Money investing is such a thing that everyone wants to play a safe game. But the need of the hour is to get good returns too. In a nutshell, everyone wants to know the safest investment with high returns.

Here in this post we will take a look at best & safe investment options in India.

Table of Contents

Which are the safe investment options in India

If we go by definition then safe investment options are the options which have negligible or no risk or either have very low risk

Let’s explore Safest Options to invest Money:

# Bank Fixed Deposit

After saving bank account, the next best safe and easy option to invest money is Bank Fixed Deposit.

Bank Fixed Deposits are an all time favourite investment option for all age groups, be it a youngster, middle age or a senior citizen.

In a Fixed Deposit, you lend your money to the bank/financial institution for a duration of 15 days/1 month/3 months/1 year or more years, depending on when you require your money back.

You can choose 5 year duration to get tax deduction U/S 80 C.

The interest rate varies from bank to bank and it gets higher with increase in duration of investment.

Premature Withdrawal:

You can demand your Fixed Deposit money back from the bank any time but this premature withdrawal is subject to penalties.

For instance, if you deposited money in bank for 5 year duration but you had to withdraw your money after 2 year or any other time, then, you are free to withdraw your money.

Bank may reduce your interest rate as per your withdrawal duration and it may charge some penalty also.

However if you do not claim your money at maturity of fixed deposit then your fixed deposit is renewed again for the same duration as you did it initially. This is a by default option.

# Post Office NSC ( National Saving Certificate)

NSC is a 5 year one time deposit post office Saving Scheme backed by the Government of India.

Current rate of interest is 7.70%.

Here, you deposit a lump sum amount and purchase an NSC certificate.

At the end of the 5 years,you have to submit the certificate and get the maturity amount (deposit amount plus Interest).

- A word of caution here – If you fail to withdraw after completion of 5 year than you will get saving bank interest rate till the time you withdraw money.

Who can invest in NSC

Indian residents of any age can invest in NSC. You can purchase it in your name, joint name, and on behalf of a minor also.

Who cannot invest NSC

- Hindu undivided family/ H U F

- Trust

- private and public limited companies

- Non-Resident Indians

Is NSC good investment

NSC is a secure and low-risk product for risk-averse investors.

If you do not want to take any risk and are looking for capital safety, diversification of your portfolio than NSC is best for you. NSC is a very good investment option for one time lump sum investment for those looking for a safe return.

Read more about NSC https://bestinvestindia.com/national-saving-certificate-interest-rate/

There is no maximum limit of investment in NSC. You can deposit any amount,any time.

The amount of money you deposit will get tax deduction U/S 80 C.

# Kisan Vikas Patra

KVP is a saving certificate that you can purchase from a bank or post office. Your money will double after 10 years and 4 months.

This scheme is 100% safe as it is backed by Government of India. It offers you guaranteed returns and moreover you can pledge KVP certificate as a security to get loan from the bank.

There is no Income Tax benefit on KVP.

The deposited amount is not eligible for tax deduction under section 80C of Income Tax Act.

Interest is taxable as interest income under the head” income from other sources”.

Current rate of interest is 7.5%.

However, no TDS tax deducted at maturity from post office of bank is this scheme..

All Indian resident can open the account in their name or on behalf of a minor.

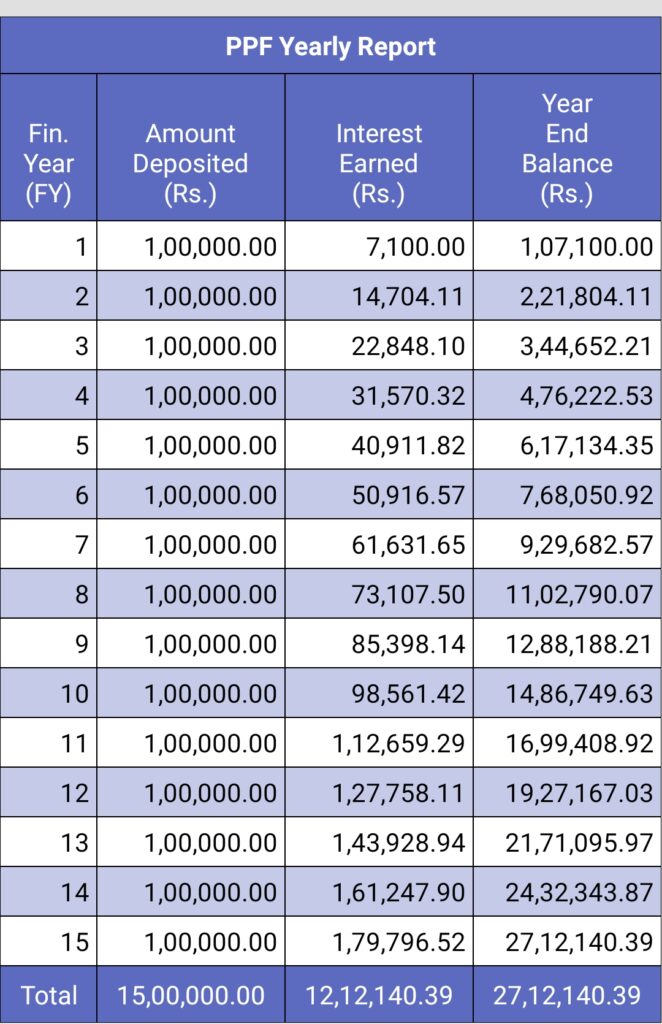

# Public Provident Fund

Public Provident Fund 15 year (yearly or any other mode contribution) is the best safe investment option in India. It is secure investment option for long tenure. PPF is a great investment scheme for risk-averse investors.

Since PPF money can not be attached to a court decree, it makes it safer for investors with huge debts also.

Current rate of interest is 7.1%.

Moreover, the PPF account becomes a safe haven for senior citizens because of its tax-free withdrawals and guaranteed safe returns.

Any resident Indian can open PPF account for himself on behalf of a minor child or a person of unsound mind of whom he/she is a guardian.

read more about PPF withdrawal ruleshttps://bestinvestindia.com/public-provident-fund-ppf-withdrawal-rules-2020/

Sukanya Samriddhi account :

Sukanya Samriddhi Yojana is a government tax saving scheme which was launched as a part of Beti Bachao Beti padhao Yojana for the benefit of the girl child.

Current rate of interest is 8%.

Any Indian parents can open SSY account for the girl child.

- The account has a tenure of 21 years.

- You can open the Sukanya Samriddhi Yojana account if your girl child is below age 10.

- The SSY account matures after 21yrs.

- You have to deposit for 15 years from the date of opening of the account.

- The interest rate is 7.6% annually. The interest rate is revised from time to time.

- You can withdraw partially when the girl child attains age 18.

- The minimum investment is Rupees 250 and the maximum investment is rupees 1.5 Lakh in a financial year.

- SSY Account Offers triple tax benefits.

- The principal amount invested get tax deduction U/S 80 C

- Interest earned is tax-free

- Maturity is also completely tax-free in nature

Deposit Amount: Rupees 250 to Rupees 1.5 Lakh every year for 15 years.

This is a 21 years scheme in which you have to deposit money for 15 years and you don’t have to deposit from 16th to 21st year.

After completion of 21 years from the date of account opening the account will mature and the girl child can withdraw the entire maturity amount and this account is closed after maturity.

If a girl child gets married before completion of 21 years( from the account opening ) then the entire accumulated balance can be withdrawn.

SSY is a 100% safe scheme as established by Government of India.

Partial withdrawal: you can withdraw partially from the scheme for the higher education of the girl child.

While the full withdrawal facility is available only after the marriage of the child.

Income tax benefits: SSA account offers exempt exempt exempt tax benefit.

When you deposit your money( up to rupees 1.5 lac in a financial year) you will get tax deduction under section 80c of Income Tax Act.

The interest earned every financial year is tax free and the maturity amount is also hundred percent tax free.

Who can open the account: Parents or legal Guardian of the girl child can open the account in the name of the girl child the girl age should be e Term for less than 10 years.

The Girl child is called the account holder parent and the guardian is called depositor in this scheme.

The parent can operate the account to the girl richest 10 years of age other girl child can operate the account when she reaches 10 year of age.

where you can open the account: you can open Sukanya Samriddhi account in authorised Bank branch or any post office.

4. Post office monthly income scheme ( POMIS) :

The five-year scheme which offers monthly payout or income to the subscriber.

Here you have to deposit lump sum amount and thereafter you can take monthly income for 5 years.

Current rate of interest is 7.4%.

Once you deposit a lump sum amount, the monthly interest is credited to your linked saving account.

After completion of 5 years the the principal amount which you had initially deposit is given to you.

Post office Monthly Income Scheme is a safe investment option which is led by Government of India and offers guaranteed regular monthly income.

Post Office Time Deposit (5 Year)

Only Indian residents can open the TD account.

TD account can be opened by an adult for himself, on behalf of a minor or a person of unsound mind of whom he is the guardian

You can also open a joint account by up to 3 adults.

Moreover, You can open more than one account in your name or jointly with another person. You can open accounts by cash or cheque.

In case of cheque, the date of realization of cheque in the account will be the date of account opening.

Current rate of interest is 7.5%.

Any number of accounts can be opened in any Post Office.

But you will get tax deduction under section 80c for Rupees 1.5 Lakh only.

Post office time deposit is also backed by Government of India, therefore, it is a safe investment option with guaranteed Returns

Senior Citizen Saving Scheme

Any Indian Citizen who is age 60 and above can purchase the scheme, deposit a lump sum amount and enjoy quarterly safe income.

Special cases in case of SCSS:

An investor Who has attained the age of 55 years or more but less than 60 years, and who has retired on superannuation or otherwise (Account has to be opened by such individual within one month of the date of receipt of the retirement benefits).The retired personnel of Defence Services (excluding Civilian Defence Employees) shall be eligible to open an account under this Scheme on attaining the age of fifty years, subject to the fulfilment of other specified conditions.

Current rate of interest is 8.2%.

- The interest rate is 8.2% annually.

- Source : https://www.icicibank.com/Personal-Banking/investments/senior-citizens/eligibility.page?#toptitle

- Investment time is for 5 years. Whatever rate is fixed at the time of purchase will remain unchanged during 5 long years.

- You can deposit Rs 15 lac in one name.

- An only quarterly mode Income is available in senior citizen saving scheme.

- Pension dates are 31 March, 30 September, 30 June, 31 December. If you have deposited prior to three months, even then dates are fixed for the pension.

- No special condition to withdraw but the different amount will be released on the basis of your invested time:

- After 1 year: 98.5% of your money (initially deposited amount)After 2 Year: 99% of your money (initially deposited amount)

- Read https://bestinvestindia.com/pmvvy-vs-senior-citizen-saving-scheme

#RBI Floating Rate Bonds

The central GOI has replaced 7.75% bonds with RBI floating rate savings bonds 2020 ( Taxable) scheme. These bonds are available from July 1, 2020.

This time these bonds will have a floating rate interest rate which will change periodically. This also means that the interest rate will change with time.

Minimum Investment – Rs 1000

Maximum Investment – No Limit

Maturity Period – 7 year ( lock-in period)

( interest rate will be set every six months)

Benchmark for interest rate – Prevailing NSC rate + 0.35%

Tax Benefit U/S 80 C – No

Tax Treatment – Interest amount is fully taxable

TDS -Yes (If an exemption under the relevant provisions of the Income Tax Act, 1961 is obtained, it may be declared in the Application Form.)

Current rate of interest is 8.05%.

Read more about Floating rate bonds https://bestinvestindia.com/rbi-floating-rate-savings-bonds-2020/

#RBI Sovereign gold bonds

sovereign gold bond is a substitute for physical gold. You can buy sovereign gold bonds by paying cash and the bonds will be redeemed in cash on maturity. These gold bonds are issued by the Reserve Bank of India on behalf of the Government of India. The gold bonds are denominated in 1 gram of gold. form

Current rate of interest is 2.5%.

Read more about gold bonds https://bestinvestindia.com/sovereign-gold-bond-scheme/

Pradhanmantri Vaya Vandana Yojana ( now withdrawn)

Any Indian senior citizen of age 60 and above can invest in Pradhan mantri Vaya Vandana Yojana.

Here, in this policy you have to deposit a lump sum amount and thereafter you can choose to have monthly pension,quarterly pension, half yearly pension or yearly pension for next 10 years.

PMVVY is offered by LIC of India.

The current rate of interest is 7.4 % which is currently very high amongst the safe investment options.

Read morehttps://bestinvestindia.com/how-to-open-pmvvy-scheme-online/

https://bestinvestindia.com/best-investment-options-for-pensioners-senior-citizens/

https://bestinvestindia.com/best-lic-pension-plan/

https://bestinvestindia.com/pmvvy-vs-senior-citizen-saving-scheme/

What is the average return on a safe investment

The average return on safe investment varies from 5% to 8/9% at max.

Usually all safe investment option invest in debt instruments which typically give low return in this range only.

Best safe investment options in India

To choose best safe investment option in India you have to look in few factors such as

- investment duration

- Tax saving required or not

- You want to invest one time or regular

- When you need Money

- Do you need Liquidity in between

- Income tax slab rate

Best safe investments with high returns

The few best safe investment with high returns are:

- National saving certificate

- Public provident fund

- Senior citizens Saving Scheme

- Sukanya samriddhi Yojana

- RBI floating rate bond

- Pradhanmantri Vaya Vandana Yojana

- Sovereign gold bond scheme

safe investments with high returns in India for NRI

There were plenty safe investment options in India but few safe investments with high returns for NRI available in India are as follows

- NRI can definitely open a fixed deposit invest their money safely.

- If as an NRI, you can pay a regularly (yearly or monthly or any other mode) till your retirement, you can invest your money in NPS also. For safety purpose you can choose active choice option and opt higher allocation in Govt.securities.

- NRI Cannot invest in most of the the safe schemes however, if you become NRI after opening the account, then the investments can be continued with terms and conditions( every scheme has its own terms and condition to continue Investments).

- if you have PPF account then you can invest till maturity but extension is not allowed.

- The other options are real estate, mutual fund and stock market Investment. (Riskier investment as compared to safest investment).