LIC has launched LIC Index Plus ( Table no. 873 ). Index Plus LIC plan is a ULIP (unit-linked Insurance Plan) with the added advantage of life cover, and the flexibility of choosing a sum assured with Guaranteed Additions.

This LIC Index Plus Plan offers the advantage of Low premium, life cover, and investment of money in Nifty 100 or Nifty 50 selected stocks investment.

Table of Contents

LIC Index Plus ( 873) -Life Cover with Market Investment – Eligibility & features

This tax season LIC has offered a new ULIP plan. Index Plus Plan offers benefits like – Life Cover, Refund of mortality charges and Guaranteed Additions.

Other features such as premium payment frequency, choose your sum assured, settlement options of claim, partial withdrawal and accident benefit rider, enhance the features of the plan.

| Basic Sum Assured | From [90] Days To [50] years (nearer birthday)- • 7 times of Annualized Premium or • 10 times of Annualized Premium From [51] years (nearer birthday) To [60] years (nearer birthday) • 7 times of Annualized Premium |

| Minimum Policy Term | Premium Less Than Rs.48,000 – 15 years Premium more than Rs.48,000 – 10 years |

| Maximum Policy Term | Premium Less Than Rs.48,000 – 25 years Premium more than Rs.48,000 – 25 years |

| Premium Paying Term | Same as the policy term |

| Minimum Premium | Yearly – Rs. 30,000/- Half-yearly – Rs. 15000/- Quarterly – Rs. 7500/- Monthly (NACH) – Rs. 2500/- |

| Maximum Premium | No limit |

| Minimum Age at entry | 90 days (completed) |

| Maximum Age at entry | 10 times of Annualized Premium –50 years (Nearest Birthday) 7 times of Annualized Premium —60 years (Nearest Birthday) |

| Minimum Maturity Age | 18 years (completed) |

| Maximum Maturity Age | For Sum Assured -7 times of Annualized Premium -85 years(nearer birthday) For Sum Assured -10 times of Annualized Premium -75 years(nearer birthday) |

| Mode of installment premium | Please choose the frequency of your payments: Monthly, Quarterly, Half-Yearly, or Yearly. |

LIC Index Plus – Fund Options

The policy holder gets two fund options to choose from.

| Fund Type | Investment in Government/ Government Guaranteed Securities/ Corporate Debt | Short-term investments such as money market instruments | Investment in Listed Equity Shares | Details and objective of the fund for risk / return | Risk Profile |

| Flexi Growth Fund | 0% to 20% | 0% to 40% | 40% to 100% | To provide long-term capital appreciation through investment primarily in select stocks that are a part of the NSE NIFTY100 Index. | Very High Risk |

| Flexi Smart Growth Fund | 0% to 20% | 0% to 40% | 40% to 100% | To provide long-term capital appreciation through investment primarily in select stocks which are a part of the NSE NIFTY50 Index. | Very High Risk |

Benefits under LIC Index Plus Policy ( 873)

Maturity Benefit

On maturity, the unit fund value will be given to the policyholder.

Death benefit

On death during the policy term BEFORE commencement of risk

An amount equal to the Unit Fund Value as on the date of intimation of death shall be payable.

On death during the policy term AFTER commencement of risk

The higher of the below three is paid

- Basic Sum Assured is reduced by Partial Withdrawals, if any, made during the two years immediately preceding the date of death

- Unit Fund Value as on date of intimation of death

- 105% of the total premiums received up to the date of death reduced by Partial Withdrawals, if any, made during the two years immediately preceding the date of death.

Refund of Mortality Charges

At maturity, an amount equal to the total amount of mortality charges deducted shall be payable along with the Maturity Benefit.

Date of Commencement of risk: In case the age of Life Assured at entry is less than 8 years, risk coverage will start either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

For instance, Suppose Bestii Singh aged 5 years, is life assured buy LIC single Premium Endowment plan on 30/1/2023.

the Since age is less than 8 years. The risk coverage will start after 30/1/2025 or at the age of 8 years. Here, the period of 2 years is completed in 2025 i.e. at the age of 7.

So, risk coverage will start from age 7 years only.

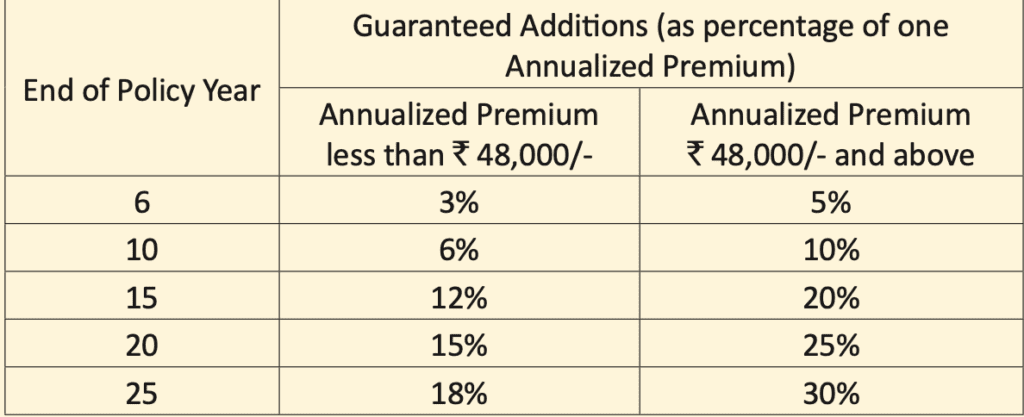

Guaranteed Additions

Guaranteed Additions as a percentage of one Annualized Premium, are added to the Unit fund on completion of a specific duration of policy years. ( if all due premiums have been paid and the policy is in force).

Partial Withdrawal

The policyholder may partially withdraw the units at any time after the 5 years lock-in period subject to the following:

- In case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

- Partial withdrawals may be in the form of a fixed amount or the form of a fixed number of units.

- The maximum amount of Partial Withdrawal as a percentage of funds during each policy year shall be as under:

| Policy Year | Percent of Unit Fund |

| 6th to 10th | 20% |

| 11th to 15th | 25% |

| 16th to 20th | 30% |

| 21st to 25th | 35% |

The above Partial withdrawals are allowed subject to the minimum balance of not less than 4 Annualized Premiums for Annual Premium less than Rs.48,000/- and in all other cases not less than 3 Annualized Premiums.

Suppose Bestii’s annual premium is 50K. He wants to make a partial withdrawal in 6th year. His fund value is 7 lac. Thus after withdrawal, his balance should not be less than 1.5 lac ( 3 Annualized Premiums for Annual Premium more than Rs.48,000/- ) and 2 lac in case his premium is less than 48K.

Switching

You have an option to switch between the two fund types during the policy term. On switching, the entire Fund Value shall be switched to the new Fund opted for.

During a given policy year, four switches will be allowed free of charge.

Subsequent switches shall be subject to a switching charge of Rs.100 per switch.

Charges under the Plan

Since this is a ULIP plan. Policy administration charges are applicable. This premium is invested after the deduction of charges.

Premium Allocation Charge

This is the percentage of the premium used towards charges from the premium received. Please note that these charges are recurrent.

| Premiums | Off line sale | Online sale |

| 1st Year | 8.00% | 3.00% |

| 2nd to 5th Year | 5.50% | 2.00% |

| Thereafter | 4.00% | 1.50% |

Mortality Charge

Mortality Charge is the cost of life insurance coverage, which is age-specific. Mortality Charges are deducted at the beginning of each policy month by cancelling an appropriate number of units out of the Unit Fund Value.

The monthly charge will be one-twelfth of the annual Mortality Charges.

How it works?

Lets take example of 45 Year Bestii. His sum assured is Rs 10- lac. Premium say 1 lac.

Premium Allocation Charge – 100000*8% = Rs 8000

Net investment = 1 lac – 8000= Rs 92000

Mortality charge – 1000000/1000*3.48 = Rs.3480

This amount is divided by 12 and thus Rs 290 will be charged each month beginning by cancelling the units.

The rate of Mortality Charge per annum per 1000/- Sum at Risk for some of the ages in respect of a healthy life are as under:

| Age | 25 | 35 | 45 | 50 | 60 |

| Amount in Rupees | 1.26 | 1.62 | 3.48 | 5.99 | 15.07 |

Fund Management Charge

Fund Management Charge is levied as a percentage of the Fund value. FMClevied at the time of computation of NAV, which will be done daily. The NAV thus declared will be net of FMC.

Fund Management Charge (FMC) shall be as under:

- 1.35% p.a. of Unit Fund for both fund types available under an in-force policy i.e. Flexi Growth Fund and Flexi Smart Growth Fund.

- 0.50% p.a. of Unit Fund for “Discontinued Policy Fund” ( when you stop paying premium and policy is in “Discontinued Policy Fund.

This is a charge levied at the time of computation of NAV, which will be done on daily basis. The NAV thus declared will be net of FMC.

Policy Administration Charge:

Policy Administration Charge shall be applicable from the 6th policy year till the end of the policy term as mentioned below at the beginning of each policy month

Policy Administration charges shall be subject to a maximum of Rs.500 per month (i.e Rs.6000 p.a) from the Unit Fund Value by cancelling units for the equivalent amount.

| Year 1 to Year 5 | Nil |

| Year 6 | Minimum of 3.25% *Annualized Premium/ 12 or Rs.125 per month |

| Thereafter from 7th year onwards | Applicable Policy Administration Charges in 6th year escalating at the rate of 5% p.a |

Settlement Option ( for death Claim)

One can choose to receive death benefits in instalments over the chosen period of 5 years instead of a lump sum amount.

The instalments shall be paid in advance at yearly,half-yearly, quarterly or monthly intervals, as opted for, subject to minimum instalment amount for in force or paid policies.

| Mode of Instalment payment | Minimum Instalment amount |

| Monthly | Rs. 5,000/- |

| Quarterly | Rs. 15,000/- |

| Half-Yearly | Rs. 25,000/- |

| Yearly | Rs. 50,000/- |

LIC Index Plus- Should you buy?

LIC Index Plus Plan is a ULIP Plan. From the terms and conditions of the plan, it is evident that the plan is for the long term with high charges. You can say it is a costly insurance plan.

I am not fond of such plans. But still, if you want to purchase this plan then few points to ponder:

- Online purchase is better since Premium Allocation charges are lower.

- If at all you decide to buy, go for the long run to get some gain from the plan.

- Do not try to buy for five years. If it is in your mind then the Post office scheme will give you better returns.

- If buying insurance covers needs, term insurance is a better bet.

- If buying for investment purposes, mutual funds are a better choice.

- Safe options to invest in are our post office saving scheme.

- If Tax saving is needed – ELSS mutual funds are a good choice.

- Top 10 Tax Saving ELSS Mutual Funds 2024 -Invest To Be Wealthy

- Top 5 Post Office Tax Saving Scheme

- Latest Post Office Savings Interest Rates 2023- How Change Will Impact You?

But before investing, it is better to explore other Pure investment and pure risk coverage Options too.

You can always work with a Certified Financial planner and plan your finances, including Emergency funding, building a corpus for house purchase, and taking care of your health needs so that you can plan a better retirement income in your second inning, leading to a more secure and financially stable retirement.

If you have learned something new and found the article informative, Then please share & Comment. This will help me reach more readers and spread financial awareness.

other LIC plans

Read more –LIC New tech term plan