While investing in mutual funds, sometimes you have to make tough choices and choose the fund type or category in same fund types. Similar is the case while choosing mutual fund vs Index fund. It is difficult to choose one of them or to choose both.

In this post, we will understand the difference between mutual fund vs index fund and which one is good for you.

Table of Contents

What are Mutual Funds

Mutual Fund is an investment scheme where people pool in money (just like other investments) and your money is invested (on your behalf) in stocks, bonds, or other securities.

It is one of the best investment avenues which can create huge wealth for its users (investors).

These investments can be used for various investment requirements such as financial goals ( retirement, child education, purchase of asset, home, etc.), short-term money parking, fixed maturity plans, regular income, tax saving, and wealth creation.

Additional Readings

https://bestinvestindia.com/are-mutual-funds-safe/

https://bestinvestindia.com/how-to-start-mutual-fund-sip/

10 Things To Know Before Investing In Mutual Funds

What are Index Funds

Index funds are the passively managed mutual funds that mimic the popular indices such as nifty 50, nifty next 50, Sensex, or some other indices. This fund’s aim is to replicate the index return only. Because these funds invest in underlying indices stocks only, therefore they are passively managed.

As the name also suggests, an index mutual fund invests in stocks that mimic any popular stock Market index like NSE Nifty, BSE Sensex Nifty 50, etc.

These funds are passively managed by the fund manager and therefore invest in the same securities and in the same proportion as in the underlying index.

Here, the fund’s aim is to track index returns.

How does index fund work?

Let’s talk about an index fund tracking Sensex. This fund will have the same stocks as the Sensex indices contained and in the same proportion. The index fund ensures that it invests in all the security of the index and the proportion also remains the same.

Whereas an actively managed mutual fund aims to outperform the underlying benchmark.

Who should invest in an index fund

An index fund tracks a market index and aims to track the index return. Therefore the investors who prefer predictable returns and want to invest in equity markets without taking a lot of risks can invest in these funds whereas in an actively managed mutual fund the fund manager manages and changes the composition of the portfolio and assess the various possibilities and try to outperform the market.

Thus actively managed funds risk is a little higher than the index fund.

Mutual Fund Vs Index Fund

Risk and returns

Index funds are the passively managed funds and track the market index and thus they are less volatile than the actively managed fund.

The downside risk of the index fund is similar to the index only whereas in an actively managed fund the downside can be higher than the index fund.

It has been seen that in a bullish market the index fund is usually performing better than all the actively managed funds but in the bearish market the actively managed fund performs better than the index funds.

Expense ratio

Expense ratio is the expense (calculated in percentile) incurred by the fund house to manage the fund.

Since an index fund is a passively managed fund, the expense ratio of these funds is lower as compared to actively managed funds.

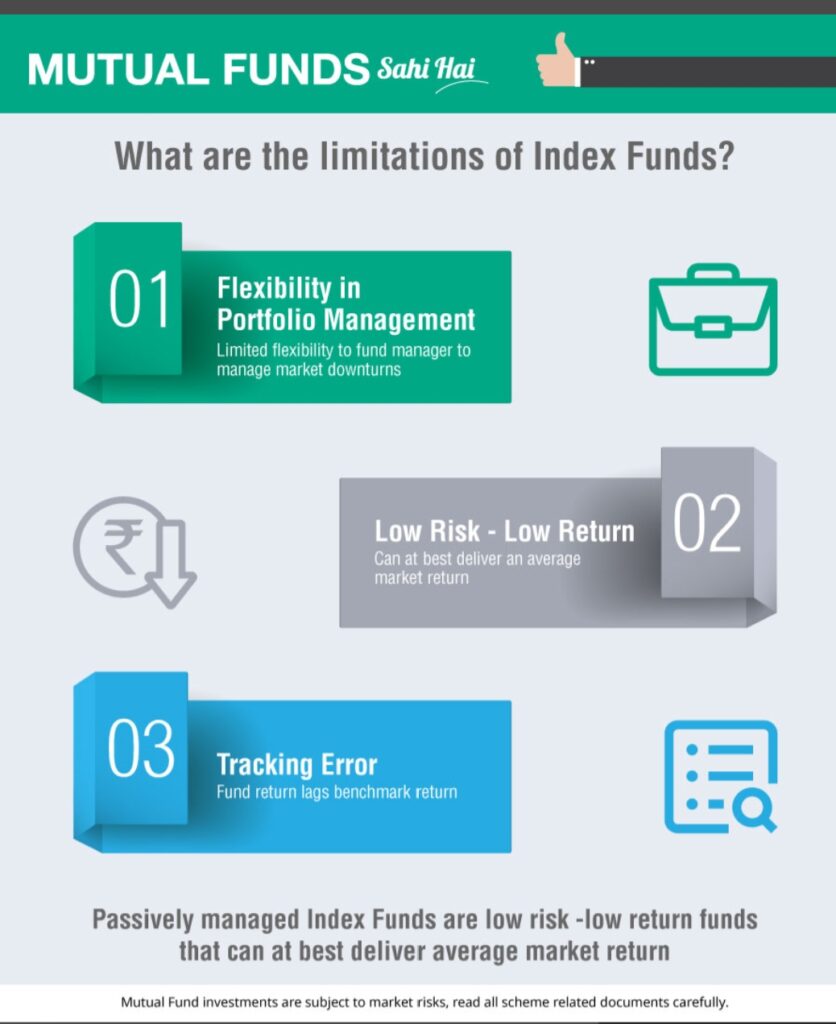

Tracking Error

Index funds typically follow index returns subject to tracking error. Because all AMCs, Similar Index funds are following the same index and in the same ratio. But the difference lies in tracking errors.

Tracking error is the difference between the actual performance of the index and the index mutual fund. Some Index funds might have a higher expense ratio. Higher the expense ratio higher will be tracking error and lower will be your retrun.

Tax

Both actively managed mutual funds and index fund returns are subject to capital gain taxation, dividend distribution tax.

If you redeem ( exit) mutual fund before completion of one year than this is called short term capitqal gain and this gain is taxable @15%.

However if you withdraw after completion of one year than capital gain above 1 lac will be taxable @10%.

Say you redeem after comepletion of one year and your gain is 2 lac than 1 lac gain is exempt from tax and on rest of 1 lac you have to pay a LTCG@10%.

https://bestinvestindia.com/mutual-fund-taxation-fy-2019-20/