Each and every company is required to provide salary slips to its employees. The salary slip gives you all the necessary information like salary breakdown and deductions etc.which one need to know. In fact your entire tax liability rests on componenets of salary slip only.

Let’s understand salary slip components one by one.

Each month the employer provides a salary slip either through mail, company ERP or as a hard copy along with the salary.

Table of Contents

Cost to the company (CTC)

Cost to the company is the total cost that an employer spends on an employee individually.

Basically it is the total cost including your in hand salary, PF, tax or other deductions, gratuity etc.

It should be noted it is NOT your in hand salary because you get salary after deductions like PF, TDS deduction etc.

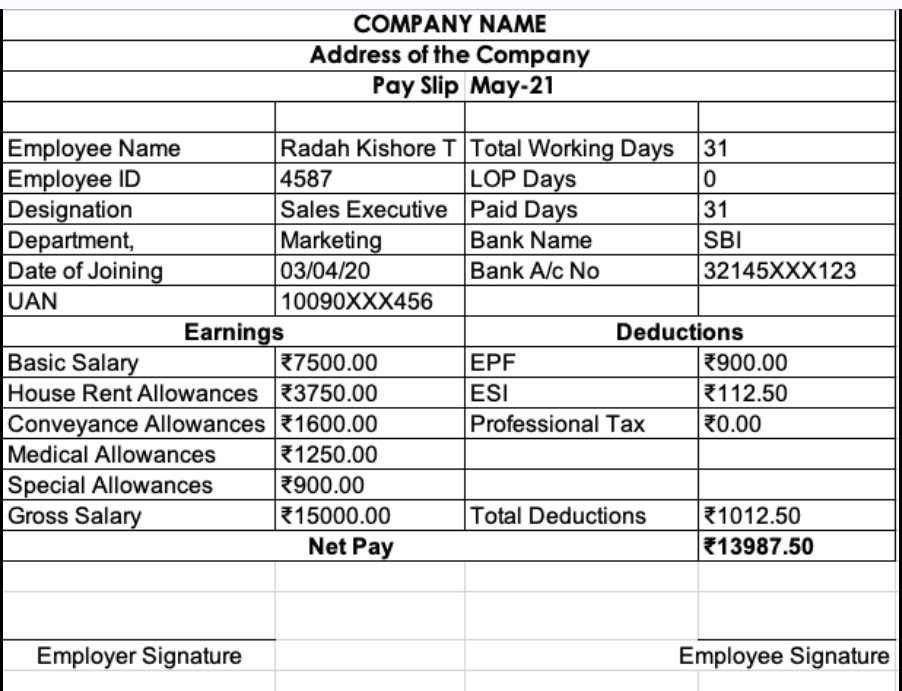

Gross Salary & Net Salary – Your before deduction salary is called Gross salary which after deduction of PF, Income tax etc, the remaining component is called net salary.

Components of Salary Slip

Basic

It is the basic component of the salary. You will be surprised why this basic component is very low. Usually this basic component is kept low for the reason, it is 100% taxable in the hands of the employee.

Also all the PF deductions etc. are based on this basic and dearness allowance components only.

Dearness allowance

As the name also suggests, it is given to compensate for the inflation effect on salary.Thus, dearness allowance is directly linked to living cost of an employee Basic and dearness. For income tax and PF deductions, basic salary and Dearness allowance is considered.

House Rent Allowance( HRA)

HRA is given to live in rented facilities. HRA depends on the city of employees residence.However HRA is not fully taxable in nature.

The tax depends on a few parameters.

The exemption amount will be applicable on the lowest of the following

- Rent paid annually ( 10% of the basic + DA)

- ActualHRA received

- 50% of basic + DA( in case of location in Mumbai, Kolkata, Chennai and Delhi) or 40% of basic plus in case of other cities

Conveyance allowance

Conveyance allowance is given to compensate the travel expenses to commute to the office.

Conveyance allowance is allowed in the minimum of the following

- Rs. 600 per month

- actual conveyance allowance

Medical Allowance

You can save tax on medical expenses you incur during your employed life. But you can save only if you submit medical bills as proof. However, if you do not submit bills then it is fully taxable in nature.

For tax exemption purposes you can save a maximum of Rs 15000 per annum on account of medical allowance.

LTA

Leave Travel Allowance is given to the employee to compensate for travel on leave expenses. As per the LTA exemption rule two journeys can be taken in a block of four calendar years. To claim LTA, you need to provide proof of journey.

Special allowance

It is a performance-based allowance, given to encourage employees to work better. This component of salary is 100% taxable in nature.

Deduction

The usual deduction are in the form of professional tax, tax deducted at source and your provident fund or NPS deduction.However if you have taken loan from the company tan interest payment or EMI payment will also be deducted from salary on monthly basis.

Professional tax

Professional tax is a small tax levied by the State government on earning professional income. It is payable only in few States

- Karnataka

- West Bengal

- Andhra Pradesh

- Kerala

- Jharkhand

- Bihar

- Maharashtra

- Madhya Pradesh

- Telangana

- Tamil Nadu

- Meghalaya

- Orissa

- Tripura

- Chhattisgarh

- Gujarat

- Assam

Professional tax is kept very low, a few hundred rupees only.

Tax Deducted at Source TDS

TDS is deducted by the employer on behalf of the IT department . One can reduce TDS by investing in ELSS, PPF, NSC and NPS and tax saving FD. you need to submit investment proof or claim TDS when you file your income tax returns.

Also read ; Top 7 Tax Saving Investments In India

Which is the safest high return investment in India

Provident Fund

The major portion of the deducted amount goes to EPF. EPF is a separate fund kept for employees retirement needs.The entire EPF contribution gets deduction under section 80C. One needs to compulsory deposit EPF up to 12% of basic and salary. basic and DA. Employer also makes a similar contribution. From EPF contribution, 8.33% goes to EPS and if the salary is less than 15000 then this EPS contribution is reduced to Rupees 1250.

Salary slip importance

Salary Slip is an important document which should be preserved because the salary slip might help you in seeking loans, it’s also important to keep the salary slip for future employment, income tax planning, availing government subsidies and legal.Basically salary slip is a legal document of your employment.