LIC’s Jeevan Utsav is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan.

Jeevan Utsav is a non- participating product under which benefits payable on death or survival are guaranteed and fixed irrespective of actual experience.

Table of Contents

LIC’s Jeevan Utsav ( 871) – Eligibility & features

LIC Jeevan Utsav Plan is a traditional insurance plan. Like other Endowment Plans, this LIC plan also provides Guaranteed money back from the vesting date.

| Minimum Sum Assured | Rs.5,00,000/- |

| Maximum Sum Assured | No limit |

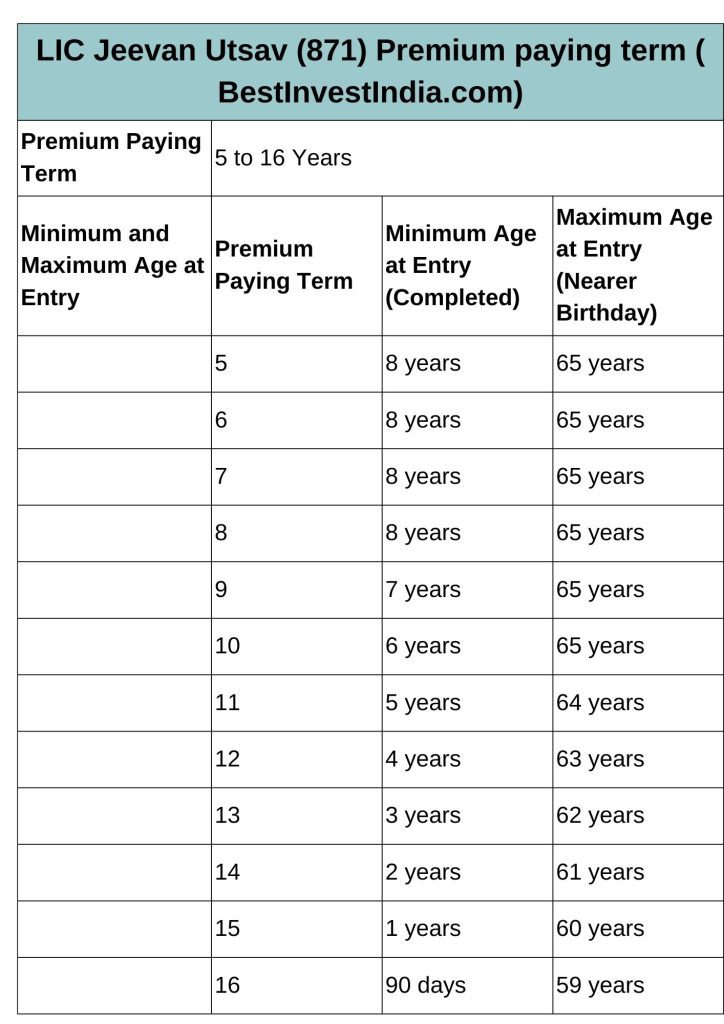

| Premium Paying Term | 5 to 16 Years |

| Minimum Age at entry | 90 days (completed) |

| Maximum Age at entry | 65 years (Nearest Birthday) |

| Minimum Maturity Age at which income starts | 18 years (completed) |

| Maximum Maturity Age | 75 years (Nearer birthday) |

| Date of risk Commesment | If Entry age less than 8 years – risk coverage will start after 2 years or at the age of 8 years |

| Date of vesting | in case of a minor – Income will start just at the 18 years age or at the specified date |

Key features – LIC Jeevan Utsav

- Whole life insurance with limited premium payment

- Two options available at inception to choose the benefit under the plan

o Option I – Regular Income Benefit

o Option II – Flexi Income Benefit

- Guaranteed Additions throughout Premium Paying Term

- Flexibility to choose Premium Paying Term from 5 Years to 16 Years

- Benefit of attractive High Sum Assured Rebate

- Option to enhance coverage by opting for riders on payment of additional premium

- Takes care of liquidity needs through loan facility

Benefits under LIC Jeevan Utsav Policy ( 871)

Maturity Benefit

There is no maturity benefit in UTSAV Policy.

Guaranteed Additions

The Guaranteed Additions will accrue at the rate of Rs. 40 per thousand Basic Sum Assured at the end of each policy year during the Premium Paying Term. There shall be no further accrual of Guaranteed Additions after Premium Paying Term.

Suppose Bestii Singh have taken 5 lac sum assure policy for 10 years ( premium paying term) then he will get guaranteed additions of Rs 2 lac only.

(500000/1000)*Rs 40 * no of premium paying term

(500000/1000)*Rs 40 * 10 = 2 lac

Survival Benefit

Jeevan Utsav offer two options to take income after completion of policy premium payment term

- Regular Income Benefit

- Flexi Income Benefit

Regular/ Flexi Income Benefit – yearly Income ( 10% of basic Sum Assured )will start as specified in the table below.

In case of Flexi Income – Policyholder have the flexibility to defer( delay) and accumulate such Flexi Income Benefits. If policyholder defer the benefits, LIC shall pay interest on the deferred and accumulated Flexi Income Benefit at the rate of 5.5% p.a. compounding yearly for completed months from its due date till the date of withdrawal or surrender or death, whichever is earlier.

| Premium Paying Term | Regular Income Benefit / Flexi Income Benefit Start Year |

| 5 years | 11th policy year |

| 6 years | 11th policy year |

| 7 years | 11th policy year |

| 8 years | 11th policy year |

| 9 years | 12th policy year |

| 10 years | 13th policy year |

| 11 years | 14th policy year |

| 12 years | 15th policy year |

| 13 years | 16th policy year |

| 14 years | 17th policy year |

| 15 years | 18th policy year |

| 16 years | 19th policy year |

Death benefit

Higher of the below two is paid along with accrued guaranteed Additional

- Basic Sum Assured on death and

- 7 times of annualised premium

Death Benefit shall not be less than 105% of total premiums paid up to the date of death.

Date of Commencement of risk: In case the age of Life Assured at entry is less than 8 years, risk coverage will start either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

For instance, Suppose Bestii Singh aged 5 years, is life assured buy LIC Jeevan Utsav on 30/12/2023.

Since age is less than 8 years. The risk coverage will start after 30/12/2025 or at the age of 8 years. Here, time period of 2 years is completing after 2025 i.e. at the age of 7.

So, risk coverage will start from age 7 years only.

Settlement Option ( for Maturity/death)

Under LIC settlement option, one can take maturity benefit or death claim in instalments over a period of 5 years instead of lump sum amount. This option can be exercised for in force or paid policies.

| Mode of Instalment payment | Minimum Instalment amount |

| Monthly | Rs. 5,000/- |

| Quarterly | Rs. 15,000/- |

| Half-Yearly | Rs. 25,000/- |

| Yearly | Rs. 50,000/- |

Settlement Option( Death Claim)

One can choose to receive death benefit in instalments over the chosen period of 5/10/15 years instead of lump sum amount.

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for in force or paid policies.

Please refer above table.

Riders

The policyholder has an option of availing following Rider benefit(s):

- LIC’s Accidental Death and Disability Benefit Rider

- LIC’s Accident Benefit Rider

- LIC’s New Term Assurance Rider

- LIC’s New Critical Illness Benefit Rider

- LIC’s Premium Waiver Benefit Rider

Rider sum assured cannot exceed the Basic Sum Assured.

LIC Jeevan Utsav( 871)-Premium Chart

The sample illustrative premiums for Basic Sum Assured of Rs. 5 Lakh for Non-Smoker, Standard lives for Offline sales are as under:

| Premium Paying Term | Entry Age 10 Years | Entry Age 30 Years | Entry Age 50 Years |

| 5 | 1,09,575 | 1,10,150 | 1,18,625 |

| 8 | 72,600 | 72,600 | 72,600 |

| 12 | 44,250 | 44,275 | 45,225 |

| 16 | 29,900 | 30,025 | 33,475 |

LIC Jeevan Utsav Review ( 871) – 10% Guaranteed income What it means for you

Jeevan Utsav 871 is sold claiming 10% Guaranteed income but actually What it means for you? Is it really worth your hard earned money? or you should ignore the noise.

The LIC Jeevan Utsav policy wordings, says, the policyholder will get 10% sum assured income. But what are the actual returns ( IRR ).

Now suppose Bestii Singh age 35 buys Jeevan Utsav for Sum assured Rs 5 lac and opts to pay premium for 5 years then he will get income of Rs. 50000 every year till the age of 99 years. Here, as you can check from the below table, the Utsav policy can fetch you return of 5.9%.

I don’t say, it is good or bad but if you want to bring few points to notice:

Jeevan Utsav Benefits

Jeevan Utsav is a good saving plan which offers life insurance and tax benefit as well. You get life time guaranteed income from money deposited.

Other guaranteed investment options

Jeevan Utsav Disadvantages

- Although income is GUARANTEED but the return rate is quite low. ( other income option)

- In between withdrawal is not possible( difficult to withdraw). That is why low on liquidity.

- If you think to withdraw in between, huge loss.

- Very bad for investment perspective ( choose better investment options)

- Really bad for insurance purposes too. ( low life cover)- Buy high life cover

LIC Jeevan Utsav Return Illustration

Sum Assured Rs 5 lac

Premium Paying term – 5 years

IRR- 5.9%

other LIC plans

Read more –LIC New tech term plan