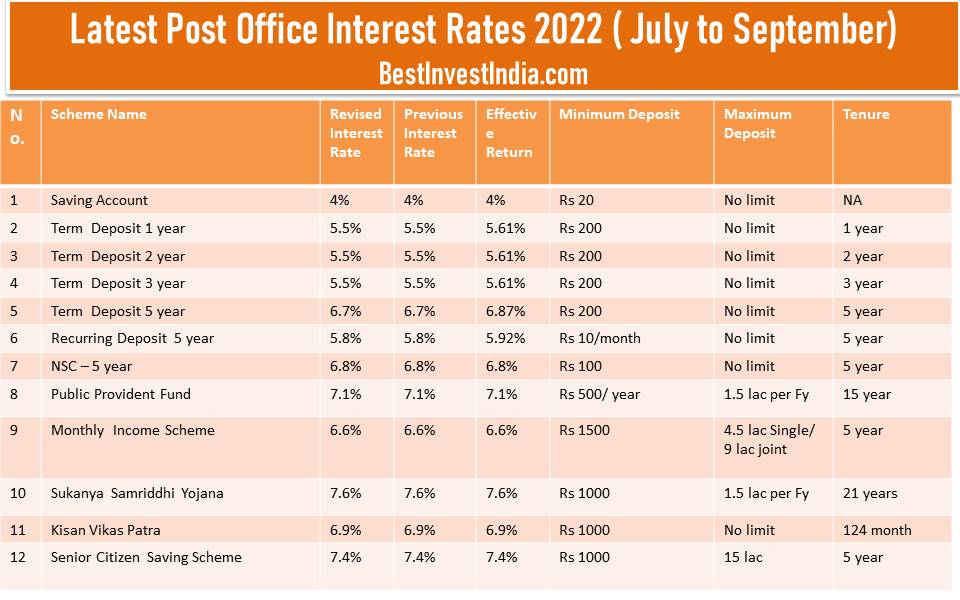

Latest post office interest rate 2022 – Post office interest rate on FD, NSC, KVP, PPF, SSY and SCSS schemes? What is the post office interest rate RD and other savings.

Recently all the banks have increased their bank FD interest rate. Therefore there was speculation that the post office interest rate will also increase this quarter. But from the last 9 quarters post office has not increased interest rates.

Table of Contents

Latest Post Office Interest Rates 2022

The small saving scheme interest rates HAVE NOT changed in the quarter July to September 2022. There is no change in interest rates from last 9 quarters.

Features of Post Office Small Saving Schemes

There are multiple Post Office saving schemes which are available for investment. This post will help you understand and choose the appropriate option based on your need.

Post Office Saving Account

Just like you have a Saving bank account, post office also offer saving accounts to the customers. In fact it is compulsory for interest payout of few schemes.

Features of Post Office Saving Account

- Minimum Amount to open Account -Rs. 500

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Minimum balance to be maintained – Rs 500

- If not maintained , maintenance fee of Rs 100 will be deducted from account on the last working day of a financial year.

- In case after deduction of maintenance fee, the balance is negative, the account will automatically be closed.

- Cheque and ATM facility available

- Net banking and mobile banking is available.

- One can link the account with IPPB Saving Account

- Fund transfer ( sweep in/Sweep out) facility is available with IPPB Saving account.

- Interest up to 10K is tax free in nature

- At least one transaction is necessary in 3 Financial years to keep the account active.

Post Office Fixed Deposit ( FD)

One can also make a FD with Post office. The duration of FD can be chosen as per own choice. The available tenure is 1/2/3/5 year fixed deposit.

Features of Post Office FD

- Minimum FD amount Rs 1000 and in multiple of Rs 100

- No maximum limit

- Tenure available 1 year, 2 year, 3 year and 5 year

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Payment- Cash/Cheque

- Account can be shifted from One post office to another

- Any number of FDs can be opened

- Annual interest payment to saving account( if chosen)

- Premature withdrawal not possible before 6 months

- If closed between 6-12 months, Post office saving account interest will be payable

- Tax benefit available in 5 year FD only.

- Interest of FD is taxable in nature

Post Office Recurring Depsit ( RD)

PO RD is a monthly deposit scheme of post office. In recurring deposit one pay a constant fixed amount each month for a duration of 5 years. At maturity lumpsum amount is paid.

Features of PO RD

- Minimum investment per month- Rs 100 (and in multiple of Rs 10)

- No maximum limit

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Duration of RD – 5 Year

- Payment- Cash/Cheque

- Premature Closure – after 3 years

- Account can be shifted from One post office to another

- Any number of RDs can be opened

- If not paid, penalty of Rs 1 per Rs 100 deposit will be charged.

- After 4 defaults, the account is discontinued.

- If not revived within 2 months,no further deposits are allowed

- The account can be extended for another 5 years.

- Loan can be taken for 50% of balance after 1 year of opening

- Rebate of Rs 10 for advance deposit for 6 months

- Rebate of Rs 50 for advance deposit for 12 months

- Interest of RD is taxable in nature

Post Office Monthly Income Scheme ( POMIS)

POMIS provide monthly income to its holder. One can deposit a lump sum amount and take monthly income from next month.

Features of POMIS

- Maximum Deposit in single Account

- Jointly max deposit is 9 lac

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Single holding can be converted to joint and joint can be converted to single

- Duration of RD – 5 Year

- Payment- Cheque

- Interest is credited to post office saving account

- Premature Closure – after 1 years at 2% discount

- Premature Closure – after 3 years at 1% discount

- Interest paid after completion of month

- If interest not claimed, no interest is earned on interest

- Also read SBI Recurring Deposit

Post Office Monthly Income Scheme – Features

Post Office Senior Citizen Saving Scheme ( SCSS)

Post Office SCSS is a senior citizen saving scheme. The scheme provide quarterly interest payout.

Read a detailed Post about Senior Citizen Saving Scheme

A Detailed Comparison between SCSS and PMVVY

Public Provident Fund ( PPF)

PPF is a 15 year deposit scheme. One has to compulsorily pay for 15 years in a PPF account.

Read detailed post about PPF

Public Provident Fund (PPF)-Features and Benefits || PPF Account Benefits 2022

PPF Extension Rules – Can I extend PPF after maturity?

Top 10 PPF Benefits you must know

PPF Vs Mutual Fund -Which is better?

Best 5 Post office Tax Saving Scheme

How to make online payment of ppfssa Post Office savings?

National Saving Certificate ( NSC)

PO NSC is a 5 year deposit scheme. Any number of certificates can be purchased.

Features Of NSC

- Minimum amount of investment – Rs 1000 and in multiple of rs 100

- No maximum limit

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Duration of RD – 5 Year

- Payment- Cash/Cheque

Read the detailed post about NSC

Kisan Vikas Patra ( KVP)

KVP is a lumpsum deposit scheme wherein your money get doubled in 10.4 years.

Features of Kisan Vikas Patra ( KVP)

- Minimum Deposit – Rs 1000

- No maximum limit

- Duration – 10.4 years

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Premature closure – after 2.5 years

- Can be transferred from one post office to another

- NRI/HUF can’t invest in KVP

Sukanya Samriddhi Accout Yojana/ SSY

SSY is a special scheme for girl child welfare scheme.

Features of Sukanya Samriddhi Yojana

- Minimum Deposit – Rs 1000

- No maximum limit

- Duration – 15 year

- Holding – Single/Joint/with minor ( above 10 years of age)/ as a guardian on behalf of minor

- Premature closure – after 2.5 years

- Can be transferred from one post office to another

- NRI/HUF can’t invest in KVP

Conclusion

Post Office Saving schemes interest rate are unchanged since last 9 quarters. There is no change in interest rates for now. Hope to increase in Post office interest rate for FD, RD and other savings.