LIC offers four different LIC pension plans to match the requirements of different people. However, the wide variety may confuse many times and it becomes difficult to choose the best pension Plan of LIC.

In this post, we will discuss Best LIC’s pension plans in detail and try to find out which plan is best suited to you.

Table of Contents

Best LIC Pension Plan Single Premium

- LIC Saral pension (table number 862) – immediate annuity plan

- LIC Jeevan Shanti (table number 858)

- LIC Jeevan Akshay VII (table number 857 )

- LIC New Pension Plus plan (Table number 867 )

- Pradhan Mantri Vaya Vandana Yojana (table no.856)- Now discontinued

LIC Saral Pension Plan(table number 862)

LIC’s Saral Pension Plan is an LIC Pension plan single premium ( immediate annuity plan )wherein the Policyholder has an option to choose an Immediate Annuity ( you start getting a pension from next month, quarter, half year or year).

There are two options available under Immediate Annuity:

| Annuity Option | Annuity Description |

| Option I | Life Annuity with Return of 100% of Purchase Price ( Here policyholder get a pension all his/her life. After policyholder death, the money is given back to the nominee) |

| Option II | Joint Life Last Survivor Annuity with Return of 100% of Purchase Price on death of the last survivor ( Here policyholder get pension all his/her life, after his/her death spouse is given 100% pension and after spouse death, the money is given back to the nominee) |

LIC Saral pension plan – Annuity/ Pension Rate (One time Premium 10 lac )

| Age last birthday | Option-I : Life Annuity with Return of 100% of Purchase Price | Option-II : Joint Life Last Survivor Annuity with Return of 100% of Purchase Price on death of the last survivor |

| 40 | 63960 | 63450 |

| 50 | 64674 | 64266 |

| 60 | 65592 | 65082 |

| 70 | 66612 | 66102 |

| 80 | 68142 | 67326 |

Can I surrender LIC Saral Pension Policy

You can surrender the LIC Saral Pension Plan at any time after six months from the date of commencement if the annuitant or spouse or any of the children of the annuitant is diagnosed as suffering from any of the critical illnesses)specified (based on the documents produced to the satisfaction of the Medical Examiner of the Corporation). Please check the list of critical Illnesses with the LIC office.

• On approval of the surrender, 95% of the Purchase Price shall be paid to the annuitant, subject to deduction of any outstanding loan amount and the loan interest, if any.

• For the purpose of surrender value calculation, the Purchase Price excludes taxes, if any.

• On payment of the surrender value, all other benefits shall cease and the policy shall terminate.

LIC New Jeevan Shanti (table number 858)

It is an Annuity plan which has the option of purchasing a Deferred annuity and can be purchased only by paying a lump sum amount. The plan provides for annuity payments of a stated amount throughout the lifetime of the annuitant.

How New Jeevan Shanti Plan works

Here you pay a lump sum amount and choose to defer ( not take ) your pension for 1 or more years and after completion of the deferment period your pension starts.

The deferment period ( pension delay time) is available for a minimum of 1 year and a maximum of 12 years.

- Pay lump Sum amount to LIC

- Choose your annuity option

- Choose your annuity mode monthly, quarterly, half yearly or yearly )

- Defer Annuity ( Delay (not take) pension for 1 to 12 Year)

- Enjoy pension from next month, Quarter, Half Year or year.

You can buy the policy for single life and joint life.

LIC Jeevan Shanti Annuity Options

| Annuity Option | Annuity Description |

| Option I | Life Annuity with Return of 100% of Purchase Price ( Here policyholder get pension all his/her life and after policyholder death, the money is given back to the nominee) |

| Option II | Joint Life Last Survivor Annuity with Return of 100% of Purchase Price on death of the last survivor ( Here policyholder get a pension all his/her life, after his/her death spouse is given 100% pension and after the spouse death, the money is given back to the nominee) |

Amount of annuity payable at yearly intervals which can be purchased for ₹.10,00,000/- under different options for Deferred Annuity for single life is as under:

| Age last birthday | Defer pension by 5 years | Defer pension by 8 years | Defer pension by 10 years | Defer pension by 12 years |

| 30 | 86784 | 104706 | 118150 | 132920 |

| 35 | 87804 | 106440 | 120496 | 135878 |

| 40 | 89028 | 108480 | 123148 | 139142 |

| 45 | 90456 | 110928 | 126208 | 142508 |

| 50 | 92190 | 113784 | 129574 | 145874 |

| 55 | 94332 | 117150 | 133144 | 148628 |

| 60 | 97086 | 120924 | 136306 | 148934 |

| 65 | 100350 | 124290 | 136612 | 143630 |

| 70 | 104022 | 124800 | 130900 | NA |

| 75 | 107082 | NA | NA | NA |

.

Can I surrender LIC New Jeevan Shanti Plan?

The policy can be surrendered at any time during the policy term. The Surrender Value payable shall be higher of Guaranteed Surrender Value or Special Surrender Value.

→If the chosen annuity option is other than specified above, surrender of policy shall not be allowed. On the payment of the surrender value, the policy shall terminate and all other benefits shall cease.

→The surrender value payable shall depend on the age (last birthday) of the Annuitant at the time of surrender/date of vesting of the policy.

LIC Jeevan Akshay VII

LIC Jeevan Akshay VII is an Immediate Annuity plan, which can be purchased by paying a lump sum amount. The plan provides for annuity payments of a stated amount throughout the life time of the annuitant.

Annuity Options LIC Jeevan Akshay VII

- Option A: Immediate Annuity for life.

- Option B: Immediate Annuity with guaranteed period of 5 years and life thereafter.

- Option C: Immediate Annuity with guaranteed period of 10 years and life thereafter.

- Option D: Immediate Annuity with guaranteed period of 15 years and life thereafter.

- Option E: Immediate Annuity with guaranteed period of 20 years and life thereafter.

- OptionF: Immediate Annuity for life with return of Purchase Price.

- Option G:Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option H : Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option I : Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

Annuity option once chosen cannot be altered.LIC Jeevan Akshay VII – How does it works?

- Pay lump Sum amount to LIC

- Choose your annuity option ( A to J)

- Choose your annuity mode monthly, quarterly, half yearly or yearly )

- Enjoy pension from next month, Quarter, Half Year or year.

Annuity Options Jeevan Akshay VII

Jeevan Akshay VII Annuity Rates ( 10 lac One time Payment)

| Age last Birthday | Option A | Option D | Option F | Option G | Option H | Option I | Option J |

| 25 | 67660 | 67456 | 64702 | 48586 | 66742 | 65722 | 64294 |

| 30 | 68986 | 68680 | 65008 | 50116 | 67762 | 66640 | 64600 |

| 40 | 72760 | 72250 | 65620 | 54400 | 70924 | 69088 | 65212 |

| 60 | 92650 | 87244 | 67252 | 74902 | 86836 | 81736 | 66742 |

| 70 | 120496 | 98362 | 68170 | 102340 | 108970 | 99382 | 67660 |

| 80 | 184858 | 104788 | 69292 | 165886 | 159970 | 141100 | 68680 |

LIC’s New Jeevan Shanti

.

Can I surrender LIC New Jeevan Shanti Plan?

The policy can be surrendered at any time during the policy term. The Surrender Value payable shall be higher of Guaranteed Surrender Value or Special Surrender Value.

→If the chosen annuity option is other than specified above, surrender of policy shall not be allowed. On the payment of the surrender value, the policy shall terminate and all other benefits shall cease.

→The surrender value payable shall depend on the age (last birthday) of the Annuitant at the time of surrender/date of vesting of the policy.

LIC Jeevan Akshay VII

LIC Jeevan Akshay VII is an Immediate Annuity plan, which can be purchased by paying a lump sum amount. The plan provides for annuity payments of a stated amount throughout the life time of the annuitant.

Annuity Options LIC Jeevan Akshay VII

- Option A: Immediate Annuity for life.

- Option B: Immediate Annuity with guaranteed period of 5 years and life thereafter.

- Option C: Immediate Annuity with guaranteed period of 10 years and life thereafter.

- Option D: Immediate Annuity with guaranteed period of 15 years and life thereafter.

- Option E: Immediate Annuity with guaranteed period of 20 years and life thereafter.

- OptionF: Immediate Annuity for life with return of Purchase Price.

- Option G:Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option H : Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option I : Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

Annuity option once chosen cannot be altered.LIC Jeevan Akshay VII – How does it works?

- Pay lump Sum amount to LIC

- Choose your annuity option ( A to J)

- Choose your annuity mode monthly, quarterly, half yearly or yearly )

- Enjoy pension from next month, Quarter, Half Year or year.

Annuity Options Jeevan Akshay VII

Jeevan Akshay VII Annuity Rates ( 10 lac One time Payment)

| Age last Birthday | Option A | Option D | Option F | Option G | Option H | Option I | Option J |

| 25 | 67660 | 67456 | 64702 | 48586 | 66742 | 65722 | 64294 |

| 30 | 68986 | 68680 | 65008 | 50116 | 67762 | 66640 | 64600 |

| 40 | 72760 | 72250 | 65620 | 54400 | 70924 | 69088 | 65212 |

| 60 | 92650 | 87244 | 67252 | 74902 | 86836 | 81736 | 66742 |

| 70 | 120496 | 98362 | 68170 | 102340 | 108970 | 99382 | 67660 |

| 80 | 184858 | 104788 | 69292 | 165886 | 159970 | 141100 | 68680 |

LIC pension Plan – Jeevan Akshay VII premium rates 2023-24

To understand the various annuity options available please visit the below link

Can I Surrender LIC Jeevan Akshay VII

The policy can be surrendered at any time after three months from the completion of policy (i.e. 3 months from the Date of issuance of policy) or after expiry of the free-look period, whichever is later under the following annuity options only:

i)Option F: Immediate Annuity for life with return of Purchase Price.

ii)Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

→If the chosen annuity option is other than specified above, surrender of policy shall not be allowed. On the payment of the surrender value, the policy shall terminate and all other benefits shall cease.

→The surrender value payable shall depend on the age (last birthday) of the Annuitant at the time of surrender/date of vesting of the policy.

LIC’s Pradhan Mantri Vaya Vandana Yojana ( now Dis countinued)

PMVVY provides immediate pension for senior citizens 60 years and above .It can be purchased by paying a lumpsum amount . The plan provides for pension payments of stated amount for the policy term of 10 years, with return of purchase price at the end of 10 years.

PMVVY scheme is offered by LIC of India, you can purchase LIC Vaya Vandana yojana online and offline from LIC of India. After depositing the lump-sum amount, you start getting a pension from the next payment cycle and after completion of 10 years, the purchase price ( lump sum amount paid initially) is returned.

Pension payment modes are available : Monthly / Quarterly/Half-yearly /Yearly

On the death of the pensioner at any time during the term of 10 years, the purchase price will be refunded to the legal heirs/nominees.

Only resident Indians are eligible to purchase this plan.

LIC New Pension Plus plan number 867

LIC’s New Pension Plus is a Non-Participating, Unit Linked, Individual Pension plan. One can pay systematically and take regular income in later years.

This plan can be purchased either as Single Premium or Regular Premium payment frequency.

LIC New Pension Plus plan works

- choose your premium amount

- Choose from Single Premium/ Regular premium

- select a premium payment frequency

- Select policy term

- Select Vesting Age ( age from when you want to take pension)

- Choose pension frequency

Buy LIC Online Process

Login to LIC’s website https://www.licindia.in/ and click “BUY POLICY ONLINE”

> Select “New Pension Plus plan ” and click on “CLICK TO BUY ONLINE”

> Fill contact details i.e. Name, Date of birth, mobile no, email ID and nearest City to create access id and OTP.

> Enter captcha and submit. You will receive a 9 digit access id and OTP on your mobile no and email.

> Enter OTP and proceed further.

> Give sum assured and term to calculate premium, click in radio button yes and proceed for filling the form.

> After successful submission of proposal, confirm the details and proceed for payment.

> You can pay premium by Net banking/credit card/debit card etc.

> After payment you will get introductory mail.

> Upload all required documents on our portal. Link will be shared to you. Non-medical cases will completed based on submitted documents.

> You have to do your self-video verification online.

> For medical LIC’s approved MSP (Medical Service Provider) will contact you. After medical, LIC will scrutinise the proposal and underwrite the case as per its underwriting principles.

> You can track status of your proposal online and also upload subsequent documents, submit your queries/response (if any) etc. through LIC’s portal.

> After getting the decision LIC will allot the policy number and will send firest-premium receipt, soft copy of policy document etc. on your registered email ID.

> Hard copy of the Policy document will be sent to your registered address by India post.

How to Choose Best LIC Pension Plan?

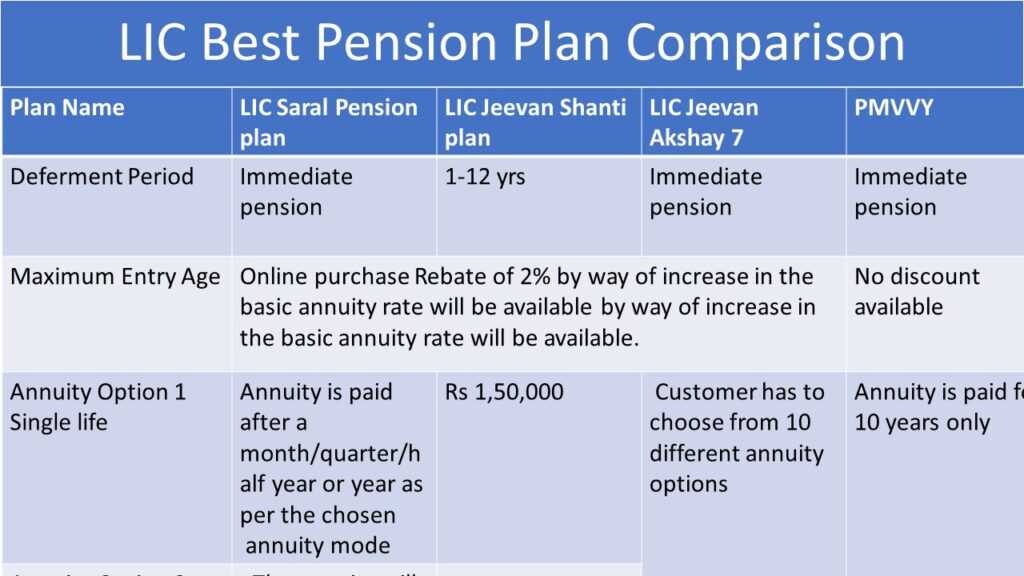

Now coming to how to choose best LIC Pension Plan depends on your requirement. LIC Saral Pension and LIC Akshay are the immediate pension plans. You can deposit a lump sum amount and start getting pension from the next month, quarter or so. But Saral pension plan has only two pension options i.e single and joint life. Additionally purchase price will be refunded back to the nominee after the annuitant s death. Whereas many pension options are available in LIC jeevan Akshay policy.

PMVVY is also a immediate annuity plan but is available only for senior citizens.

While Jeevan Shanti is a deferred annuity plan, in which after lump sum amount payment you have to wait for 1 yr to 12 year to get the pension. The pension amount from all LIC plan depends on age of the person and option chosen. You can choose the plan as per your needs and requirements.

Please also read the post https://bestinvestindia.com/best-investment-options-for-pensioners-senior-citizens

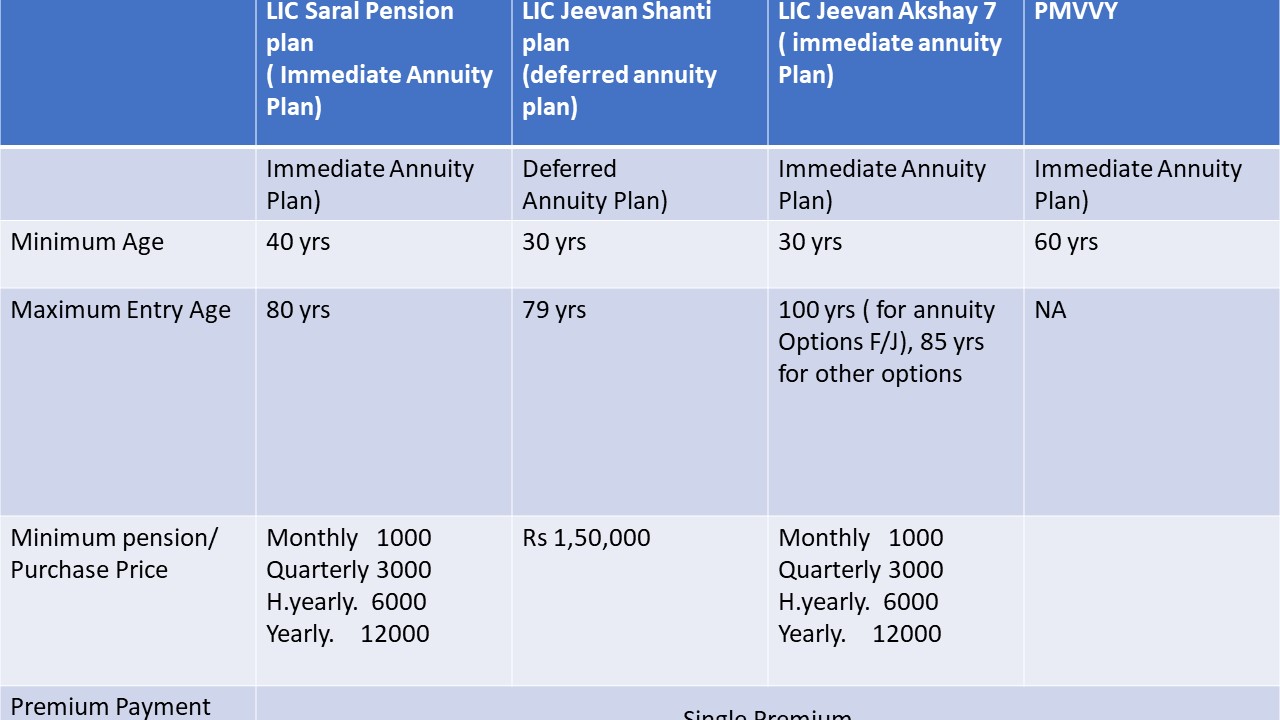

You can compare the basic features of all four plan as under

LIC Pension Plan Calculator

You can check yourself about what is the best pension plan in LIC by calculating the exact premium by LIC pension Plan calculator.

Conclusion

Looking at the pension chart LIC Jeevan Akshay can be the LIC best pension plan for senior citizens. While others can opt for other pension plan.

Read more about other exciting pension plans & ways to plan retirement

| Exploring SBI Pension Plan For A Secure Retirement | ICICI Prudential Guaranteed Pension Plan Flexi- Should You Buy? | LIC Pension Plans |

| LIC Jeevan Dhara 2 – Will You Get Enough Pension? | LIC Term Insurance Plans- The Ultimate Buying Guide | Start SIP & take income in retirement days SBI Mitra SIP – A Powerful Tool To Get Monthly Income |

| Start SIP & take income in retirement days ICICI Prudential Freedom SIP- Worry Free Retirement Solution | To give income to family SBI Bandhan SWP – Tax Efficient Family Income | Still want to understand why retirement planning Why Is Retirement Planning Important? |

| Explore the best method to take monthly income How SWP Works In Mutual Funds – With Example | Learn to plan Retirement in easy steps 9 Super Easy Steps To Retirement Planning | Explore another way to take pension NPS Scheme- Entry To Exit Rules |