NPS subscribers are constantly looking for the best pension Fund manager for NPS. This is also because they want to increase their NPS Returns. Hence one should look for the best pension fund manager.

Post last updated on 4 Feb 2024

NPS is a retirement scheme, therefore, you have to contribute in NPS till your retirement age i.e. till the age of 60. Thereafter you get a pension for all your life.

The amount of pension depends on the amount you utilize for annuity purposes and the annuity option chosen by you.

Table of Contents

NPS Investment Options

Once you open the NPS account, there are two investment styles from which you have to choose your investment option

- AUTO CHOICE- Who do not want to manage their investment themselves

- ACTIVE CHOICE – Who want to manage their investment themselves

Before explaining about Auto and Active choice let us understand the Investment options ( or asset classes or the funds/securities in which your money will be invested ) in NPS.

Asset Class -ECGA in NPS

There are 4 asset classes (Investment options) in NPS. You can call it ECGA in short.

- E- Equity (High Risk – High Return)

- C- Corporate bonds (Moderate risk- moderate return)

- G- Govt. Bonds. (Low risk – low return)

- A- Alternative assets like real estate investment trust (REIT) & Infrastructure investment trusts ( InvIT) ( Very high risk – very high return)

NPS Tier 1 Investment options

Auto Choice –

NPS offers an easy option for those participants who do not have the required knowledge or time to manage their NPS investments.

In case you are unable/unwilling to exercise any choice about asset allocation, your funds will be invested under the Auto Choice option.

Under this type of investment choice, the investments will be made in a life-cycle fund where different allocations of funds will be given based on the life-cycle fund you have chosen.

When you opt for Auto choice, it further asks you to choose from

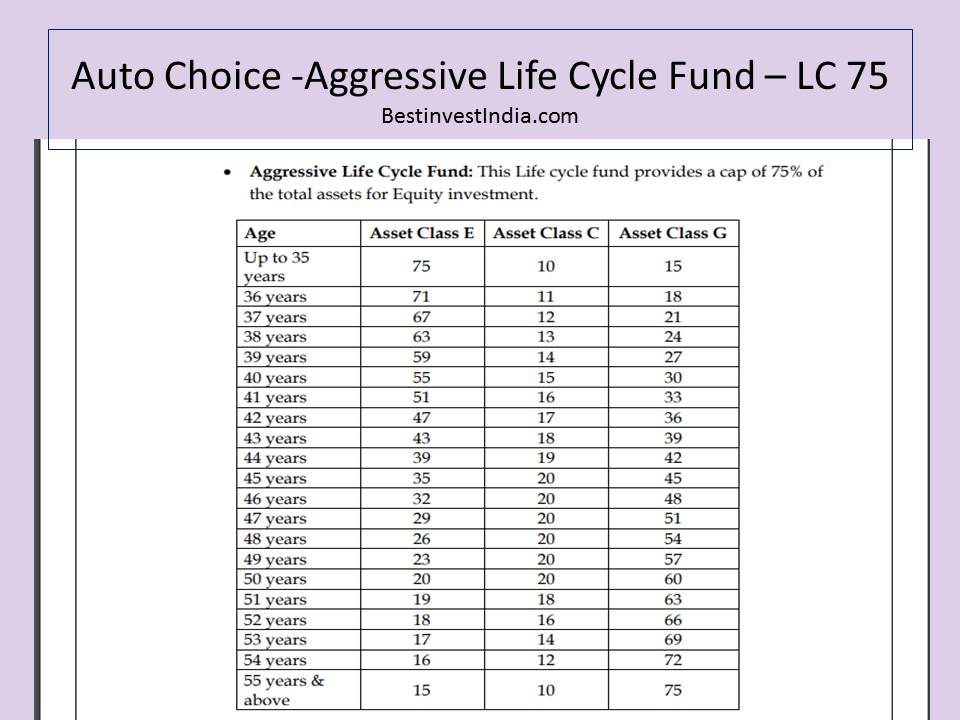

- Aggressive Life Cycle ( LC 75) – Higher equity allocation as per age

- Moderate Life Cycle ( LC 50) -Higher Corporate bonds allocation as per age

- Conservative Life Cycle Fund ( LC 25) – Higher Govt. securities allocation as per age

Active Choice: Under Active investment choice, you have an option to choose the ratio among the asset classes.

But you cannot invest more than 75% of your money in equity in both options. Even as per new updates NPS subscribers can continue 75% Equity exposure till retirement. Earlier it was till age 50.

Types of Fund Available in NPS

There are 4 asset classes (Investment options) in NPS. You can call it ECGA in short.

- E- Equity (High Risk – High Return)

- C- Corporate bonds (Moderate risk- moderate return)

- G- Govt. Bonds. (Low risk – low return)

- A- Alternative assets like real estate investment trust (REIT) & Infrastructure investment trusts ( InvIT) ( Very high risk – very high return)

NPS Fund Manager ( PFM in NPS) for Govt. Sector

- LIC Pension Fund Ltd.

- SBI Pension Funds Pvt. Ltd.

- UTI Retirement Solutions Ltd.

NPS Fund Manager ( PFM in NPS) for Private Sector

- HDFC Pension Management Co. Ltd.

- ICICI Prudential Pension Fund Management Co. Ltd.

- Kotak Mahindra Pension Fund Ltd.

- LIC Pension Fund Ltd.

- SBI Pension Funds Pvt. Ltd.

- UTI Retirement Solutions Ltd.

- Aditya Birla Sunlife Pension Management Ltd.

If you are looking for early retirement please read

Best Performing NPS Fund Manager 2024

Best Performing NPS Fund Manager 2021- Central Govt.

If we compare the returns since inception then SBI pension fund manager returns are highest at 10.11% as compared to 9.91% and 9.88% of LIC and UTI respectively. However, all Pension fund managers for Central Govt. sector are approximately at par and in competition with each other.

Best Performing Central Govt. NPS Returns 2021 – Scheme C

Best Performing NPS Tier 1 Returns 2021- State Govt.

NPS State Govt.

While comparing the return for the state government NPS Fund managers LIC pension Fund manager has given the highest return of 9.91% as compared to 9.82 % from SBI and 9.8 7% from UTI retirement solutions. However, all three players are at par therefore you can choose any one of them.

Best Performing NPS Tier 1 Returns 2021- Scheme E

As you know there are 3 asset classes in the NPS scheme so the returns of all three asset classes are different. Let’s compare returns from the NPS tier 1 scheme. The last one-year return of all the pension fund managers is amazing. However, the best last three and five-year return is given by HDFC . But ICICI and UTI are consistent performers since inception.

Best Performing NPS Tier 1 Returns 2021- Scheme C

Looking at the returns for NPS Tier 1 Scheme C, ICICI Prudential and SBI has given the highest return in the last 10 year. However, ICICI, SBI, and UTI are consistent performers since inception.

Best Performing NPS Tier 1 Returns 2021- Scheme G

The best performing NPS Tier 1 Scheme G is again ICICI Prudential and SBI if we compare the last 10-year performance.

Best Performing NPS Tier 1 Returns 2021- Scheme A

Let’s compare scheme A returns also. NPS Tier 1- Scheme A is a new entrant from the last 3 years only. The best returns are given by SBI in the last 3 years. and the second-best return is given by HDFC.

Best Performing NPS Tier 2 Returns 2021- Scheme E

Comparing the returns of NPS Tier 2 account Scheme E, ICICI and UTI have given the best returns on comparing the last 10 yr returns.

Best Performing NPS Tier 2 Returns 2021- Scheme C

Looking at the returns ICICI and SBI have given best since inception returns. However last 10 years best performers are again ICICI and Kotak.

Best Performance NPS Tier 2 Returns 2021- Scheme G

How to choose Best pension Fund Manager for NPS?

If we compare the performance all the NPS fund managers are doing well. However, while choosing the fund manager you may choose the fund manager based on your allocation. For instance, if you have a high corporate bond allocation you can look for the highest performer in the corporate bond category.

Additional resources

How SWP Works In Mutual Funds – With Example