SBI Life – SBI Smart Platina Plus an Individual, Non-linked, Non-participating Life Insurance Savings Product. This is a SBI Guaranteed income Plan.

Table of Contents

SBI Life- Smart Platina Plus – Features & Eligibility

| Feature of SBI Life – Smart Platina Plus | Eligibility Conditions |

| Minimum Entry Age | 30 days |

| Maximum Entry Age | 60 Years |

| maximum Maturity Age | 99 Years |

| Minimum Annual Premium | Rs 50000 |

| Maximum Annual Premium | No Limit |

| Premium Mode | Yearly / Half-yearly/Monthly |

| Premium for Non – Yearly Modes : | Half-Yearly: 51.00% of annualized premium |

| Monthly: 8.50% of annualized premium | |

| Basic Sum Assured | (11* Annualized Premium) |

| Minimum Sum Assured | Minimum : Rs. 5,50,000 |

| Maximum Sum Assured | Maximum : No limit, |

| Premium Payment Term | Payout period | Policy Term |

| 7 Years | 15/20/25/30 | 23/28/33/38 |

| 8 Years | 15/20/25/30 | 24/29/34/39 |

| 9 Years | 15/20/25 | 26/31/36 |

How does SBI smart Platina plus work?

- Choose Annualized Premium amount and premium payment frequency.

- Select your Premium payment term

- Select Payout period

- Income plan option.

- The Policy term would be determined based on this ( Policy term is equal to Premium Payment Term + one year + Payout Period)

- Choose the frequency in which you want to receive guaranteed income in the payout period.

How is policy term calculated?

Suppose you take the premium payment term as 7 year and you choose to get income for 15 years then your policy term will be 7+15+1=23 years.

Premium payment -7 years

Income duration – 15 years

So total Policy duration = 7 year+15Year+1 year =23 Years

What will you get from SBI Platina Plus?

- Guaranteed income

- Maturity Benefit -110% of premium will be returned

- Life Cover

Guaranteed income Options?

SBI life Platina Plus offer two income options. You have to choose from the below mentioned options:

- Life Income

- Guaranteed Income

*Please note the below mentioned points carefully

- Income plan option once chosen at inception cannot be changed.

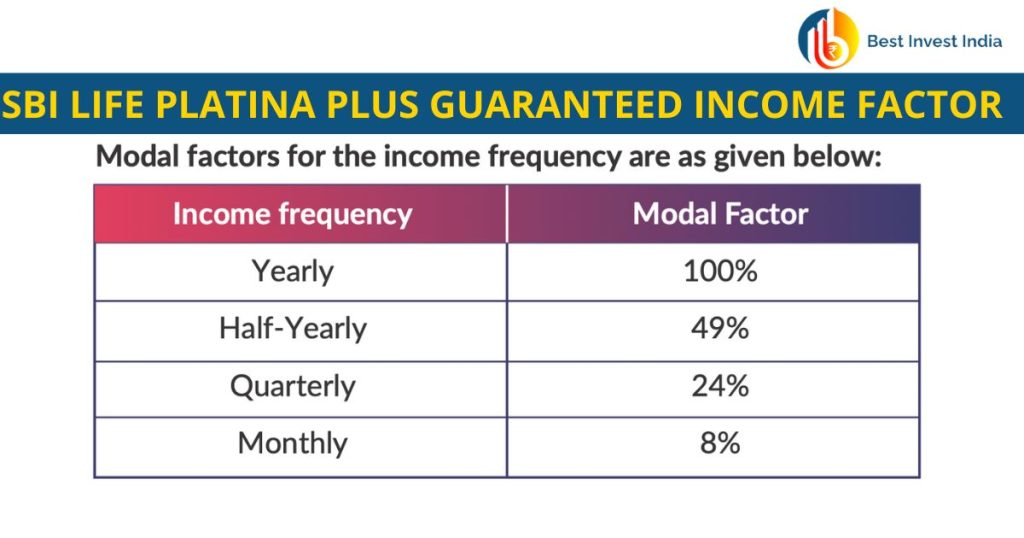

- You have a choice to receive your income in Yearly, Half-yearly, Quarterly or Monthly payout instalments as per your needs.

- You may change the income payout frequency selected at inception or within nine months from the date of expiry of Premium Payment Term, by writing to the company.

How much Guaranteed income you will get?

Guaranteed income = Guaranteed income factor * Annual Premium* modal factor.

SBI Platina Plus Plan Illustration

Death Benefit (For In-force policies)

The death benefit is paid higher of below options:

- Basic Sum Assured = 11 times of annualized premium

- 105% of total premiums paid upto the date of death

- Annual Guaranteed Income* Death Benefit Factor for Guaranteed Income + Maturity Benefit* Death Benefit Factor for Maturity Benefit

However, Death benefit will be different for Life income and Guaranteed Income

Life Income:

Sum Assured is paid

Guaranteed Income

In case you choose Guaranteed income, the death benefit payout will differ on the basis of when the unfortunate event occurred i.e before/after commencement of payout period.

BEFORE the commencement of the payout period

Sum assured on death is payable as lump sum to the nominee and the policy terminates.

AFTER the commencement of the payout period

Sum assured on death is payable as lumpsum to the nominee or legal heir of the life assured.

AND nominee or legal heir shall continue to receive the future Guaranteed Income during the payout period.

The nominee or legal heir shall have an option to receive the discounted value of the future Guaranteed Income, in the form of a lump sum, anytime during the Payout Period, discounted at 8.25% per annum.

Looking at all the benefits and options, Let’s evaluate the plan and compare it with other options:

SBI Smart Platina Plus Review

Let’s first evaluate SBI Platina plus insurance plan benefits and disadvantages

Benefits of SBI Life Smart Platina Plus

- Life cover

- Guaranteed Income for certain duration

- Income tax benefit U/S 80C

- Easy payment options such as monthly and other modes of payment

- Limited premium payment options – 7, 8 and 10 years

- Choice of two income plan options – Guaranteed Income & Life Income

- Guaranteed Income Benefit: Enjoy fixed regular income during the payout period opted.

- Maturity Benefit : Get return of 110% of total premiums paid at the end of policy term.

Disadvantages of SBI Platina Plus Policy

- Low returns

- Long payment duration-

- If you fail to pay premium for lesser than 2 years , the policy will lapse and you will not get anything in return. However, it can be revived by paying in full amount within period of 5 years from first unpaid premium.

- If you pay 2 years and no subsequent premium payment, the policy will acquire paid up mode and thus you will get reduced maturity and the benefits.

- Once you buy the policy, you have to continue the policy otherwise you will have to bear the losses.

If we compare the return and benefits of the policy with PPF+ Term insurance or ELSS MF + term insurance, you will be better off with the later options.

Additionally you get FD kind return from SBI Platina Plus policy. which also means you won’t be able to get inflation adjusted returns. Even the returns 5.63% ( refer calculations table below) is much lower than the inflation rate. Thus in long run, you are going to loose money rather than saving it. Negative inflation adjusted returns.

SBI Smart Platina Plus Calculator

If we take above illustration example for calculation purpose then below is the return calculator. than ultimately the return you get is around 6% from SBI Platina Plus.

| SBI Smart Platina Plus Calculator ( BestinvestIndia.com) | |

| Year | Premium |

| 0 | -100000 |

| 1 | -100000 |

| 2 | -100000 |

| 3 | -100000 |

| 4 | -100000 |

| 5 | -100000 |

| 6 | -100000 |

| 7 | -100000 |

| 8 | -100000 |

| 9 | -100000 |

| 10 | 0 |

| 11 | 0 |

| 12 | 99210 |

| 13 | 99210 |

| 14 | 99210 |

| 15 | 99210 |

| 16 | 99210 |

| 17 | 99210 |

| 18 | 99210 |

| 19 | 99210 |

| 20 | 99210 |

| 21 | 99210 |

| 22 | 99210 |

| 23 | 99210 |

| 24 | 99210 |

| 25 | 99210 |

| 26 | 99210 |

| 27 | 1,100,000 |

| IRR | 5.63% |

Final thoughts

SBI Life Platina Plus scheme is a guaranteed income plan but if we compare the return part of the policy with other options such as PPF plus term insurance or ELSS or term insurance, than the return and life cover are comparatively much lower. In addition one has to make compulsory payment for entire duration.

If you fail to do so, the Sbi Platina plus guaranteed income plan benefits will be reduced or removed.

The return rate is much low 5.6% only therefore investment purpose won’t be served. Thus if your purpose to buy the plan is investment, then strict NO for the Platina plus plan. But if you are good to go with saving only and happy with FD kind of returns than go for it.