Pradhan Mantri Vaya Vandana Yojana is a LIC’s guaranteed pension scheme for senior citizens in India. Here, you deposit a lump sum amount of money and start getting a regular payout( pension) from next month.

However, the payout depends on the payout option you have chosen at the start of the policy.

Table of Contents

PMVVY Scheme Details

PMVVY scheme is offered by LIC of India. You can buy LIC PMVVY online and offline from LIC of India.

After depositing the lump-sum amount, you start getting a pension from the next payment cycle and after completion of 10 years, the purchase price ( lump sum amount paid initially) is returned.

- Investment time is 10 years.

- Rate of interest is fixed (at the time of buying) for 10 long years.

- The PMVVY Interest rate will not change for you for 10 long years.

- However, the interest rate will change with each time you purchase a new scheme.

Where to open PMVVY account?

PMVVY account can be opened in LIC ONLY. To open PMVVY account either you can visit LIC office or purchase Vaya Vandana Yojana Online.

Who can Invest in LIC PMVVY ?

Any Indian Citizen who is age 60 and above can purchase the scheme. You can purchase LIC Vaya Vandana yojana both offline or online also.

Amount of deposit

PMVVY: You can deposit Rs 15 lac in one name. Thus husband and wife in total can invest 30 lac. You can open multiple accounts but the maximum investment amount is 15 lac in total for all accounts.

PMVVY interest Rate 2023

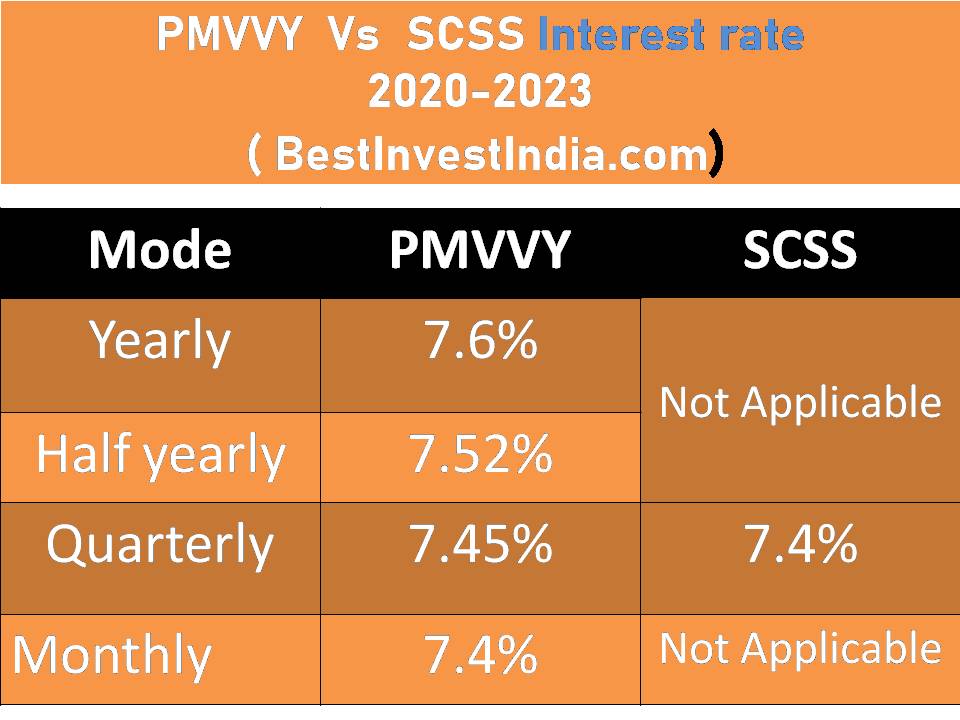

You can take pension payout on a monthly, quarterly, half-yearly, or yearly basis. The interest rate is different for different options. Please refer to the below chart for the interest rate of the LIC Vaya Vandana Yojana.

Is PMVVY Taxable?

PMVVY: You do not get any deduction U/S 80 C in PMVVY. The pension earned is fully taxable in nature. The pension received is considered as your income from other sources and taxed as per your income tax slab rate.

Does LIC deduct TDS on PMVVY?

No, TDS is not applicable on annuity payout( pension amount). However, the pension payment is treated as income earned and tax payment liability remains on the policyholder.

Mode of Pension- Pradhan Mantri Vaya Vanadana Yojana

You can choose between monthly, quarterly, half-yearly, or yearly mode. You can choose the frequency at your convenience.

Can I take Loan in PMVVY scheme?

You can take a loan after the completion of 3 years.

You can take a loan of 75% amount of the initial purchase price. The loan is available on the money you have paid initially to buy the policy.

You have to pay the loan interest @10% per annum and the loan is recovered from your pension amount. In the case of the demise of the policyholder, the loan amount is recovered from the purchase price.

Can I Surrender and take money back from PMVVY?

In case of critical illness of you or your spouse, you can surrender and take money back, but at a 2% discount.

If you had deposited Rs 10 lakh initially you will be able to get 9.8 lakh.

How to open PMVVY Account Online?

- To buy PMVVY online, Please visit https://digisales.licindia.in/eSales/liconline

- For PMVVY Online Registration, you have to provide your name, date of birth, mobile number, location, and email address.

- After submission of the details when you tick the confirmation, you will receive an OTP on the given mobile number.

- It will ask for other policy details.

- If you have not invested in any, select no and proceed further.

- Select the purchase price option or pension amount.

- The system will calculate the rest of the premium etc.

- Or else just write or copy-paste the purchase price in the below column.

- It will take you to the premium details page.

- Now, you can proceed further with eKYC or without KYC.

- If you opt for without e KYC then you have to manually give your details like your address, nominee, and Plan options.

- otherwise, it will fetch the details from your Aadhar card.

- Make Payment and invest in PMVVY scheme online.

For any clarifications, you can contact 011-678119281 or 011-678119290 or else write at onlinedmc@licindia.com

PMVVY Disadvantages

LIC PMVVY is a golden scheme for senior citizens in India, However, every plan has some limitations. Similarly, PMVVY Yojana also has some disadvantages.

- Pradhan Mantri pension plan has limited access to your money once you buy the policy. If you want to withdraw you have to pay a penalty for the same.

- You do not get any tax deduction U/S 80 C and income earned is also taxable in nature.

- The interest rate is also fixed for the entire duration so in between if you get a chance to get better returns you might not be able to withdraw the money.

- If you wish to invest a higher sum than 15 lac then you can not invest more than 15 lac in the pension plan.

- Returns are not inflation adjusted thus after few years you may feel low returns on your money.

Additional resources

https://bestinvestindia.com/pmvvy-vs-senior-citizen-saving-scheme/

https://bestinvestindia.com/top-5-mistakes-to-avoid-while-planning-for-retirement/

https://bestinvestindia.com/best-investment-options-for-pensioners-senior-citizens/

https://bestinvestindia.com/senior-citizen-saving-scheme-scss/

https://bestinvestindia.com/nps-withdrawal-rules/

https://bestinvestindia.com/national-saving-certificate-interest-rate/

https://bestinvestindia.com/top-5-post-office-tax-saving-scheme/

https://bestinvestindia.com/public-provident-fund-ppf-withdrawal-rules-2020/