In this tax season 2024, investors are keen on tax saving under section 80C. Equity Linked Saving Schemes (ELSS) stand out as an attractive option. But which are the Best Tax Saving mutual funds to invest in.

ELSS mutual funds not only offer tax benefits under Section 80C but also provide the potential for long-term wealth creation through equity investments.

In this article, we’ll explore the top ELSS mutual funds to consider in 2024.

Table of Contents

Understanding ELSS and its Advantages:

ELSS Mutual Fund Full form is Equity Linked Saving Schemes. ELSS funds are a category of mutual funds which invest in equities and equity-related instruments. These tax-saving mutual funds come with a mandatory three-year lock-in period.

The Advantage of ELSS Mutual Fund Scheme

1. Tax Benefits – ELSS investments qualify for deductions under Section 80C of the Income Tax Act, allowing investors to claim up to ₹1.5 lakh in tax benefits.

2. Wealth Creation– Since equity-oriented, ELSS funds have the potential to deliver higher returns compared to traditional tax-saving instruments over the long term.

3. Diversified Portfolio – Since ELSS Mutual Funds invest its money in the diversified mutual fund category, have lower risk as compared to other equity mutual funds.

4. Least Lock-In period– ELSS Mutual Funds have a lock-in period of 3 years only, which is the lowest amongst all tax-saving investment options.

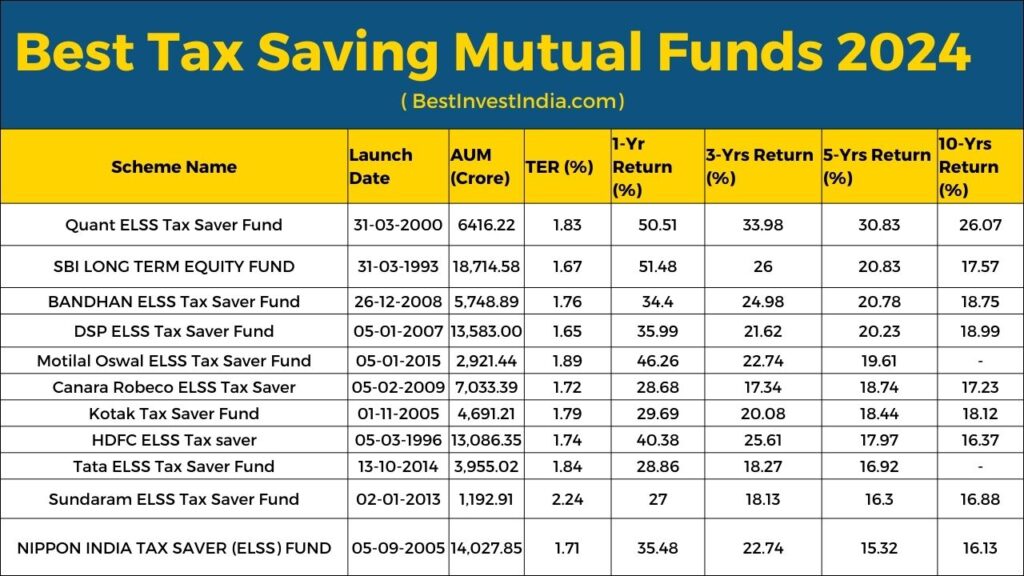

Best ELSS Mutual Funds in 2024

-Here is the list of some of the best Equity Linked Saving Schemes/ Tax saver mutual funds best suited to investors. All these tax-saver mutual funds under 80C provide tax deduction of Rs 1.5 lac in a Financial year.

If an investor opts for the old tax system, then these tax-saving mutual fund offer tax saving, and wealth creation at the same time.

All these funds are the most consistent. The top 10 Mutual Fund Schemes have been chosen based on average rolling returns and consistency with which funds have beaten category average returns.

We have ranked schemes based on these two parameters using a proprietary algorithm and are showing the most consistent schemes for each category.

Note that we have ranked schemes that have performance track records of at least 5 years (consistency cannot be measured unless a scheme has a sufficiently long track record covering multiple market cycles e.g. bull market, bear market, sideways market etc.). Also, note that schemes whose AUMs have not yet reached Rs 500 Crores have been excluded from the ranking. The fund details and ranking have been taken from Advisorkhoj.com.

Tax Treatment of ELSS Mutual Funds

- You can not sell your investments in fund for 3 years from the purchase date.

- Long term capital gain tax will be applicable when you sell your investments after 3 years.

- Current tax rate is 10%, if your total long term capital gain exceeds 1 lakh in a financial year. Any cess/surcharge is not included.

- However, you can claim a deduction on your taxable income under section 80c for your investments in this fund. (Current tax deductions are capped at 1.5 lakh per year).

Is ELSS taxable after 3 years?

ELSS is not taxable after 3 years but gains from ELSS are taxable when you sell the fund. Read about mutual fund taxation Mutual Fund taxation – How your gains are taxed?

Read more links.

4. Least Lock-In period– ELSS Mutual Funds have a lock-in period of 3 years only, which is the lowest amongst all tax-saving investment options.

Best ELSS Mutual Funds in 2024

-Here is the list of some of the best Equity Linked Saving Schemes/ Tax saver mutual funds best suited to investors. All these tax-saver mutual funds under 80C provide tax deduction of Rs 1.5 lac in a Financial year.

If an investor opts for the old tax system, then these tax-saving mutual fund offer tax saving, and wealth creation at the same time.

All these funds are the most consistent. The top 10 Mutual Fund Schemes have been chosen based on average rolling returns and consistency with which funds have beaten category average returns.

We have ranked schemes based on these two parameters using a proprietary algorithm and are showing the most consistent schemes for each category.

Note that we have ranked schemes that have performance track records of at least 5 years (consistency cannot be measured unless a scheme has a sufficiently long track record covering multiple market cycles e.g. bull market, bear market, sideways market etc.). Also, note that schemes whose AUMs have not yet reached Rs 500 Crores have been excluded from the ranking. The fund details and ranking have been taken from Advisorkhoj.com.

Tax Treatment of ELSS Mutual Funds

- You can not sell your investments in fund for 3 years from the purchase date.

- Long term capital gain tax will be applicable when you sell your investments after 3 years.

- Current tax rate is 10%, if your total long term capital gain exceeds 1 lakh in a financial year. Any cess/surcharge is not included.

- However, you can claim a deduction on your taxable income under section 80c for your investments in this fund. (Current tax deductions are capped at 1.5 lakh per year).

Is ELSS taxable after 3 years?

ELSS is not taxable after 3 years but gains from ELSS are taxable when you sell the fund. Read about mutual fund taxation Mutual Fund taxation – How your gains are taxed?

Read more links.