While it comes to choosing between ULIPs vs Mutual Funds, it becomes difficult for the investor to understand and choose – which will provide better returns. At the first instance both Unit linked insurance plans and Mutual Fund look alike but as an investor one should choose the investment carefully. Hence, it is prudent to understand the differences, between ULIP and mutual funds before investing.

In this post, we will evaluate and understand both in much detail. But before understanding the difference, let’s first catch up with the basics.

The Mutual Fund investment vehicle option which is a pure investment product with no component of life insurance attached to it. If you want tax benefit then you can invest in the ELSS mutual fund to have tax benefit.

Table of Contents

What are Mutual Funds?

Mutual Fund is an Investment option through which you can invest in underlined securities such as equity/stocks,bonds and debentures etc.

A Mutual Fund is an investment scheme where people pool in money (just like other investments) and your money is invested (on your behalf) in stocks , bonds or other securities.

It is one of the best investment avenues which can create huge wealth for its users (investors).

These investments can be used for various investment requirements such as financial goals ( retirement, child education, purchase of asset, home etc.), short term money parking, fixed maturity plans, regular income, tax saving and wealth creation.

Also Read : Best Retirement pension Plan In India

Mutual fund provides the benefit

- Investment

- Wealth Creation

- For tax saving uses you can invest in ELSS mutual Fund

Additional reading about mutual funds https://bestinvestindia.com/mutual-fund-guide/

What are ULIPs?

Ulip or unit linked insurance plans are market linked insurance plans. Generally these plans’ tenure ranges from 5 -20 or more years. ULIP plans are also available in regular premium( pay premium for the entire duration of plan), limited premium payment and single premium. Like Mutual Funds, ULIPs also invest in equity shares,bonds and money market instruments.

The investor has to choose the investing option as per his risk appetite.

Unit linked insurance plans are sold as a wonderful gift bundle to the customers.

ULIP provides benefits

- Investment

- Insurance

- tax saving U/S 80C

ULIPs Vs Mutual Funds – Difference between ULIP & Mutual Fund

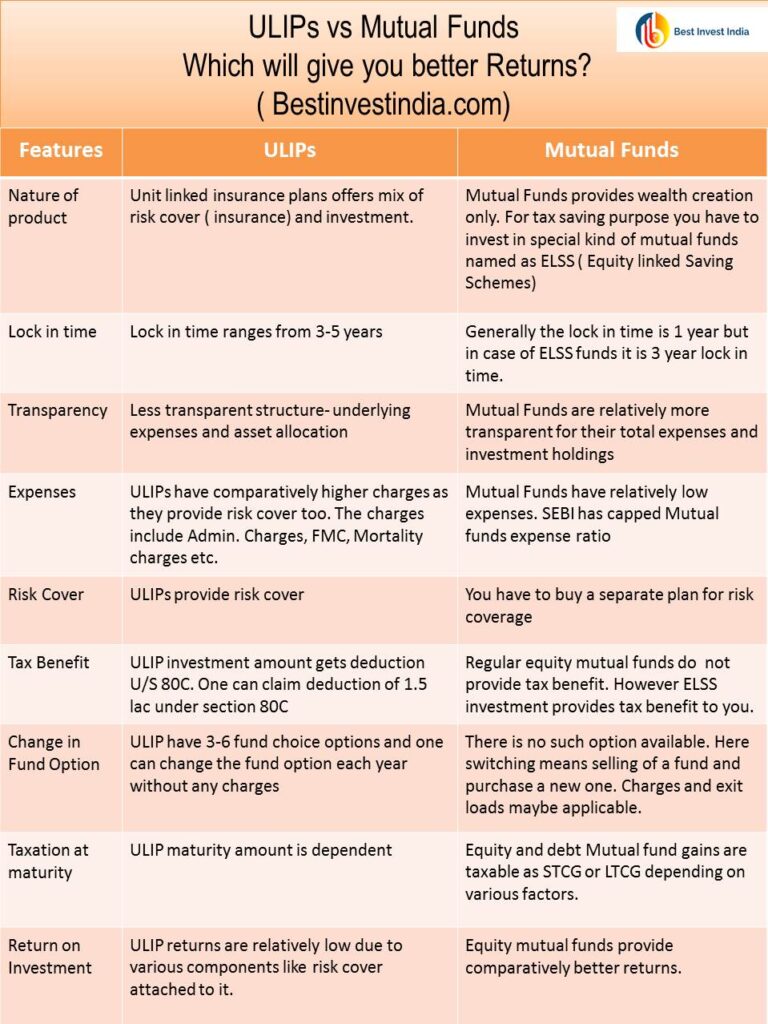

ULIP and mutual funds are both investment product which offer different benefits and suitable for different needs altogether.

Let’s evaluate both on certain parameters:

# Nature of Product

Unit linked Insurance plans offer a mix of risk cover and investment. These plans provide tax deduction under section 80C. ULIPs are available as a single premium. Limited premium and regular premium plans. Mutual funds do not provide any life cover, but a highly efficient product for wealth creation in the long term. There are a variety of mutual fund options available to cater different needs of the investors.

For tax saving purpose one can use ELSS mutual funds.

#Lock-in Time

The usual Lock-in time In ULIP ranges from 5-30 year, depending on the plan whereas the typical lock-in period in mutual funds( equity mf) is 1 year.However you can withdraw from equity mf before completion of 1 year- subject to penalties in the form of exit load. ELSS mutual funds have higher lock in period of 3 year.

#Transparency

In case of ULIP underlying expenses and asset allocation ( stock choice, debt choice)is comparatively less transparent as compared to a mutual fund scheme.

#Expenses

ULIP plans are expensive insurance plans because of their high charges as compared to mutual funds. These market linked insurance plan deduct charges like admin charges, mortality charges, fund management charges, miscellaneous charges etc.Because these plans also provide insurance cover along with the investment, thus charges need to be deducted to compensate the cost.

In case of mutual funds the charges are low as compared to ULIP, since mf do not provide life cover with it. The total expense ratio is also regulated from SEBI and kept low.

#Risk Cover( Life Insurance)

As the name suggests ULIP plans provide life cover to the investor while mutual funds do not provide any olife cover to the investor. One has to buy a separate life insurance plan to fulfill the protection needs of the investor.

#Tax Deduction

ULIP investment amount gets a deduction U/S 80C. One can claim deduction of 1.5 lac under section 80C. While all mutual funds do not provide tax deduction U/S 80C. However,one can invest in ELSS Mf to get tax deduction U/S 80 C.

# Fund Choices ( Asset Class Choice & Switch)

ULIP has 3-6 fund choice options ( different asset classes such as equity, debt, cash market, balanced etc) and investors are free to switch between the asset class without any hassle each year without any charges. However, more switches are also permitted subject to some charges. While in case of mutual funds, a switch is considered as selling of existing units and purchase of new units, this may attract exit load and capital gain tax.

#Return on Investment

ULIP returns are lower due to high inbuilt charges such as admin charge,mortality charge, FMc etc. While mutual funds provide higher returns as compared to ULIPs.

For additional reading: How to invest lump sum amount in mutual funds?

ULIPs Vs Mutual Funds – Which will give you better Returns?

ULIP is a better investment product for those who are low to moderate risk takers and need insurance cover with their plan. It is also suitable for those who are ready to pay a premium for the long term and are ready for moderate returns. Whereas mutual funds are suitable for low to high risk takers who do not need any insurance cover along with their investments.

Liquidity might be a good barrier for some.Hence people who are looking for high liquidity ( ease of withdrawal) mutual funds will hold good for them while if liquidity is not an issue, can invest in ULIP too.

ULIP allows switching between asset classes through various fund choices but in mutual fund switches meant to sell and buy a new scheme. This may attract penalties in the form of exit load and capital gains.

But clearly if you are looking for returns than there is no better choice than mutual funds, however if insurance and investment is your need than ULIP will hold better for you.

Also Read: Top 5 reasons why you should choose Mutual Funds over Insurance

Mutual Fund or insurance- which is a better option for investment