Tata AIA Life Insurance Param Rakshak Solution is an Comprehensive solution which combines Tata AIA Life Insurance Smart Sampoorna Raksha plan( a Unit-linked Insurance Plan) and Tata AIA Vitality Protect Plus, a Non-linked, Non-participating, Individual Health Rider. Thus Param Rakshak solution provide a complete solution for Protection that focuses on savings with market-linked returns.

Table of Contents

Tata AIA Param Rakshak Solution – Features & Benefits

- Life Insurance Coverage-Get life insurance coverage for up to 100 years

- Accidental Death Cover– Additional Sum Assured is given in case of Accidental Death.

- 2X Additional Sum Assured in case of accidental death in public transport.

- Accidental Total & Permanent Disability– Benefit payout is given.

- 2X Benefit in case of disability due to accident in public transport

- Comprehensive coverage-The Tata AIA Life Insurance Param Rakshak solution offers a life cover, health cover and savings solution

- Choice of funds-Choose one or all of the 11 fund options provided under the plan or opt for the Enhanced Systematic Money Allocation & Regular Transfer (Enhanced SMART) portfolio strategy.

- The Flexibility of Premium Payment-Choose between the Regular Premium Pay or Limited Premium on an annual basis.

- Tata AIA Vitality (Wellness Program)-A comprehensive wellness program that helps you understand and improve your health

- Return of Fund Value– At maturity fund value (at the rate of 4% or 8% ) is given back

- Tax Benefits -Get Income tax benefits as per applicable tax laws.

What is Tata AIA Vitality (Wellness Program)

On enrolling into the Wellness Program, you can get an upfront discount of up to 10% on your premium. The premium discount in the subsequent years may increase or decrease based on your Wellness status (decided based on your engagement levels, i.e., completion of health assessments, achievement of fitness goals etc).

Tata AIA Param Rakshak Solution – Eligibility

| Minimum Age at Issue | 18 Years |

| Maximum Age at Issue | 60 Years |

| Policy Term | 30 To 40 Years |

| Available Premium Payment Term Options | Limited Pay: 5/10/12 Years and Regular Pay |

| Rider PPT will be the Same as The Base Plan | |

| Premium Payment Term | (Subject to Max Maturity Age of Chosen Riders) |

| Premium Payment Frequency Options | Annual, Half Yearly, Quarterly and Monthly mode |

| Maximum Age at Maturity | Base Cover – 100 Years Accidental Death, Accidental Total and Permanent Disability – 85 Years |

| Minimum Sum Assured | Base (Life Cover) – Rs. 50 Lakhs AD And ATPD – Rs. 50 Lakhs |

| Maximum Sum Assured | Base (Life Cover) – No Limit AD And ATPD – Rs. 2 Cr. |

| Minimum Premium | Base Plan Premium: 5 Pay – Rs. 60,000 per annum Others – Rs. 18,000 per annum |

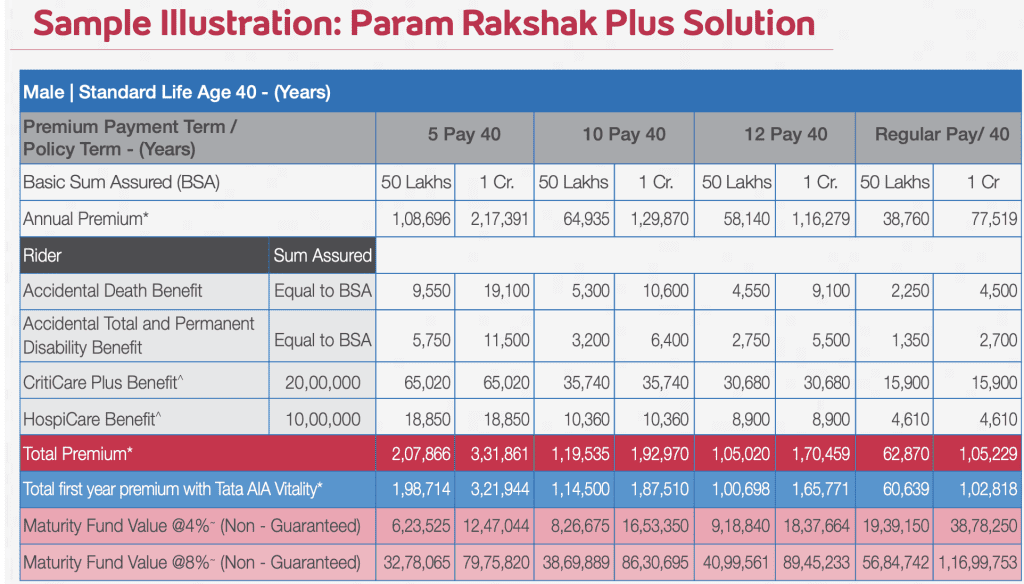

Benefit illustration

Should You buy -Tata AIA Param Rakshak Solution

Looking at the benefits and illustration, you must have derived some conclusion. But before finalising any decision please consider the following points:

- Tata AIA Param Rakshak Solution is a combination of unit link plan and life cover plan which focuses on providing high risk coverage.

- In a nutshell, you may consider this plan as a ULIP with high life cover.

- As it is ULIP, returns are not guaranteed.

- You also get additional benefits on extra premium payment.

- Risk is obviously borne by the investor.

Now coming to the point of should you buy the plan or look for other solutions. Still today our choice goes to term plans only. Since paying high premium in lieu of getting money back is a psychological trap. It is in your best interest to buy a term plan and invest money in some other instruments such as mutual funds.

In addition the charges under the plan are not disclosed anywhere, so the return generation calculations are difficult to predict.

Read more about LIC Latest Term plans online

LIC New Jeevan Amar- All You Should Know?

Top 7 Reasons Why Should You Buy Term Life Insurance?

Mutual Fund Or Insurance – Which Is A Better Option For Investment

Top 5 Reasons Why You Should Choose Mutual Funds Over Insurance

LIC Or SIP Or Mutual Funds- Which Is Better?

ULIPs Vs Mutual Funds – Which Will Provide You Better Returns?