of the contributions made by the Subscriber

- The withdrawal can happen a maximum of three times during the entire tenure of the subscription.

- Withdrawal is allowed only against the specified reasons, for example;

- Higher education of children

- Marriage of children

- Purchase or construction of a residential house or flat in your name or a joint name with your legally wedded spouse

- Specified illnesses that involve hospitalization and treatment, either of yourself or your legally wedded spouse, your children (including those legally adopted), or dependent parents

- Meeting your medical and incidental expenses arising out of a disability or incapacitation suffered

- Meeting your expenses for skill development or re-skilling, or any other self-development activities, as permitted by PFRDA

- Establishment of your venture or start-up, as permitted under PFRDA guidelines

The specified Illnesses for NPS Partial withdrawal are as follows:

- Cancer

- Primary pulmonary arterial hypertension

- Kidney failure (end-stage renal failure)

- Multiple sclerosis

- Major organ transplant

- Coronary artery bypass graft

- Aorta graft surgery

- Heart valve surgery

- Stroke

- Myocardial infarction

- Coma

- Total blindness

- Paralysis

- Accident of a serious or life-threatening nature

Partial Withdrawal NPS is eligible for tax exemption on the amount withdrawn up to 25% of the self-contribution.

NPS Premature Exit Rules- If you joined NPS before age 60

NPS Premature Exit from NPS rules are the same for Govt. Employee and non-Gov. Employees.

Except, non-Govt. subscribers should have contributed for at least 5 years before making a premature exit from the scheme. ( Exit means – permanently close NPS scheme).

Non-Gov. sector employees can withdraw their money only if they have continued the NPS for at least 10 years.

Withdrawal Amount NPS 2024 for Govt. & Non Govt. Employee

# If the corpus is 2.5 lac or lesser than 2.5 lac one can withdraw the entire amount and exit NPS scheme completely.

# However, if the corpus exceeds 2.5 lac, one is required to purchase an annuity from a annuity ( pension) service provider insurance firm for 80% of the amount, with the remaining money being withdrawn as a lump payment.

At present seven ASPs are providing the Annuity services to NPS Subscribers. The ASPs are as follows:

- Life Insurance Corporation of India

- SBI Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Co. Ltd.

- HDFC Standard Life Insurance Co Ltd.

- Bajaj Allianz Life Insurance Co. Ltd.

- Kotak Life insurance Co. Ltd.

- Reliance Life Insurance Co. Ltd.

- Star Union Dai-ichi Life Insurance Co. Ltd.

The contact details of the ASPs is available at https://www.npscra.nsdl.co.in/annuity-service-provider.php

NPS Normal Exit Rules

As per Pension fund withdrawal rules NPS withdrawal at age 60 is also possible with an annuity ( pension). In this aspect, two different rules apply for a corpus equal to 5 lac or less and corpus more than 5 lac. However, the rules are exactly the same for Govt. & Non Govt. employees.

Latest Withdrawal Amount NPS 2022-23 for Govt. & Non Govt. Employee at age 60

# If the corpus is 5 lac or lesser than 5 lac one can withdraw the entire amount and exit NPS scheme completely.

# However, if the corpus exceeds 5 lac, one is required to purchase an annuity from a annuity ( pension) service provider insurance firm for at lest 40% of the amount, with the remaining money being withdrawn as a lump payment.

However one can purchase annuity from higher amount also.

Latest Withdrawal Amount NPS 2022-23 for Non Govt. subscribers who join beyond age 60

# Premature Exit ( exit before completion of 3 year) – If one has started investing in NPS but want to exit before completion of 3 years than if the corpus is lesser than 2.5 lac than you can withdraw entire amount. However if the corpus is more than 2.5 lac than one has to compulsorily buy annuity from 80% money and rest 20% can be withdrawn as lump sum.

# Normal Exit ( exit After completion of 3 year) – If one has started investing in NPS but want to exit after completion of 3 years than if the corpus is lesser than 5 lac than you can withdraw entire amount. However if the corpus is more than 5 lac than one has to compulsorily buy annuity from 40% money and rest 60% can be withdrawn as lump sum.

# In case Unfortunate death of subscriber- Entire amount is given to the nominee or legal heirs. However one can purchase annuity from higher amount also.

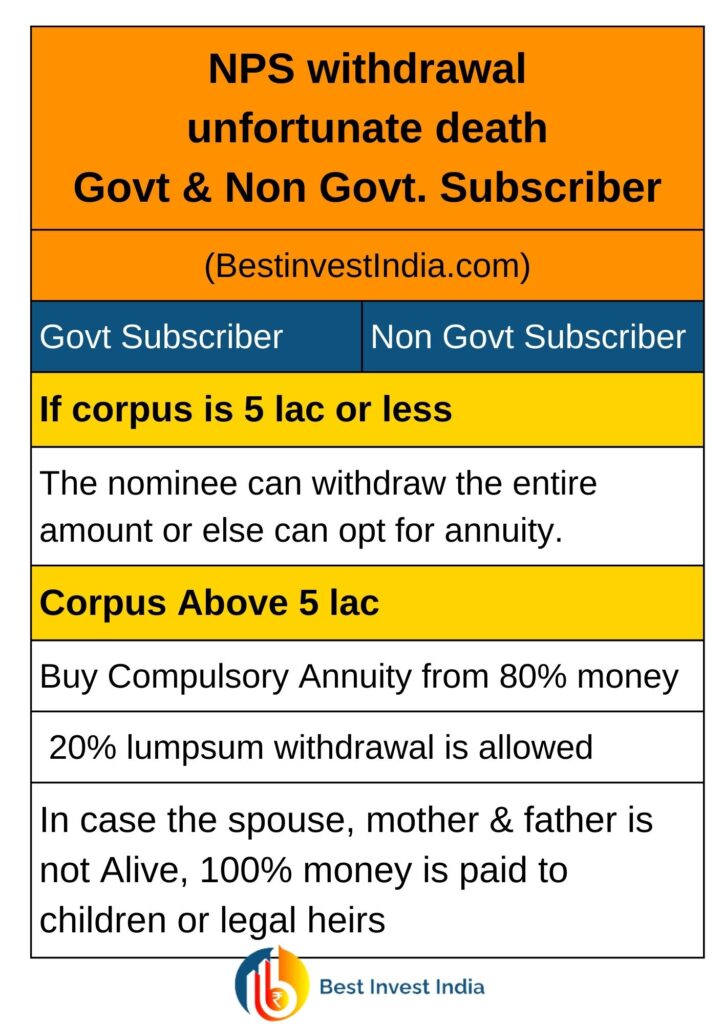

NPS Latest Withdrawal Rules 2023-24 – Unfortunate death of Subscriber

For Govt. Employees

#If corpus equal or less than 5 lac– Lump sum amount is payable to nominee or legal heirs.

# If corpus more than 5 lac – Dependent has to Compulsorily buy annuity from 80% corpus and rest of 20% corpus paid as lump sum to the nominee/legal heir

# If unfortunately non of spouse, mother , father not alive than 100% paid to surviving children or to legal heir.

For Non Govt. Employees

Entire amount is paid to nominee or legal heirs.

Conclusion

To make NPS more lucrative PFRDA has introduced easy exit rules for all age subscribers. If you have more queries related to NPS please read the post National Pension Scheme(NPS)- All you need to know from Entry to Exit Rules

Additional resources

http://Retirement Planning के लिए Best Pension Scheme in India 2019 || Equity Mutual Fund Vs NPS

NPS ( National Pension Scheme ) || NPS Calculator ( Exact Calculation) || Retirement Planning